Metaplanet Buys 319 BTC Pushing Total Holdings to 4,525

0

0

Highlights:

- Metaplanet increases Bitcoin holdings to 4,525 following 319 BTC purchases.

- The company spent $26.3 million on its most recent purchase at $82,549 per token.

- Metaplanet’s Bitcoin holdings surged $386.3 million following the acquisition.

On April 14, Metaplanet’s Chief Executive Officer (CEO), Simon Gerovich, tweeted that the company bought an additional 319 BTC for $26.3 million, increasing its total holdings to about 4,525 tokens. In the X post, the CEO noted that the Japanese investment firm purchased each token at $82,549 per coin and has achieved year-to-date returns of about 108.3%.

Metaplanet has acquired 319 BTC for ~$26.3 million at ~$82,549 per bitcoin and has achieved BTC Yield of 108.3% YTD 2025. As of 4/14/2025, we hold 4525 $BTC acquired for ~$386.3 million at ~$85,366 per bitcoin. pic.twitter.com/aN0Jz9SgwQ

— Simon Gerovich (@gerovich) April 14, 2025

Today’s purchase increased Metaplanet’s Bitcoin holdings valuation to about $386.3 million, with each token valued at roughly $85,366. In a separate tweet, Metaplanet’s official X handle summarized the company’s events from January this year. One of Metaplanet’s most recent events includes its 14th and 17th series stock rights exercise. According to the shared document, the investment firm issued 8.66 million shares in its 14th series and 4.2 million shares in its 17th issuance.

The above exercises utilized part of the available rights, leaving 12.5 million shares from the 14th series unexercised and 25.3 million shares from the 17th series unexercised. Meanwhile, Metaplanet completed 41.7% of its plan to issue 210 million shares via stock rights to EVO FUND.

So far, Metaplanet has raised ¥35.1 billion ($245.66 million) from its 13th, 14th, and 17th series exercises. On April 11, Metaplanet approved new stock options, the 18th series for employees and directors. The stock options covered 4.85 million shares, priced at ¥160 ($1.12) per share.

*Metaplanet Purchases Additional 319 $BTC* pic.twitter.com/haBS1NjtwI

— Metaplanet Inc. (@Metaplanet_JP) April 14, 2025

Metaplanet Intensifies Bitcoin Accumulation in April

In March, Metaplanet bought 1,115 Bitcoin via five different procurements. This month, the company has built on a consistent investment strategy with marked BTC acquisitions.

On April 1, Metaplanet bought 696 Bitcoin for $67.8 million. This purchase was followed up with another 160 Bitcoin acquisition worth $13.2 million on April 2. In January, Metaplanet’s CEO said the company’s long-term goal entails procuring 10,000 BTC by the end of this year and 21,000 by the end of 2026.

Meanwhile, Metaplanet reported significant gains from its Bitcoin investments earlier this month. According to the report, the company earned ¥770.31 million ($5.39 million) in revenues generated in 2025’s first quarter (Q1), marking an 11% increment from the figure reported in 2024’s Q1. The publication also noted that the investment firm generated the funds through structured cash-secured BTC put options. This strategy allows Metaplanet to earn a passive income from Bitcoin acquisitions.

Beyond acquiring 10,000 BTC by the end of this year, Metaplanet has set a ¥3 billion ($20.97 million) target for Bitcoin-related operations in 2025. The earnings from Q1 already accounted for 25.7% of this target, implying that the company is on track to meeting its target for the year.

Metaplanet Shareholders Record Significant Jump

In an April 11 tweet, Metaplanet’s CEO announced that the company’s shareholders have jumped significantly. In the X post, Gerovic stated that Metaplanet now has 63,654 members, about six times the number at the end of 2023. This figure implies strong faith in the company’s investment strategies.

メタプラネットの「惑星」がどんどん拡大中!

現在の株主数は63,654名に到達しました。2023年末の約6倍です。ご参加いただいている皆さま、本当にありがとうございます。

この先、どこまで広がるのでしょうか?

pic.twitter.com/9f3Y4lC33U

— Simon Gerovich (@gerovich) April 11, 2025

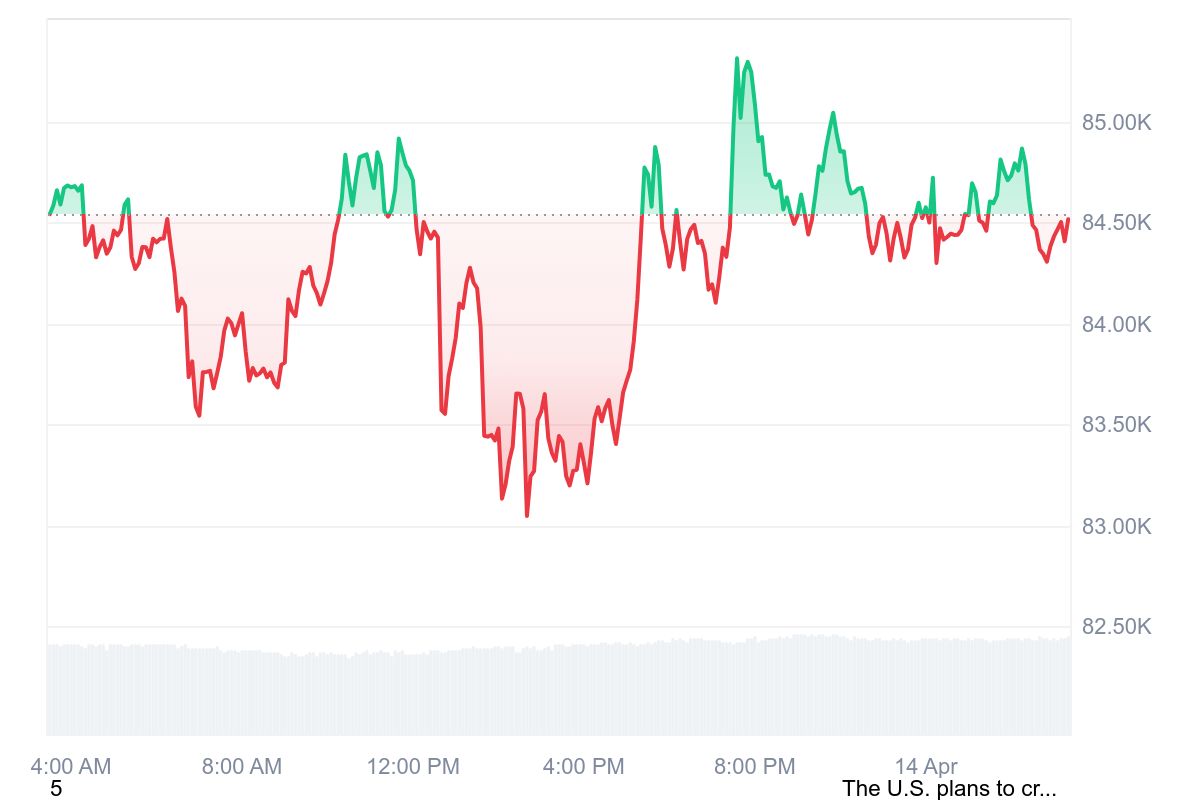

At the time of writing, Bitcoin is up 0.1% in the past 24 hours, trading at approximately $84,700. In the past week, Bitcoin has surged 12.7%, with prices fluctuating between $75,101.40 and $85,528.04. This range suggests the token has recovered significantly from last week’s declines.

Aside from the short-term interval price jump, BTC’s 14-day-to-date and month-to-date price change variables also reflected spikes of about 3.5% and 0.9%, respectively. Following the recent slight recovery, Bitcoin’s market cap increased to about $1.68 trillion. Its 24-hour trading volume spiked 6.5% to about $30.59 billion.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.