Bitcoin (BTC) Price Has A New ATH: Where Is It Headed Next?

0

0

The Bitcoin (BTC) price briefly surged above $111,970, marking a new BTC ATH and confirming a breakout that had been building for weeks. This move puts the Bitcoin price in discovery mode, with no past levels to act as resistance.

While price has since cooled slightly, the overall trend remains intact. With institutional inflows continuing and on-chain structure holding firm, the question now is whether Bitcoin can carry this move toward its next leg, or if the breakout fades.

Open Interest Reset Signals Strength Behind BTC Price Move

Crypto Analyst DaanCrypto pointed out that Open Interest in BTC surged $1.1 billion just before a sharp $400 million flush took place, all thanks to the move towards $111,000.

This liquidation event cleared many overleveraged long positions. What makes this significant is that the BTC price didn’t collapse after the flush.

Instead, it held above $108,000, signaling that spot buyers were still present and willing to support the Bitcoin price at higher levels.

These resets are common during ATH tests. They remove weak leverage, reset funding rates, and allow more stable growth. Plus, short liquidations even trigger auto buy mode for BTC, which is a bullish signal.

The next massive liquidation or flush window sits at $120,000.

And yes, the Bitcoin OI continues to rise, and with the price rise in picture, it necessarily points towards bullish bias or Longs.

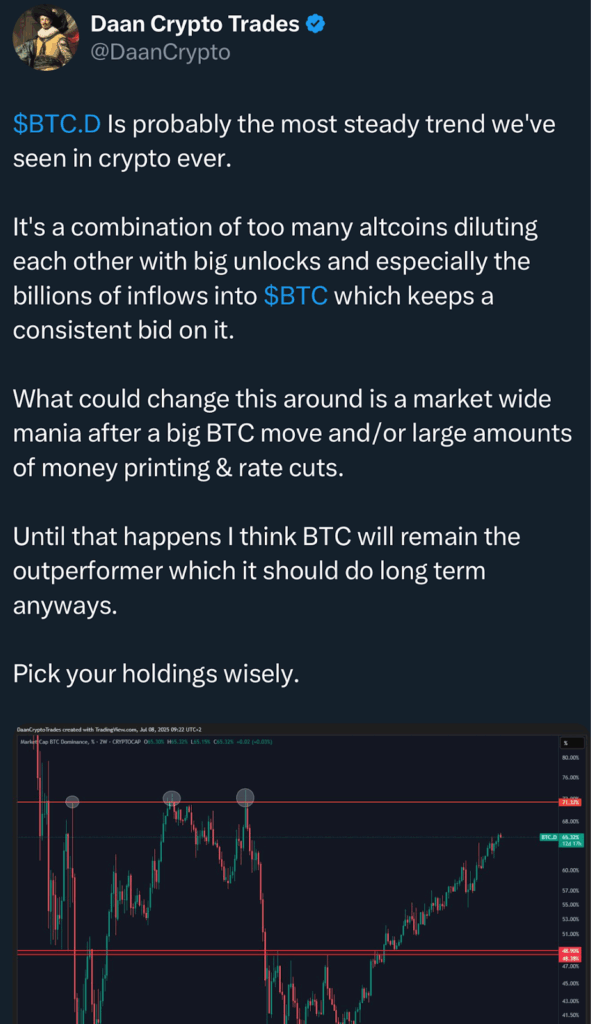

Bitcoin Dominance Rises as Altcoins Lag

As Bitcoin pushed into ATH territory, Bitcoin Dominance (BTC.D) climbed steadily to above 60%, currently at 63.8%, per CoinMarketCap data. According to DaanCrypto, this move reflects real capital rotation.

While altcoins continue to face selling pressure and token unlocks, BTC is absorbing market liquidity through ETFs and institutional flows. A rising dominance metric typically confirms strength in Bitcoin during breakout phases.

When Bitcoin Dominance rises during new highs, it usually leads to longer BTC-led cycles before the market rotates into altcoins. So far, that script is playing out exactly.

Bukele’s Post Sparks Long-Term Sentiment

Adding fuel to the breakout optimism, El Salvador’s President Nayib Bukele posted a screenshot of the country’s Bitcoin holdings.

As of now, their BTC portfolio is worth over $691 million, with nearly $400 million in unrealized gains.

While this was once dismissed as political hope, Bukele’s post now represents a different kind of signal; one that mixes national adoption with long-term conviction.

Retail investors tend to pick up on these moments, especially when the macro picture supports continuation. In a bull cycle, these posts can drive waves of speculative re-entry.

BTC Price Targets and Invalidation

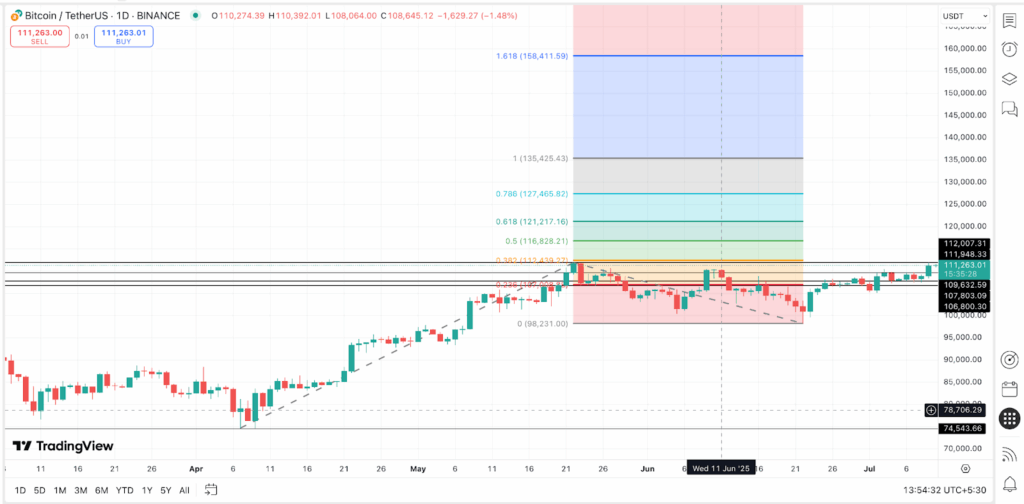

With Bitcoin in price discovery, historical resistance is no longer useful. Instead, traders are using trend-based Fibonacci extensions to project potential turning points.

The current chart setup begins from the previous macro low of $74,543 and extends to the new ATH at $111,948. Based on this structure, the next levels to watch are $112,439 as immediate resistance, followed by $116,000 as the first major breakout level.

If Bitcoin price breaks that zone, the next likely levels are $127,465 and $135,425, both of which also align with high-leverage liquidation clusters. The full 1.618 extension puts a longer-term BTC price target at $158,411.

That said, invalidation is always on the table. If BTC price falls below $107,000 with declining Open Interest and increasing exchange inflows, the short-term bullish thesis weakens.

A break below the swing structure near $98,000 would be a more significant structural failure.

The Bitcoin price is being driven by healthy flows, a clean Open Interest reset, and increasing dominance.

With liquidation triggers ahead and sentiment catching fire, the BTC price has room to move, and levels like $135K and even $158K are not fantasy.

For now, all eyes remain on Bitcoin and whether it can convert this breakout into something much bigger.

The post Bitcoin (BTC) Price Has A New ATH: Where Is It Headed Next? appeared first on The Coin Republic.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.