Why is The Crypto Market Down Today?

0

0

The total crypto market cap (TOTAL) and Bitcoin (BTC) are noting a drop today, with the latter falling to $115,500 as the broader market conditions worsen. Altcoins, on the other hand, are performing rather well, moving against BTC, led by Chainlink (LINK), whose price rose by 9%.

In the news today:-

- Japan’s Financial Services Agency will approve JPYC Inc. to issue the nation’s first yen-denominated stablecoin later this year. The move marks a milestone in Japan’s financial modernization, with distribution set to begin after JPYC’s registration as a money transfer provider.

- Tokenized assets have hit a record $270 billion in assets under management, according to Token Terminal. The surge highlights Ethereum’s growing role as the preferred settlement layer for stablecoins and institutional tokenization.

The Crypto Market Is In the Red

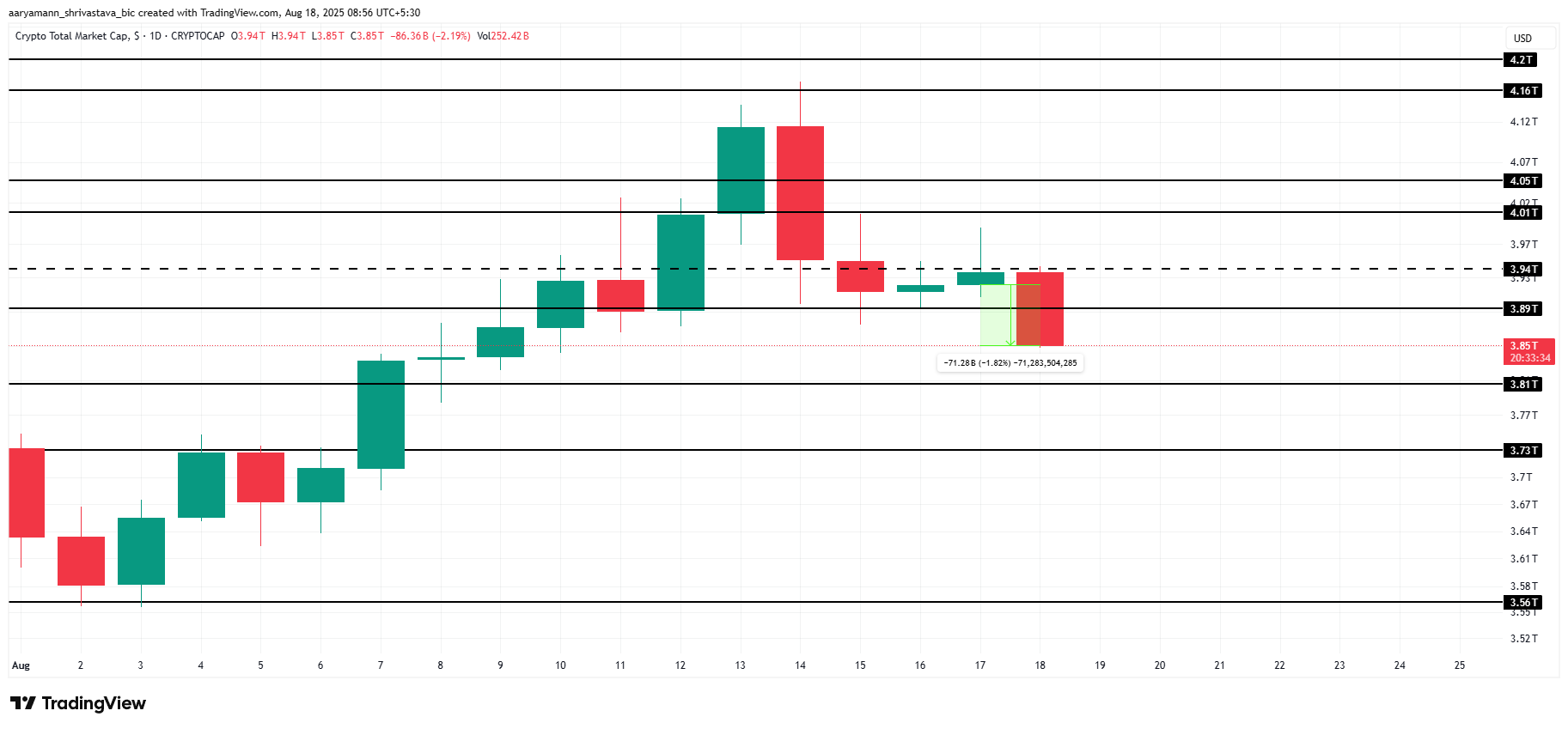

The total crypto market cap dropped by $71 billion in the past 24 hours, settling at $3.85 trillion. The decline follows uncertainty sparked by the Trump-Putin Alaska meeting, which triggered risk-off sentiment. This shift highlights the market’s sensitivity to geopolitical events impacting investor confidence across digital assets.

TOTAL now appears vulnerable to another decline, with downside risk pointing toward $3.81 trillion. Bitcoin’s weakness has led to a broader downturn, dragging altcoins with it.

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Total Crypto Market Cap Analysis. Source: TradingView

Total Crypto Market Cap Analysis. Source: TradingView

Should market conditions improve, TOTAL may reclaim the $3.89 trillion support level. This recovery could provide momentum for a push toward $4.01 trillion, signaling renewed optimism. Such a move would ease investor concerns and strengthen confidence.

Bitcoin Lost Another Support

Bitcoin’s price slipped in the past 24 hours, trading at $115,409 at press time. However, the crypto king continues to hover above the critical $115,000 support level.

The Relative Strength Index has dipped below the neutral 50 mark, signaling fading bullish momentum. This shift suggests growing bearish sentiment across the market. Bitcoin could decline toward the $112,256 support level if selling pressure continues, highlighting the risk of deeper losses and weakening near-term investor confidence in BTC.

Bitcoin Price Analysis. Source: TradingView

Bitcoin Price Analysis. Source: TradingView

If Bitcoin rebounds from the $115,000 support, the crypto king could regain strength. A successful bounce may allow BTC to retest $117,261, with a breakout potentially flipping it into support. This scenario would open the path for a climb toward $120,000, reinforcing renewed optimism among traders.

Chainlink Gains in 24 Hours

Chainlink defied Bitcoin’s pullback, emerging as a top performer with a 9% gain. At press time, LINK trades at $24.65, showing strong momentum. The move highlights investor confidence in the altcoin’s resilience.

The Parabolic SAR indicator currently sits below LINK’s candlesticks, confirming an active uptrend. This bullish signal suggests upward momentum remains intact. If buying pressure continues, Chainlink could break through $26.73 and extend its rally toward $30.00, reinforcing optimism.

LINK Price Analysis. Source: TradingView

LINK Price Analysis. Source: TradingView

However, if selling pressure builds, LINK risks losing traction. A decline could push the price down to $22.63 support, with a further breakdown potentially dragging it to $19.88 or lower. Such a move would invalidate the bullish outlook and shift sentiment toward caution among traders.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.