Trump SEC guts Gensler-era crypto staking policy and opens door to ETFs

0

0

In President Donald Trump’s second term, the US Securities and Exchange Commission has been busy dismantling Gary Gensler’s crypto doctrine one rule at a time.

On Thursday, the SEC’s Division of Corporation Finance knocked down the latest domino — staking.

The unit clarified that solo staking, delegated staking, and even some forms of staking-as-a-service do not constitute securities offerings, the agency said in a statement.

It’s a major policy reversal from the previous Gensler-led commission, which aggressively pursued centralised staking providers like Kraken and Coinbase for allegedly offering unregistered securities.

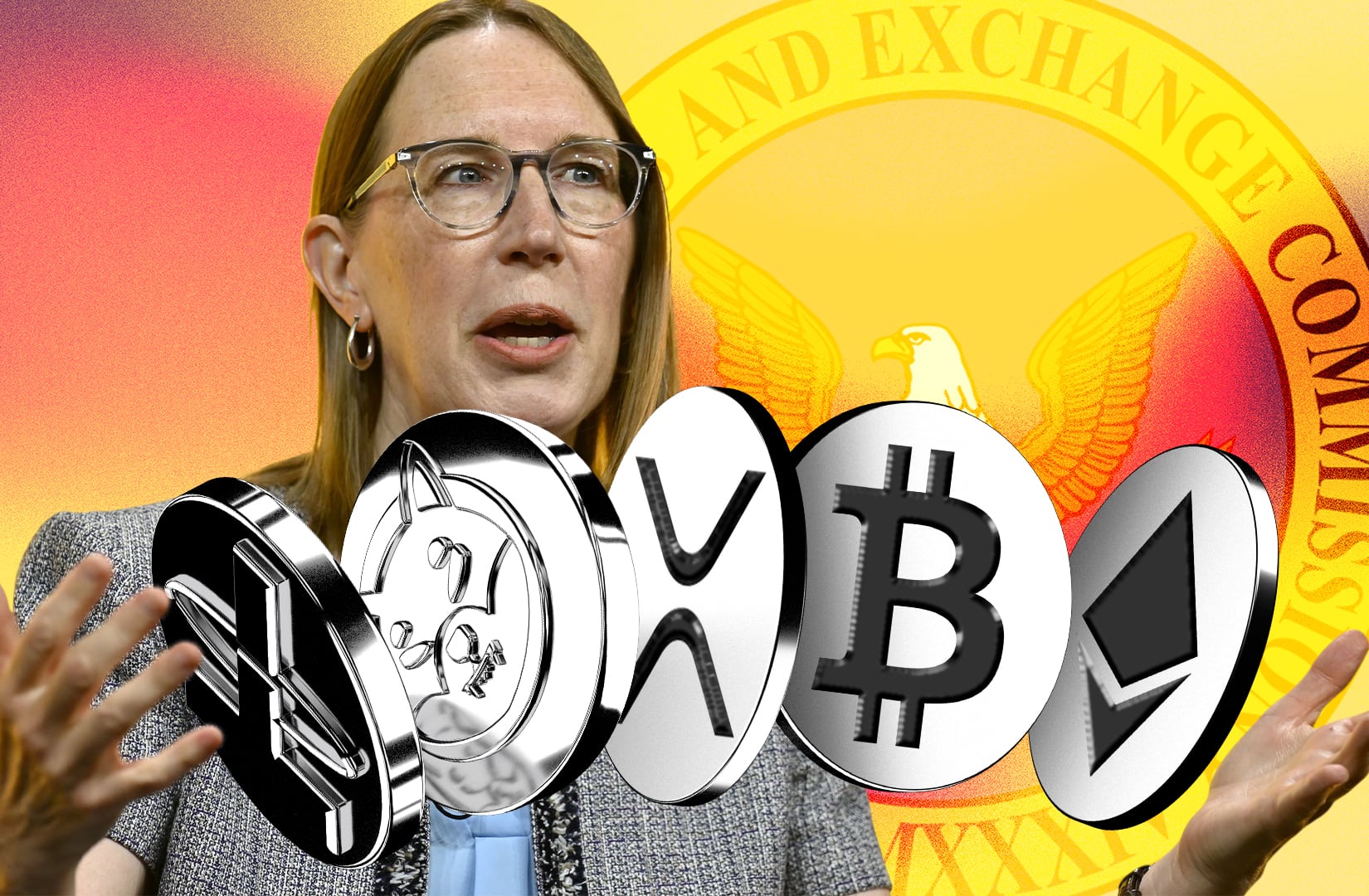

“Providing security is not a security,” SEC Commissioner Hester Peirce quipped in a recent speech.

Now head of the commission’s Crypto Task Force, Peirce called the new guidance a “coherent path forward” and criticised the prior administration’s reliance on enforcement actions rather than clear rules.

The guidance gives exchange-traded fund issuers new grounds to explore staking-linked products, which could soon join the queue of altcoin and futures ETFs already awaiting SEC action, according to Rebecca Rettig, the chief legal officer at Jito Labs.

New ETF frontier

Ethereum and Solana, the two largest proof-of-stake networks by market capitalisation, stand to benefit most from the SEC’s new staking stance.

Staking ETFs for both have already been live in Europe for years.

For instance, 21Shares launched its Ethereum and Solana staking ETPs in Europe in 2019 and 2021, respectively. Both are physically backed, offer staking rewards, and trade on exchanges like SIX Swiss.

Recent data shows its Ethereum staking ETF holds around $386 million in assets.

But despite Ethereum’s two-year head start and significantly larger market cap, 21Shares’ Solana product has nearly doubled that figure, drawing close to $1 billion in AUM.

More than 70 crypto-related ETF proposals are already piled up at the SEC, according to Bloomberg Intelligence analysts Eric Balchunas and James Seyffart.

They include multiple spot and futures applications tied to Solana, XRP, Cardano, Litecoin, and even memecoins like Dogecoin and Melania.

So while staking ETFs may have a clearer regulatory footing, any incoming proposals will likely have to wait in the back of the queue.

Crypto market movers

- Bitcoin has lost 2.8% in value over the last 24 hours and is trading at $105,885.

- Ethereum is down 3.7% in the same period to $2,620.

What we’re reading

- Hyperliquid airdrop farming drives 84% token surge — here’s three other factors driving the price ― DL News

- Animoca Could Be Crypto’s Next U.S. Public Offering. Is It a Strong GameFi Bet? ― Unchained

- The crypto app everyone missed — Milk Road

- Saudi-backed VivoPower makes $121m XRP treasury bet ― DL News

Kyle Baird is DL News’ Weekend Editor. Got a tip? Email at kbaird@dlnews.com.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.