XRP Comeback Gains Pace as 1B Nasdaq Listing Planand 1,000 Percent Liquidity Surge Spark Institutional Rush

0

0

Updated on 22nd October, 2025

XRP is moving from courtroom drama to Wall Street boardrooms. The digital asset is experiencing a powerful revival after clearing legal hurdles that once pushed it to the fringe of the crypto market.

A new Nasdaq listing plan tied to a major institutional liquidity partner and soaring derivatives volume has given traders a fresh reason to revisit the XRP price prediction narrative.

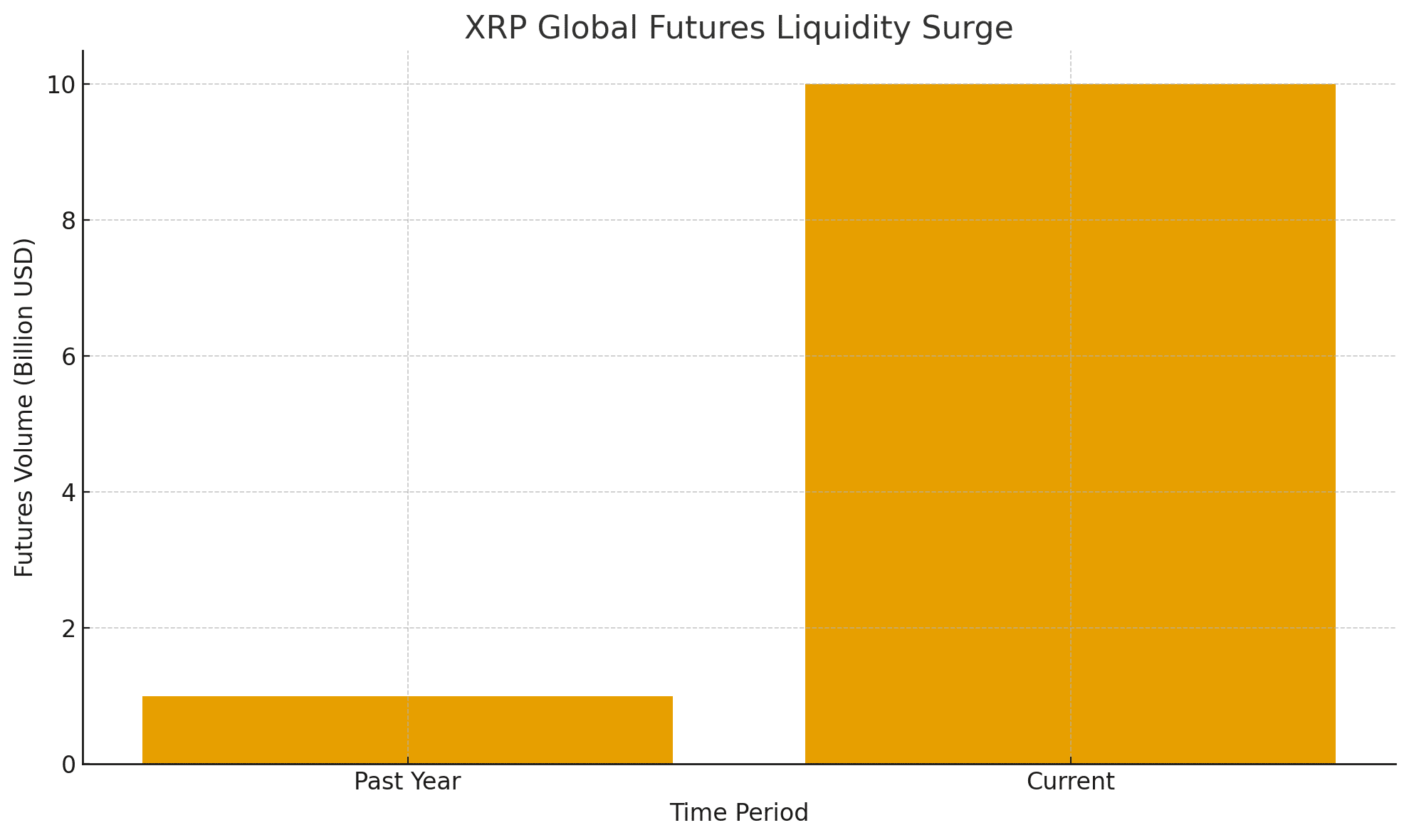

Global liquidity for XRP has surged more than 1,000 percent over the last year. Average daily futures volume has crossed 10 billion dollars. Open interest across major exchanges has tripled. That alone signals aggressive positioning by institutional traders who were once hesitant to touch the asset due to regulatory uncertainty.

Nasdaq Listing Signals Institutional Legitimacy

A new corporate entity named Evernorth has filed to list on Nasdaq under the ticker XRPN. The public filing shows a planned one billion dollar raise. The firm’s primary purpose is portfolio accumulation of XRP and liquidity provisioning for institutional settlement networks. If approved, this will be the first regulated equity tied to XRP exposure in the United States.

Market analysts note the significance of a Wall Street listing. It moves XRP from a speculative altcoin into an investable asset class. A Nasdaq listing also strengthens the long-term XRP price prediction conversation because regulated access historically brings stability, investor education, and structured participation from hedge funds and liquidity desks.

SEC Exit Unlocks Capital Flows

The U.S. regulator recently closed its long-standing legal dispute involving XRP without further appeal. That decision lifted constraints on U.S trading platforms and cleared risk barriers for hedge funds and corporate treasuries.

Crypto analyst Michael Arrington wrote on X that XRP now enters a “clean runway phase” for institutional adoption, adding that “regulatory overhang is finally gone, and now capital will decide the truth.”

Market data shows the shift. XRP, once struggling against delistings, now holds one of the highest spot trading volumes among top ten cryptocurrencies. Traders watching XRP price prediction trends tied to news flows have already noted recurring momentum cycles that build after U.S based announcements.

ETF Demand Building Beneath the Surface

While no spot XRP ETF has received approval yet, multiple asset managers have confirmed applications in progress. Analysts estimate potential inflows between five to eight billion dollars in the first year of approval, if conditions mirror early Bitcoin ETF demand. Traders following XRP price prediction trends argue that ETF speculation alone has helped support price floors across recent pullbacks.

Research firm 21st View wrote in a market note that XRP has graduated from a single-narrative asset to a multi-use financial instrument. It is no longer just a payment token. It is evolving into a liquidity asset.

Liquidity Surge Confirms Market Depth

Markets do not lie. Liquidity only rises for assets that find real buyers and real sellers. XRP derivatives volume has multiplied from under one billion dollars to over ten billion dollars daily. Open interest across major venues is up more than 1,000 percent year over year. That is not a meme rally. That is a structural shift.

Analyst Raoul Pal noted that futures build is a sign big money players are positioning ahead of regulated product launches.

XRP Price Prediction Outlook

Short term XRP price prediction sentiment points to volatility. Long term sentiment is constructive. Liquidity is growing. Institutional instruments are forming. Regulatory shields are in place. The digital asset now sits in a narrative pivot similar to early stage Ethereum adoption.

Conclusion

XRP has entered a different era. It has momentum, money flow, and credibility. If the Nasdaq listing proceeds and ETF approvals follow, XRP will no longer fight for relevance. It will shape part of the infrastructure of institutional crypto markets.

Frequently Asked Questions

What is driving the XRP comeback?

Legal clarity in the United States, institutional interest, and a planned Nasdaq listing have revived confidence in XRP.

Is XRP getting a spot ETF?

ETF filings have been submitted but not yet approved. Analysts expect strong inflows if approval occurs.

Why is XRP liquidity rising?

More institutions are trading XRP futures and spot positions, increasing global trading depth.

Does the Nasdaq listing include XRP directly?

No. The listing is for Evernorth, a firm that intends to buy and hold XRP as reserves, similar to early Bitcoin treasury strategies.

Glossary

Open Interest

Total number of active futures or options contracts that have not been settled.

Liquidity

The ability to buy or sell an asset without causing large price changes.

Institutional Adoption

Participation by hedge funds, banks, and regulated financial entities in a market.

ETF (Exchange Traded Fund)

A regulated investment product that tracks an asset, allowing public market access.

Read More: XRP Comeback Gains Pace as 1B Nasdaq Listing Planand 1,000 Percent Liquidity Surge Spark Institutional Rush">XRP Comeback Gains Pace as 1B Nasdaq Listing Planand 1,000 Percent Liquidity Surge Spark Institutional Rush

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.