Crypto Whale’s $27M Short Lives Briefly in Profit Then Gets Wiped Out

0

0

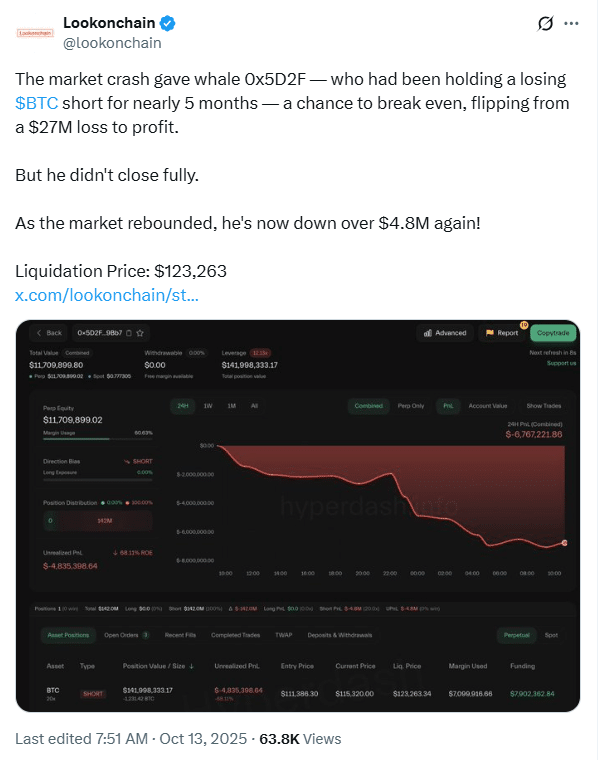

Crypto market turbulence has once again taken down a major player. A prominent crypto whale, identified by the wallet address 0x5D2F, has returned to heavy losses after briefly escaping a five-month losing streak on a major Bitcoin short.

The trader’s open position, once showing profit during the recent flash crash, is now sinking back into deep red territory. This turn of events highlights the unforgiving pace of the cryptocurrency market.

Whale’s Costly Gamble Highlights Crypto Market Volatility

The whale’s position once carried a staggering $27 million unrealized loss before turning positive during the sudden market drop. Instead of closing the trade, the investor held on, expecting Bitcoin’s price to decline further.

Also Read: Arthur Hayes Says the Bitcoin 4-Year Cycle Is Dead

That decision has now backfired. As Bitcoin rebounded over the past week, the same trade has flipped into a $4.8 million unrealized loss, with the liquidation price hovering around $123,263.

This reversal illustrates the essence of crypto market volatility, where fortunes are made and lost in days. Market analysts say the trader’s hesitation shows how even seasoned players can misjudge rapid swings in sentiment.

The High Stakes of Whale Trading

Large investors, often called whales, dominate massive positions in crypto. Their moves can shift prices, influence market trends, and spark widespread reactions. But in periods of crypto market volatility, even whales struggle to time entries and exits effectively.

| Month | Min. Price | Avg. Price | Max. Price | Potential ROI |

|---|---|---|---|---|

| Oct 2025 | $ 115,919 | $ 122,599 | $ 127,945 |

11.46%

|

| Nov 2025 | $ 117,617 | $ 121,422 | $ 132,394 |

15.34%

|

| Dec 2025 | $ 134,941 | $ 139,435 | $ 144,491 |

25.87%

|

The 0x5D2F case serves as a reminder that no amount of capital shields a trader from emotional and strategic missteps. Leaving a short position open in a recovering market amplified risk exposure as Bitcoin regained strength.

Bitcoin’s Sharp Rebound

Bitcoin’s comeback has been fast and fierce. Over the last 24 hours, it gained 3.2%, climbing to about $115,430. Analysts attribute this rebound to renewed investor confidence and reduced selling pressure after mass liquidations.

Data from CoinGlass shows more than 1.6 million traders were liquidated on October 11, resulting in $19.1 billion in total losses. This chain reaction was triggered by a combination of thin weekend liquidity, automated trading mechanisms, and macroeconomic fears—a classic example of crypto market volatility at work.

What Triggered the Crash

Analysts from Presto Research pointed to external factors driving the sell-off. China’s new export restrictions and the United States’ plan for 100% tariffs on tech imports rattled global markets.

Rick Maeda, senior analyst at The Block, said the timing of these announcements coincided with low liquidity, causing a spiral of forced liquidations. Such cross-border developments often fuel crypto market volatility, as traders react sharply to global economic shifts.

Analysts Split on Uptober Trend

Despite recent turbulence, opinions remain divided on the outlook for the bullish “Uptober” phase. Vincent Liu, Chief Investment Officer at Kronos Research, said that risk appetite has returned and the uptrend remains intact.

Nassar Achkar, Chief Strategy Officer at CoinW, said traders are keeping a close eye on the Federal Reserve’s upcoming meeting and US inflation data. He added that inflows into spot ETFs are also being watched as key indicators of market direction.

These factors could shape short-term sentiment across the crypto sector. Nick Rak, Director at LVRG Research, observed that whales are quietly accumulating Ethereum, showing steady confidence amid ongoing crypto market volatility.

Cautious Optimism Among Experts

Some experts urge caution despite signs of recovery. Maeda warned that the record level of liquidations could weigh on sentiment for weeks. Traders may become more sensitive to global news, especially developments in US–China trade relations.

A report from The Kobeissi Letter described the crash as technical rather than structural, emphasizing that the downturn stemmed from leverage and liquidity issues—not from weakening fundamentals.

Lessons From the 0x5D2F Case

The situation underscores the need for strong risk management during crypto market volatility. Even experienced whales can make emotional decisions in fast-moving markets. Clear exit strategies and timely profit-taking often separate success from loss.

For 0x5D2F, the coming days will determine whether the whale cuts losses, doubles down, or holds the line. Either choice will offer valuable insights into how major traders navigate extreme volatility.

Conclusion

The case of 0x5D2F underscores a critical truth: crypto market volatility spares no one. It is a constant test of timing, strategy, and psychology. As Bitcoin stabilizes and optimism returns, the market once again proves that hesitation can be costly—even for the biggest players.

Also Read: Q4 2025 Could Be Bitcoin’s Biggest Bull Run Yet: Here is Why

Appendix: Glossary of Key Terms

Crypto Whale – A trader or entity holding large amounts of cryptocurrency capable of influencing market trends.

Unrealized Loss – A potential loss on an open position that has not yet been closed.

Liquidation Price – The price level at which a leveraged position is automatically closed to prevent further losses.

Flash Crash – A rapid and steep market decline followed by a swift recovery.

Uptober – A term describing Bitcoin’s historically bullish trend during October.

ETF Inflows – Capital entering exchange-traded funds, often signaling market sentiment.

Leverage – Borrowed capital used to increase potential returns, which also magnifies risk.

On-Chain Data – Blockchain-based information used to track market activity and investor behavior.

Summary

Whale 0x5D2F gets rekt on heavy crypto market volatility after briefly making a major profit shorting Bitcoin. An abrupt reversal in Bitcoin wiped out gains from earlier this week, offering another reminder of how twitchy the market can be even when it’s trying to form a bottom.

Analysts attributed the drop to global trade tensions, trade war tariffs and weekend liquidity shortfalls. With experts offering mixed opinions on Bitcoin’s short-term prospects, we see once again the importance of timing, discipline and risk control in maneuvering volatile crypto markets.

Frequently Asked Questions Crypto Market Volatility

1. What does the 0x5D2F case show about crypto market volatility?

It shows how rapidly profits can turn into losses, emphasizing that even whales face risks in volatile markets.

2. What caused the recent crypto crash?

Analysts link it to China’s export restrictions, US tariffs, and weekend liquidity shortages that led to mass liquidations.

3. How much did traders lose during the crash?

Over 1.6 million traders lost a combined $19.1 billion, according to CoinGlass data.

4. What are experts predicting next for Bitcoin?

Many believe bullish sentiment could continue if inflation data and ETF inflows remain favorable.

Read More: Crypto Whale’s $27M Short Lives Briefly in Profit Then Gets Wiped Out">Crypto Whale’s $27M Short Lives Briefly in Profit Then Gets Wiped Out

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.