Crypto Market Liquidations Expose Risk: Why Institutions Are Still Buying

0

0

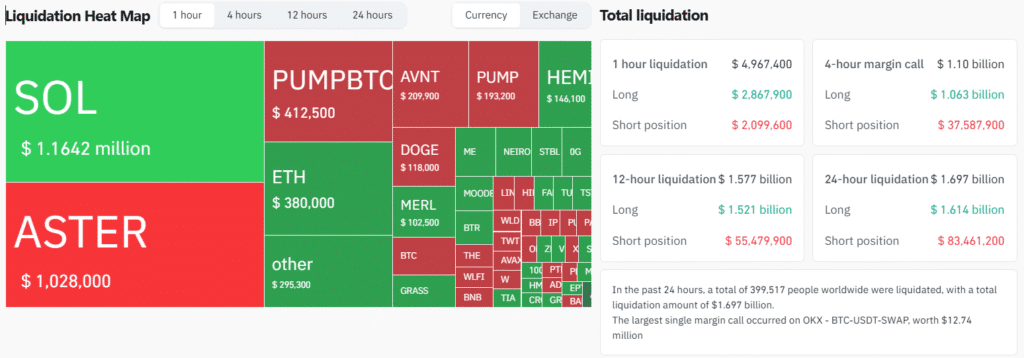

The crypto market saw a surging volatility over the past day, with more than $1.7 billion worth of leveraged positions liquidated. Most of these liquidations were longs, which shows that the market was over-optimistic.

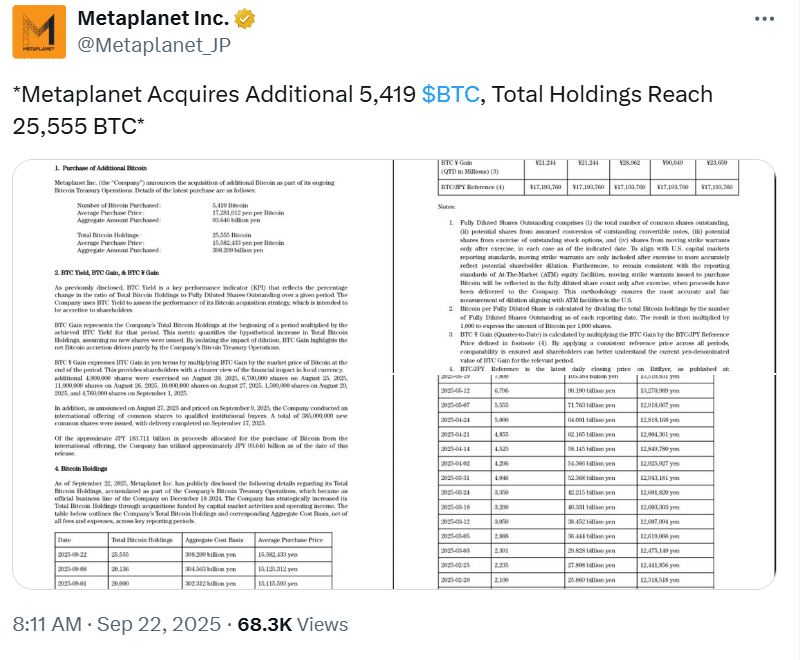

Institutional sentiment despite sell-off: Despite the market’s downturn, institutions still held their ground, with Japan-based investment firm Metaplanet adding to its Bitcoin stash and picking up an extra 5,419 BTC.

And the event underscores the dangers of leveraged positions, and likely huge prevalence of crypto market liquidation, making it worthwhile to gain some insights about crypto market liquidations.

Crypto Market Faces Sharp Decline

It was a bad week for cryptocurrency; the market suffered a 15% decline at the start of the week. Bitcoin (BTC) was trading below $115,000 on the first day of the week during early Monday’s Asian trading session. Altcoins, including Ethereum (ETH), Ripple (XRP), and Solana (SOL), also came under pressure as they traded lower.

Also Read: Bitcoin Weekend Dip Explained: Whale Selling, $620M Liquidations, Fed Caution

Meme coins, on the other hand, suffered deeper losses that deepened an already tumbling market. Some 89% of these liquidations were longs, data from Coinglass show, highlighting how too bullish a market position can be risky.

The Crypto Market’s ‘Extreme Power’ Move? The Liquidation Spike.

Recent data shows that more than $1.7 billion worth of positions had been liquidated in the crypto market over the past 24 hours. Of the amount, $1.615 billion came from long positions and $85.88 million from short ones.

Most of these liquidations were due to traders who were trading in high leverage, leading them to be forced to sell. During the same 24-hour period, Bitcoin (BTC) was liquidated to the tune of $276 million, and Ethereum (ETH) by $483 million.

How Leverage Brought Crypto Market Liquidations to the Crypto World

The leverage has the potential to generate big profits, but also considerable losses. The cryptocurrency space, notorious for its wild swings up and down is highly susceptible to quick turnarounds.

In this situation, as the price of Bitcoin plummeted, the liquidations resulted in a domino effect of forced selloffs across altcoins. This is what, in part, drove down the value of Bitcoin and Ethereum but also led to broader market losses.

The speed of the slide underscored how risky it can be to trade with high leverage, particularly in a market subject to such rapid swings. Crypto market liquidations like this provide a sharp lesson in the rapidity with which leverage becomes a risk when sentiment pivots.

Institutional Sentiment Stands Firm Even as the Market Withdraws

Despite the liquidation in leveraged bets, institutional demand for Bitcoin remains strong. On Monday, Metaplanet, a major Japanese investment firm, disclosed that it had purchased an additional 5,419 BTC to bring its total holdings to 25,555 BTC.

This strategic buy is further indication that institutions still believe in BTC, even amidst the earthquake happening throughout crypto. Metaplanet buying more Bitcoin into the market reflects the long-term vision of Institutional investors.

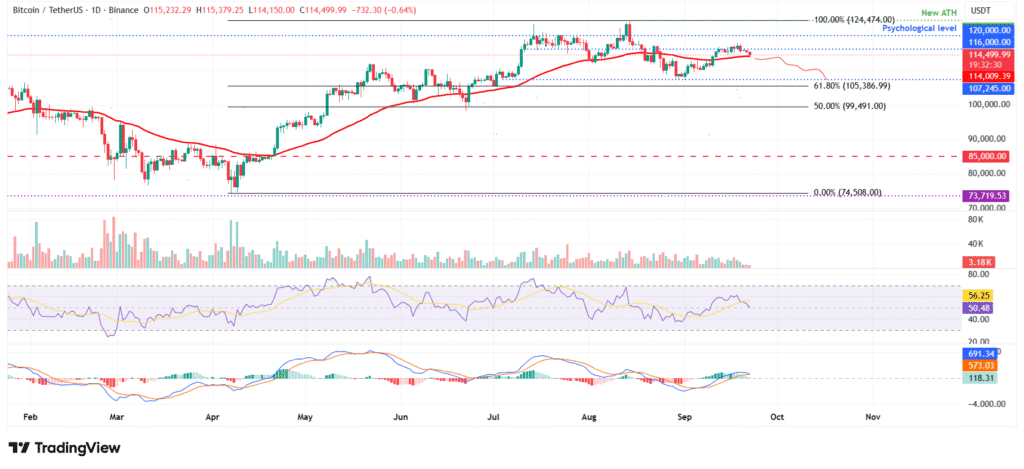

Bitcoin Approaches a Critical Support Level

The price of Bitcoin is also resting near the crucial support at $114,009 that lies in line with its 50-day Exponential Moving Average (EMA). Bitcoin has a lot to lose slipping below this level. If Bitcoin does lose this key price point, a massive drop could kickstart across the cryptocurrency market.

Traders should monitor for sustained weakness, especially with the RSI on Bitcoin’s daily chart slipping below 50, a neutral level. Moreover, the MACD is hinting towards a bear cross over, which indicates that we may continue to descend in the next few days.

Crypto Market Liquidations

Traders should be wary when the current trend of crypto market liquidation takes place. Speculators who had bet on higher prices were wrong-footed by the surprise decline in prices.

The volatility in the market and pace of liquidations are a reminder of the importance of good risk management. Traders who leveraged up without placing stop-loss orders or with too much exposure to high-risk trades were faced with losses of epic proportions.

The Significance of Risk Management in Crypto Trading

The crypto market is a tricky one and this latest round of liquidations proves just what can happen when you don’t practice solid risk management. Traders should be circumspect, especially when factoring in leverage, which can compound both gains and losses.

Stop-loss orders and disciplined efforts at risk management can help mitigate market volatility. Traders should continue to monitor volatility and rework strategies in order to prevent further liquidations from happening.

Conclusion

The latest Crypto market liquidations serve as a grim reminder of the dangers inherent in cryptocurrency trading. Although leverage can yield high returns, it also imposes the risk of magnified losses, particularly in a fast-moving market.

With the market so choppy, traders need to use proper risk management. In the days ahead, more ebbs and flows could be in store, so traders must stay alert as crypto markets may continue to liquidate.

Also Read: What $1.5B in Liquidations Say About Bitcoin’s Record-Breaking Rally

Summary

The cryptocurrency market experienced heavy volatility and saw about $61.7 billion of leveraged positions liquidated, the majority being long trades, indicating over-optimism. The price of bitcoin fell to below $115,000, taking altcoins and meme coins down further.

The cascade of forced selling was exacerbated by high-leverage contracts, highlighting the dangers of some aggressive trading strategies. Against the gloom, institutional investors’ confidence remained intact with Metaplanet from Japan buying 5,419 BTC.

Frequently Asked Questions about Crypto Market Liquidations

1- What caused the recent $1.7 billion in crypto Market liquidations?

The sharp decline in Bitcoin and altcoins triggered forced sell-offs, mostly from overleveraged long positions.

2- Why were long positions hit harder than shorts?

Because the market was overly bullish, most traders used leverage expecting gains, leaving them exposed when prices dropped.

3- Did institutional investors exit the market during the sell-off?

No. Firms like Metaplanet increased Bitcoin holdings, signaling long-term confidence despite short-term volatility.

4- How can traders protect themselves from liquidations?

By using stop-loss orders, limiting leverage, and diversifying to manage sudden price swings.

Appendix Glossary of Key Terms

Liquidation: Forced closure of a leveraged trade when losses exceed collateral.

Leverage: Borrowed funds used to amplify trading positions.

Altcoins: Cryptocurrencies other than Bitcoin.

Stop-Loss Order: A preset instruction to sell an asset once it hits a certain price.

Exponential Moving Average (EMA): A technical indicator that smooths price trends.

RSI (Relative Strength Index): A momentum indicator measuring overbought or oversold conditions.

MACD (Moving Average Convergence Divergence): A trend-following tool showing momentum shifts.

Read More: Crypto Market Liquidations Expose Risk: Why Institutions Are Still Buying">Crypto Market Liquidations Expose Risk: Why Institutions Are Still Buying

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.