Bitcoin: Navigating Crucial Market Tests Near Record Highs

0

0

BitcoinWorld

Bitcoin: Navigating Crucial Market Tests Near Record Highs

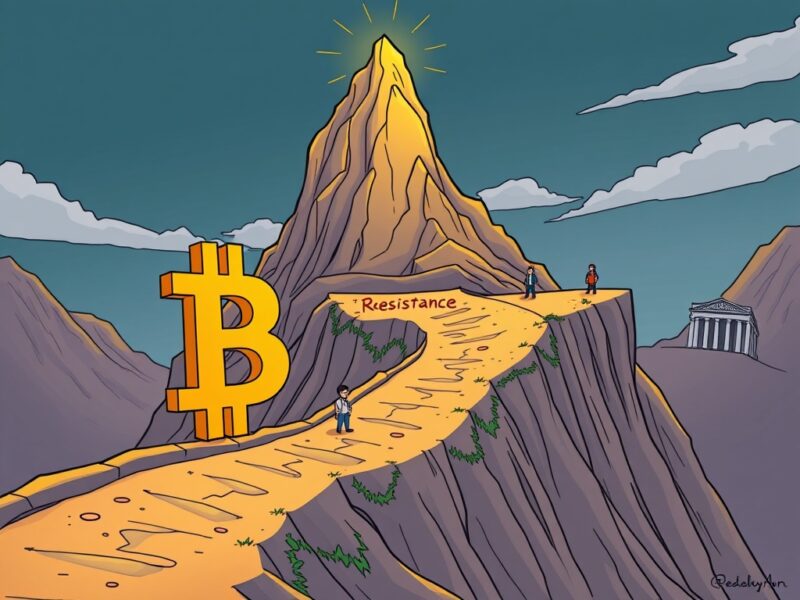

The cryptocurrency world is buzzing! Bitcoin has once again captured headlines, surging significantly and nearing its all-time Bitcoin record highs. This latest ascent has created immense excitement, but also brings into focus several critical Bitcoin market tests that could define its immediate future. As investors watch closely, understanding these pivotal moments is key to navigating the volatile digital asset landscape.

Bitcoin’s Remarkable Ascent: Approaching Record Highs

Over the past weekend, Bitcoin displayed impressive strength, soaring past the $122,000 mark. This rapid climb led to the liquidation of over $100 million in short positions, catching many traders off guard. However, following this strong move, Bitcoin experienced a slight retracement, which is a common occurrence after significant price surges.

This rally brings us tantalizingly close to the previous Bitcoin record highs. The market’s current energy suggests a strong underlying demand, but also highlights the importance of observing how Bitcoin handles the pressure at these elevated levels.

What Are the Key Bitcoin Resistance Levels to Watch?

As Bitcoin pushes higher, traders are now intently watching specific price points that could act as barriers. One immediate point of interest is the $123,000 level, which presents a significant psychological and technical resistance. Overcoming this hurdle could pave the way for a sustained push towards new peaks.

Beyond immediate resistance, market participants are also considering a potential pullback to the $117,200 CME gap. A CME gap occurs when the closing price of Bitcoin futures on the Chicago Mercantile Exchange (CME) differs significantly from the opening price on the next trading day. Often, the price tends to ‘fill’ these gaps over time, making it a crucial area to monitor for a possible retest or consolidation before further upward movement. These are vital Bitcoin resistance levels that dictate short-term price action.

How Does Federal Reserve Policy Influence the Crypto Market Outlook?

The broader economic environment, particularly actions taken by central banks, significantly impacts the crypto market outlook. Upcoming U.S. Consumer Price Index (CPI) and Producer Price Index (PPI) data are highly anticipated events. These inflation reports play a crucial role in shaping expectations for Federal Reserve policy regarding interest rate cuts.

- Higher-than-expected inflation: Could reduce the likelihood of near-term rate cuts, potentially creating headwinds for risk assets like Bitcoin.

- Lower-than-expected inflation: Might increase the odds of rate cuts, generally seen as a positive catalyst for cryptocurrencies as it makes holding traditional assets less attractive.

The Fed’s decisions on interest rates can profoundly influence investor sentiment and capital flows, directly affecting the overall crypto market outlook.

Decoding Whale Activity and Sustained Buying: Important Bitcoin Market Tests

Beyond macroeconomic factors, internal market dynamics provide critical insights into Bitcoin’s health. Whale activity, which refers to the movements of large holders of cryptocurrencies, offers a glimpse into institutional and high-net-worth investor sentiment. Currently, data suggests that whale USDT (Tether) activity shows little significant profit-taking, which could be interpreted as a bullish sign of confidence in Bitcoin’s continued appreciation.

However, a negative Coinbase Premium raises some concerns about sustained buying pressure, particularly during U.S. trading hours. Coinbase Premium refers to the difference between Bitcoin’s price on Coinbase (a popular U.S. exchange) and other global exchanges. A negative premium indicates that Bitcoin is trading at a discount on Coinbase, suggesting weaker buying interest from U.S. retail and institutional investors. These are important Bitcoin market tests that reflect the strength of demand at critical junctures.

Conclusion: Navigating the Path Ahead

Bitcoin’s journey near record highs is a testament to its resilience and growing adoption. However, the path forward is not without its challenges. From overcoming key Bitcoin resistance levels and navigating potential CME gaps to reacting to crucial Federal Reserve policy decisions and internal market indicators like whale activity and Coinbase Premium, Bitcoin faces a series of pivotal Bitcoin market tests. Understanding these factors provides a clearer picture of the current crypto market outlook and helps investors make informed decisions in this dynamic environment. Stay vigilant, stay informed, and prepare for the next exciting chapter in Bitcoin’s story.

Frequently Asked Questions (FAQs)

1. What is the significance of the $123,000 resistance level for Bitcoin?

The $123,000 level is a key technical and psychological resistance point. If Bitcoin can decisively break above it, it could signal strong bullish momentum and open the door for further price appreciation towards new record highs.

2. What is a CME gap and why is it important for Bitcoin’s price?

A CME gap occurs when the closing price of Bitcoin futures on the CME differs from the opening price of the next trading session. These gaps often act as magnets, meaning the price tends to return to ‘fill’ them. For Bitcoin, the $117,200 CME gap is a potential target for a pullback or consolidation.

3. How do U.S. CPI and PPI data affect Bitcoin’s price?

U.S. CPI (Consumer Price Index) and PPI (Producer Price Index) data measure inflation. Higher inflation can reduce the likelihood of Federal Reserve interest rate cuts, which can negatively impact risk assets like Bitcoin. Conversely, lower inflation might increase the chances of rate cuts, generally seen as positive for crypto.

4. What does a negative Coinbase Premium indicate?

A negative Coinbase Premium means Bitcoin is trading at a lower price on Coinbase (a U.S. exchange) compared to other global exchanges. This can suggest weaker buying interest from U.S.-based investors, potentially signaling a lack of strong, sustained demand during U.S. trading hours.

5. Are Bitcoin whales taking profits at current levels?

According to recent data on whale USDT activity, there has been little significant profit-taking by large Bitcoin holders. This could indicate confidence among these major players that Bitcoin’s price may continue to rise, rather than expecting an immediate downturn.

Did you find this analysis helpful? Share this article with your friends and fellow crypto enthusiasts on social media to keep them informed about Bitcoin’s exciting journey and the crucial market tests it faces!

To learn more about the latest Bitcoin trends, explore our article on key developments shaping Bitcoin price action.

This post Bitcoin: Navigating Crucial Market Tests Near Record Highs first appeared on BitcoinWorld and is written by Editorial Team

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.