Solana wallets cross 11 mln – A catalyst for SOL’s run to $270?

0

0

- Solana broke above $180 with a 3.5% daily gain, backed by an 11% surge in trading volume.

- Traders built $362M in long positions near $171.8, showing conviction in SOL holding above key support.

Solana [SOL] registered a sharp rebound this week, breaking out of a key resistance level and attracting strong participation across the board.

This strong performance has garnered significant attention from traders and investors, resulting in a massive amount of SOL being moved into wallet addresses.

Retailers’ participation in SOL skyrockets

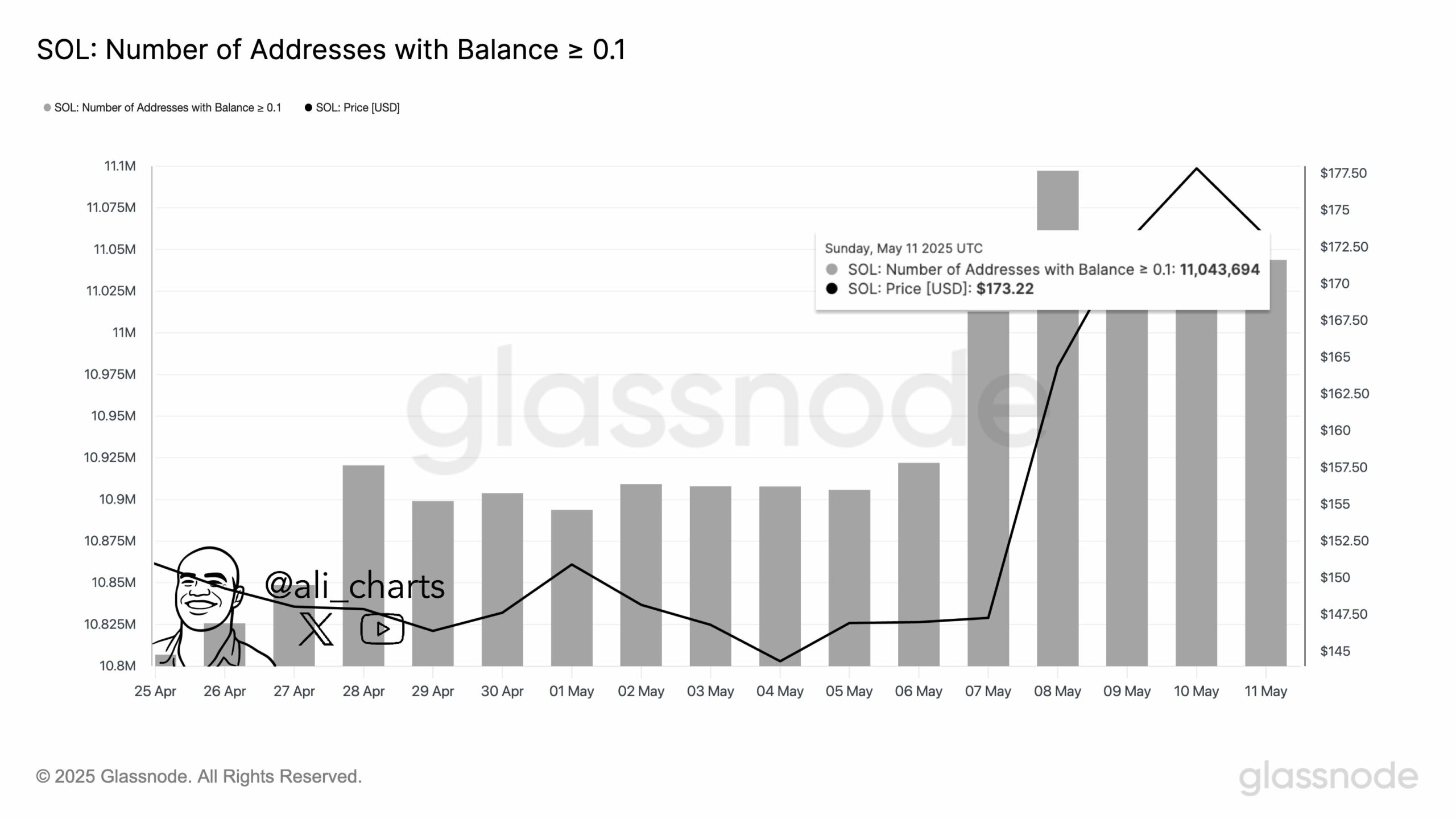

According to data from Glassnode, the Number of Addresses holding at least 0.1 SOL jumped to 11.04 million.

This reflected the growing interest and confidence of retail investors and long-term holders in the asset, which is a bullish sign in the long run.

Source: X (Formerly Twitter)

This surge in the number of wallets began when the SOL price was consolidating in a tight range above $150, following the breakout of a prolonged descending trendline.

At press time, SOL traded near $180, having gained 3.5% over the past 24 hours.

During the same period, participation from traders and investors has soared, leading to an 11% increase in Trading Volume.

This jump in volume, along with the rising price, indicates strong momentum in the asset and reflects current market demand and interest.

Solana price action and upcoming levels

According to AMBCrypto’s technical analysis, SOL appeared bullish and poised to continue its upward momentum at press time.

As per the daily chart, the altcoin recently broke out of a key resistance level at $180 after consolidating near this level for the past four trading days.

Based on the recent price action and historical patterns, the breakout has opened the path for a 40% upside rally, with SOL potentially reaching the $270 level.

Solana’s bullish thesis will hold only if the SOL price remains above the $179 level, otherwise, it may fail.

As of press time, SOL’s Relative Strength Index (RSI) stood at 72, indicating that the asset is in overbought territory and may experience a correction before continuing its rally.

$13M outflow points to accumulation phase

Given the current market sentiment, traders and investors are strongly betting on the bullish side and appear to be accumulating the token, per CoinGlass data.

Data from Spot Inflow/Outflow revealed that exchanges have witnessed an outflow of $13 million worth of SOL over the past 24 hours.

This outflow following the breakout indicates potential accumulation and could create buying pressure, leading to a further upside rally.

SOL’s Liquidation Map revealed heavy leverage, clustered around the $171.8–$186.5 range.

Interestingly, traders built $362.41 million in long positions near $171.8 support and $222.77 million in shorts near resistance.

This data indicates that bulls are currently dominating SOL and believe the asset’s price is unlikely to fall below the $171.8 level anytime soon.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.