DeFi Dev Corp. Adopts Solana-Based LSTs, Leveraging Sanctum

0

0

Highlights:

- DeFi Development Corp. has ventured into liquid staking technology, leveraging Sanctum’s infrastructure.

- The move will improve validator operations and treasury management, enhancing users’ experience.

- Users will earn rewards in the form of dfdvSOL tokens by staking SOL on DeFi Development Corp.

Nasdaq-listed company DeFi Development Corp. has adopted liquid staking technology (LST), leveraging Sanctum protocol infrastructure. For context, DeFi Dev Corp. is the first public firm to develop a treasury strategy specifically for Solana. On the other hand, Sanctum allows users to access liquid staking solutions on the Solana blockchain.

The company announced the latest move in a May 28 press release as part of its effort to improve validator operations and treasury management. It also aims to drive DeFi Dev Corp.’s mission of maximizing SOL Per Share (“SPS”) growth. Notably, SPS is a unique performance metric that tracks the value of SOL in DeFi Dev Corp.’s balance sheet relative to the number of shares it has given out. With this, the company seeks a transparent view of the underlying value of its treasury allocation.

Parker White, the Company’s Chief Investment Officer (CIO) and Chief Operating Officer (COO), stated:

“The adoption of dfdvSOL not only creates additional ways to drive stake to our validators and increase SOL holdings but also advances our role as a long-term participant in the Solana ecosystem.”

DeFi Development Corp, a Nasdaq-listed firm, just became the first public company to hold liquid staking tokens (LSTs) on Solana!

Here’s why this matters for crypto fans & new X users:

What’s Happening?

DeFi Dev Corp owns 609,190 SOL (~$105.8M) as of May 15.

… pic.twitter.com/okhcwYGr1O

— ₿tcSolver (@btcsolver) May 29, 2025

LST Operational Modalities

Per the press release, users can receive dfdvSOL tokens by staking their SOL tokens on LSTs. Over time, the value of the earned tokens would increase significantly. Notably, this value appreciation is automated as holders do not need to claim anything. dfdvSOL holders can use the tokens across several Centralized Finance (CeFi) and Decentralized Finance (DeFi) platforms.

In addition, users can decide to redeem their dfdvSOL tokens on Sanctum to receive their earned rewards and the initial amount of tokens they staked. DeFi Dev Corp. noted that it will roll out more information about the planned integration between dfdvSOL and LSTs in the future.

Nasdaq-listed company DeFi Development Corp (Ticker: DFDV) has announced its adoption of liquid staking token (LST) technology developed by Sanctum, becoming the first publicly traded company to invest in Solana-based LSTs. The company will allocate a portion of its SOL reserves…

— Wu Blockchain (@WuBlockchain) May 29, 2025

Solana Continues to Attract DeFi Platforms’ Interests

Crypto2Community reported two strategic investments involving the Solana ecosystem on May 6. First, SOL Strategies, a Toronto-based company, expanded its SOL position after spending $18.25 million to procure 122,524 SOL tokens at $148.96 per coin.

The company announced on X:

“SOL Strategies has acquired 122,524 $SOL at an average price of $148.96, deploying the full $20M initial tranche from our recently closed ATW facility.”

Earlier this month, DeFi Development Corporation (formerly Janover) announced a modification in the company’s priority. The company said it has shifted its focus from real estate to blockchain infrastructure. It added that it purchased a new validator business worth $3.5 million. Restricted stock accounted for $3 million, while the remaining $500,000 came from cash payments.

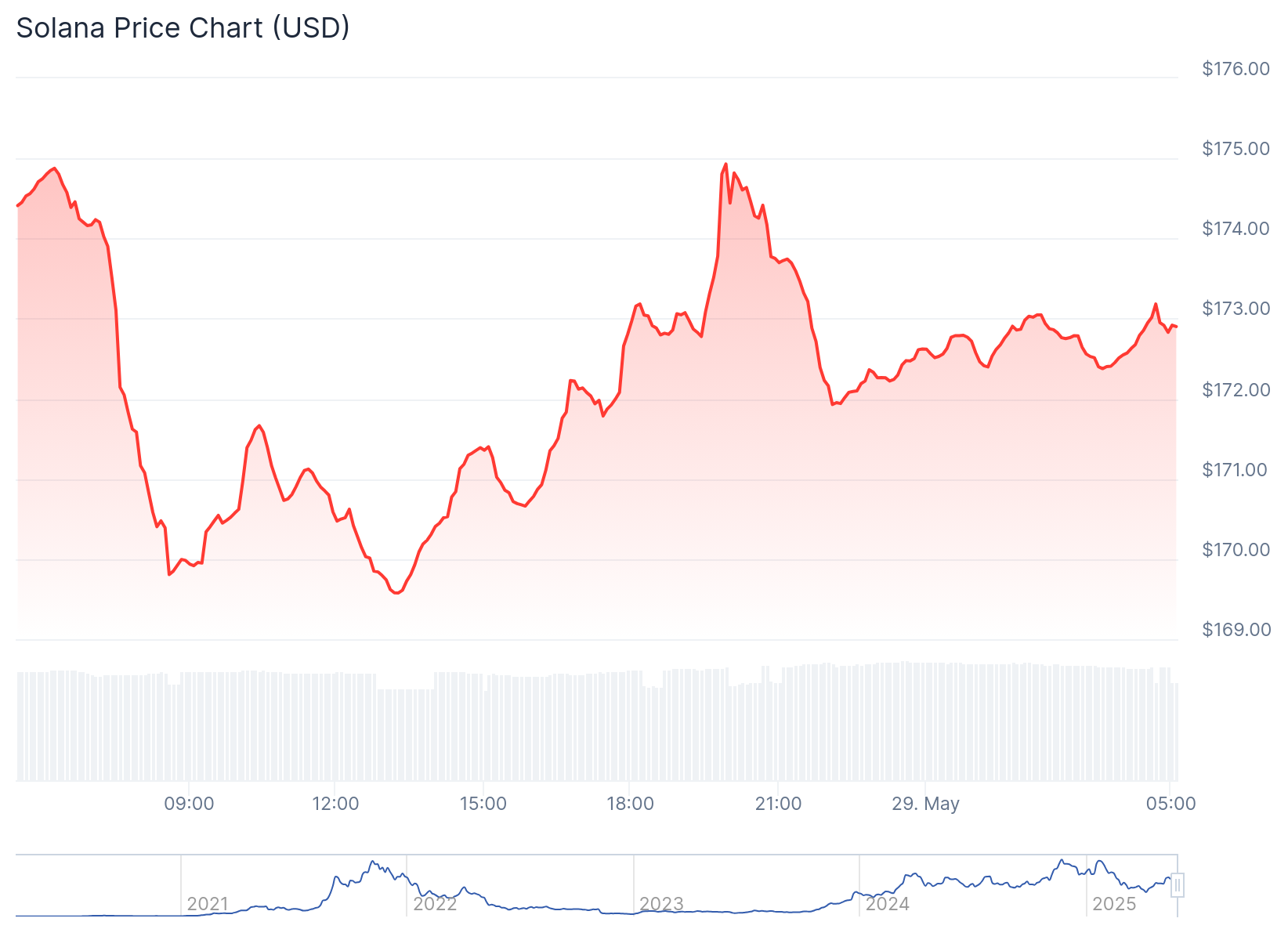

SOL Records Slight Drop

SOL has shed 0.4% in the past 24 hours, changing hands at approximately $172.75. In the past seven days, SOL reflected a 3.5% decline, fluctuating between $169.74 and $186.79. Relative to SOL’s current price, the price range shows that the token has retraced after a significant recovery.

Meanwhile, other extended-period price change data reflected price increments, suggesting transient decline tendencies. For context, SOL appreciated 0.1% 14-day-to-date, 15.7% 30-day-to-date, and 2.2% year-to-date. Despite the slight price correction, SOL’s 24-hour trading volume increased by about 5.18% to reach $3.68 billion.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.