Solana Price Nears Key Resistance, Global Liquidity Signals Upside Potential

0

0

Solana (SOL) price is approaching a critical resistance level, capturing the attention of many investors. Recent trends indicate an uptick in the global money supply, signaling favorable conditions for risk assets like Solana coin.

As M2 global liquidity expands, Solana price appears to be poised for a potential breakout beyond its current resistance, aligning with positive macroeconomic conditions that could lead to significant upward movement.

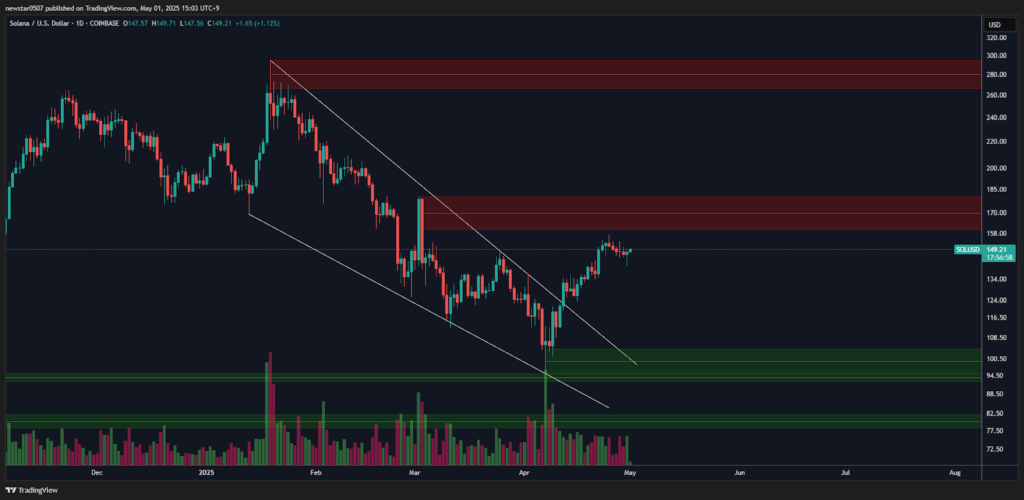

Solana Price Faces Key Resistance Levels

Solana price has demonstrated strength recently, bouncing off support zones between $134 and $140.

That suggested a potential bullish reversal. It was testing the upper boundary of a descending channel at press time, which often occurs before upward movements.

A break above the $150 resistance could lead to further gains, with targets between $170 and $185, and possibly even $260 and $320.

Rising trading volume supports the likelihood of a breakout. Increased volume typically indicates growing interest from traders, often leading to larger price movements. It suggested that Solana could be preparing for a move above its current resistance levels.

Strong price momentum and favorable macroeconomic conditions, especially the rise in global liquidity, further strengthen the breakout potential.

If Solana manages to break the $150 resistance, it could signal a continued upward trajectory with significant price gains ahead.

Global Liquidity Expansion Fuels Bullish Sentiment

Recent increases in global liquidity suggest favorable conditions for risk assets like Solana price. The rise in M2 money supply, which tracks the total money in circulation, often signals increased market liquidity and investor confidence.

Historically, such expansions have contributed to price growth in assets like cryptocurrencies.

This boost in liquidity could help Solana price break through its current resistance levels. There was a well-established correlation between rising global liquidity and bullish market conditions at the time of writing.

As the money supply expands, speculative activity typically increases, driving asset prices higher. Solana’s price action was in line with that trend, suggesting strong upside potential if it could break through its current sell wall.

The increase in open interest in Solana futures also supported this bullish outlook. Open interest, which measures the number of outstanding futures contracts, rose alongside Solana’s price. That reflected growing market confidence.

As more traders enter the market, betting on future price growth, Solana’s potential for a breakout strengthens, particularly as global liquidity continues to rise.

Solana’s Rising Open Interest Supports Bullish Outlook

The rise in open interest in Solana price futures has become a key indicator supporting a bullish outlook. From early 2024, both Solana’s price and open interest began to increase in tandem, signaling growing confidence in the asset’s future performance.

As Solana’s price surged from $50 in early 2024 to around $150 by April 2025, open interest also saw a significant rise. That reflected traders’ optimism.

This strong correlation between price and open interest is often viewed as a bullish signal. When both increase together, it indicates that traders are not only confident in the price direction but are also committing more capital to the market.

This growing market participation could help Solana break through its resistance levels. It could help Solana price continue its upward trend.

The sharp spike in open interest in April 2025 suggested that speculative activity was intensifying. As Solana’s price rose, more traders were positioning themselves for a potential breakout.

With rising global liquidity and increasing participation from traders, Solana’s bullish outlook was gaining momentum.

Institutional Confidence in Solana Strengthens Market Sentiment

Institutional investments are becoming a major sign of confidence in the future development that Solana price will experience.

Recently, a NASDAQ-listed company, namely, Upexi Inc., bought more than 45,000 Solana tokens through its treasury management. The price of all those SOL coins amounted to $100 million, proving its institutional appreciation of Solana’s worth.

This move, accompanied by funding from top venture capital firms, proved that big names started to take notice of Solana.

It serves as a stream that keeps on building up the next level of the price appreciation as more institutional players begin to enter the market, with a boost from global liquidity.

With the increased institutional interest, the upward trend in value, and the relative openness, Solana could hit its upper resistance. Those factors point to the positive direction, and, therefore, the possibility of Solana price shooting up soon.

The post Solana Price Nears Key Resistance, Global Liquidity Signals Upside Potential appeared first on The Coin Republic.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.