Ethereum Price Derivatives Market Shows Increased Interest as Investors Prepare for Potential Price Surge Above $2660

0

0

Highlights:

- The price of Ethereum has increased 1.34% to $2,539.49, as it consolidates ahead of a potential breakout.

- ETH technical indicators show mixed reactions as bulls attempt a breakout above the $2660 mark.

- Ethereum’s derivatives volume and open interest have risen significantly, reflecting increasing investor interest.

Ethereum price has recently been moving sideways, with bulls attempting a breakout to the upside. Today, the ETH/USD pair is being traded at $2,539.49, which is a 1.34% rise. Even though Ethereum is currently consolidating, it is still recognizable by its structure from 2020-2021, which brought a major rally, according to analysts.

$ETH is in a consolidation phase right now, but the breakout will be massive.

Ethereum continues to mirror its 2020–2021 price structure almost perfectly.

A breakout is only a matter of time. You can expect significantly higher levels in the coming weeks and months.

Altcoins… pic.twitter.com/djMV89McbG

— BATMAN

(@CryptosBatman) June 9, 2025

The recent Ethereum chart shows the price has established strong support at $2,284, which aligns with the 50-day MA. However, for further upside, the Ethereum price must overcome the $2,660 resistance, which aligns with the 200-day MA. It is expected that this period of consolidation will cause Ethereum’s price to soar, with traders hoping for a sizable rise soon.

Technical Indicators: Mixed Signals on ETH’s Short-Term Outlook

Right now, important technical indicators on Ethereum, like the Relative Strength Index, show it is hovering at 54.43 and is seen as neutral. From this, we know that Ethereum is neither too high nor too low in price, so its value can go up or down. As long as RSI is above 50, you may see the price going higher, but the trend isn’t clearly defined yet.

The MACD (Moving Average Convergence Divergence) is showing some bearish prospects. This is evident as the blue MACD line has crossed below the orange signal, upholding a sell signal. However, the fact that Ethereum’s price is making higher lows and highs lately indicates that a breakout might occur soon. Although during consolidation, traders should still be careful because, if the price does not break important resistance markers, it may lead to a drop in the sector.

Ethereum’s Derivatives Market: Rising Volume and Bullish Sentiment

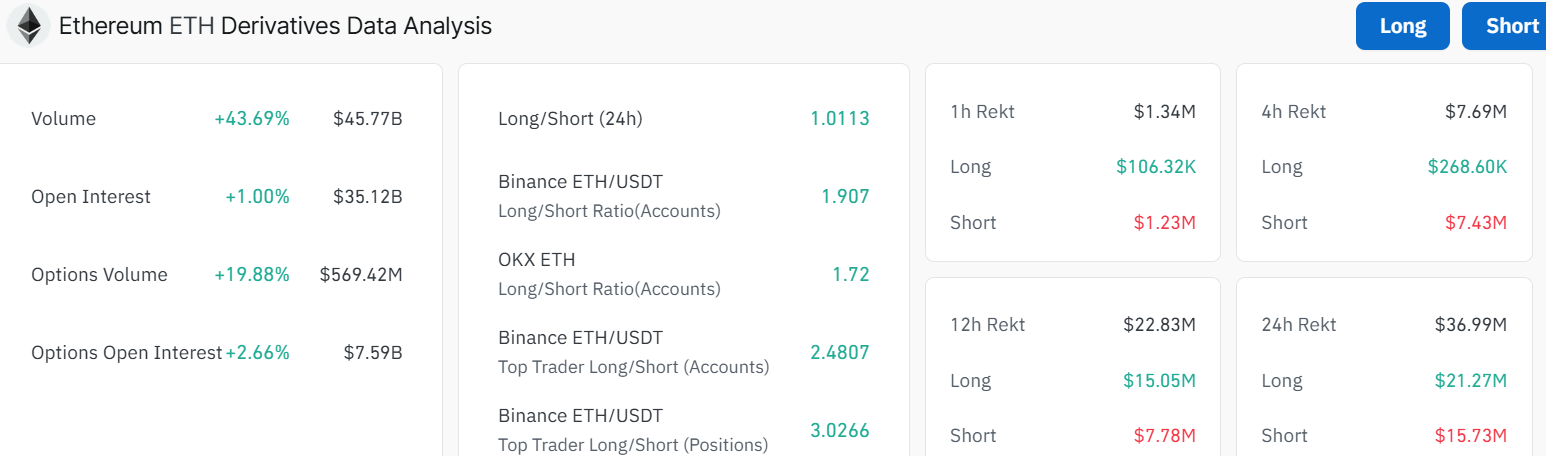

Greater numbers of investors believe in Ethereum as the derivatives market’s volume and open interest spike. Ethereum’s derivatives volume has risen by 43.69% to $45.77 billion, and open interest has increased by 1% to $35.12 billion. More people are now involved in Ethereum and believe that the price could make a bigger move in the upcoming days.

Ethereum’s options market has experienced a 19.88% rise, with the traded options reaching $569.42 million. The amount of options open interest went up by 2.66% to $7.59 billion, proving that institutions are preparing for notable price movements. Remarkably, the ratio of long positions to short ones for Ethereum is now above 1, at 1.01, revealing that the traders are becoming bullish about the expected price rise.

Can Ethereum Price Breakout?

Ethereum is present going through a consolidation period. However, with higher trading volume and traders showing interest in derivative products, it could experience a breakout soon. These technical signs show that Ethereum might soon exceed $2,660 and go on a significant run. There is a possibility that if Ethereum’s price surges ahead, its price may target anywhere from $2,800 upwards over the short term.

On the other hand, if the $2660 resistance proves too strong, the Ethereum price could experience a consolidation or drop. In such a case, the $2,476 and $2398 support levels will be in line to cushion against further downside. Meanwhile, if Ethereum’s price reaches the important $2,660 mark will signify it’s ready to move in a positive direction.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.