Chainlink Price Soars 10% as Whale Transactions Hit ATH in 3 Months – Bulls Target $35 Soon

0

0

Highlights:

- Chainlink price soars 10% to $23, as trading volume soars 141%.

- Chainlink whale transactions have hit the highest level in 3 months.

- Bullish indicators show a potential rally to $35 if bullish momentum bolsters.

The Chainlink price has spiked 10% to $23, as its daily trading volume skyrockets 141% to $2.74 billion. This surge indicates heightened market activity in the LINK market. LINK now boasts a 45% spike over the past week and a 48% rise in the past month, showing intense hype in the market.

Further, there has been an increased number of whale transactions. According to Santiment data, Chainlink transactions made by whales are the highest in three months, indicating the higher engagement of bigger investors. A whale trade usually implies any volatility in the market opinion, and the recent spike shows that the key traders are not afraid of the future price dynamics of $LINK.

Chainlink $LINK whale transactions surged to the highest level in 3 months! pic.twitter.com/ejFsf4zyNx

— Ali (@ali_charts) August 13, 2025

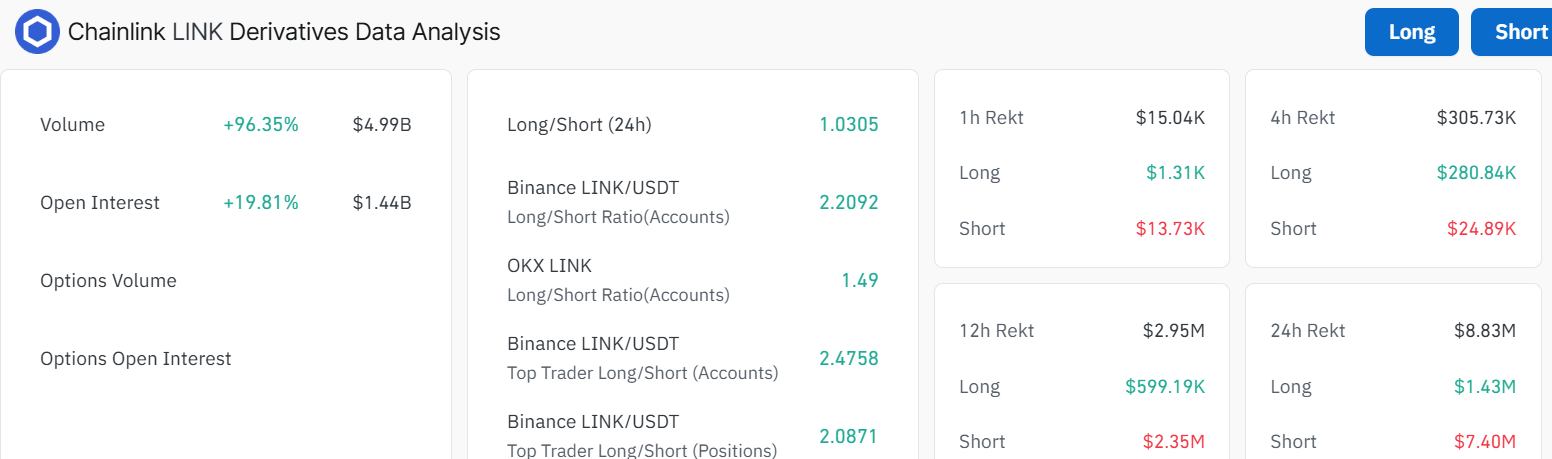

Moreover, the increased level of whale transactions was accompanied by a global increase in the derivatives market around Chainlink. The LINK volume has soared 96% to $4.99 billion, as the open interest has surged19% to $1.44 billion. It means that both retail traders and institutional investors are showing more interest in LINK, thus stimulating its market reputation.

Chainlink Price Breakout of a Rising Channel

On the other hand, the daily chart outlook shows Chainlink price has been steadily rising from lower levels around late July inside a rising channel. Moreover, the short-term MA (50-day) has crossed above the long-term MA(200-day), confirming a golden cross. Looking at the chart, LINK’s recent spike is turning heads as the 10% pop to $23 signals some bullish energy.

The upper trendline has been tested several times in the past, and with volume picking up, the LINK price has broken out. The 50-day and 200-day (SMA) on the 1-day chart at $16 and $15, respectively, act as support, with price bouncing off of them lately, which is a green flag for holders.

The Relative Strength Index (RSI) at 72.36 upholds overbought conditions, giving the bulls room for a potential pullback. Moreover, the Moving Average Convergence Divergence (MACD) histogram is green, upholding a bullish outlook. Additionally, the blue MACD has crossed above the orange signal line, calling for more traders to buy LINK tokens.

LINK Poised for Further Upside

Looking at the bigger picture, the recent 10% pump suggests strong community sentiment and trader confidence. Moreover, the Golden Cross and the recent breakout above the parallel channel uphold further upside in the Chainlink market. If the current bullish momentum holds, Chainlink price might test resistance around $27 and soar to $30-$35, a 47% surge from here. A break above that and LINK could run back to $40 territory.

Conversely, if the bears take control, those 50 and 200 SMAs could turn into a battleground. A drop below might send the altcoin back to $14. Overall, the Chainlink price trend is still firmly bullish. However, the key test now will be whether the bulls have enough strength to push ETH beyond $35 and into the next phase of its uptrend.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.