Trump’s Fearless Tariff Reversal: Averting Economic Depression and Igniting a Market Rebound

0

0

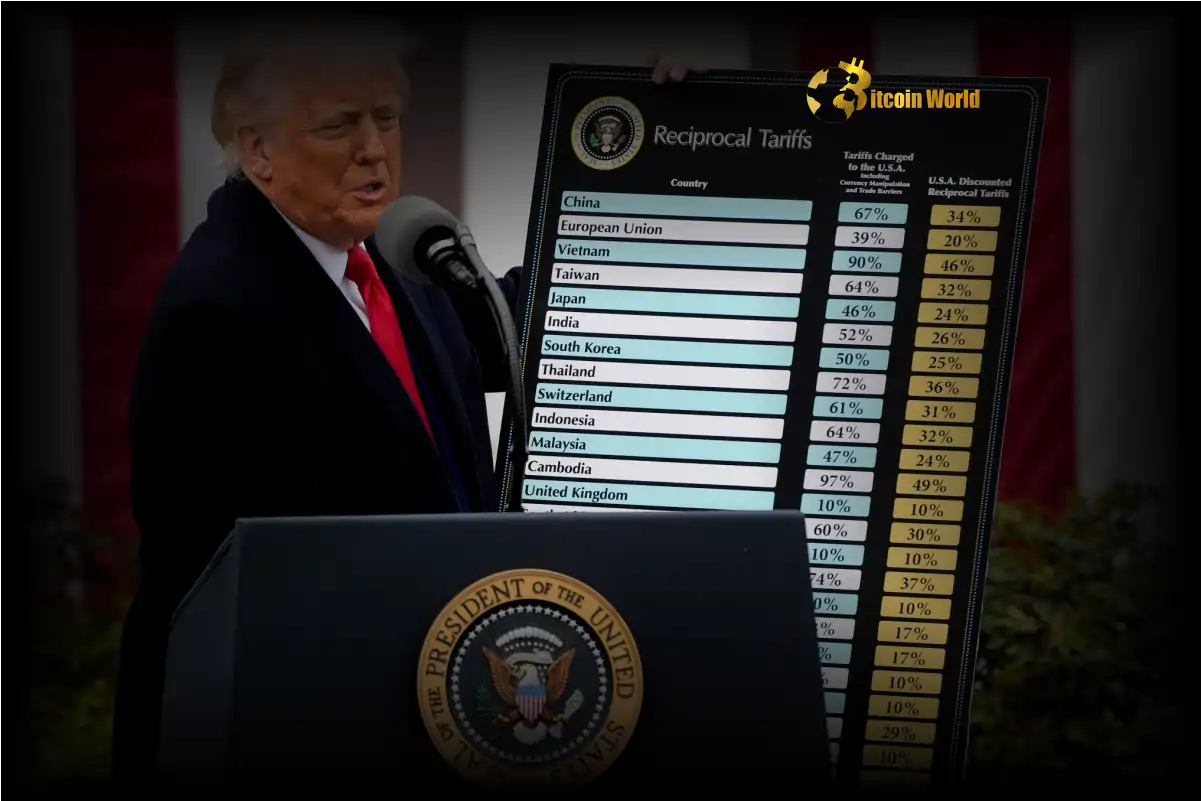

In a stunning turn of events that sent shockwaves through financial markets, former President Donald Trump reportedly reversed course on his controversial tariff policies. Why? To avoid what insiders feared could spiral into a full-blown economic depression. This move, detailed in a Wall Street Journal exclusive, wasn’t just a minor tweak – it was a significant pivot driven by escalating recession fears and market turmoil. For those in the cryptocurrency world, always keenly observing traditional market movements for signals, this episode offers a powerful lesson in how policy shifts can trigger dramatic market reactions.

Why Were Trump’s Tariffs Fueling Recession Fears?

Trump’s aggressive implementation of tariffs, particularly on goods from major trading partners, was initially aimed at reshaping international trade and bolstering American industries. However, the unintended consequences began to mount, igniting serious recession fears across the global economic landscape. Here’s a breakdown of why these tariffs became a source of major concern:

- Increased Costs for Businesses: Tariffs acted as import taxes, directly raising the cost of goods for American businesses that relied on imported materials or components. This squeezed profit margins and, in many cases, led to price increases for consumers.

- Reduced Consumer Spending: As prices climbed due to tariffs, consumers found their purchasing power diminished. This decrease in consumer spending is a critical factor that can slow down economic growth and edge towards a recession.

- Trade Retaliation: Trump’s tariffs often provoked retaliatory tariffs from other countries. This tit-for-tat trade war disrupted global supply chains, created uncertainty for businesses, and further dampened economic activity.

- Market Instability: The unpredictability of tariff policies injected significant volatility into financial markets. Investors became wary, leading to market corrections and increased anxiety about the economic outlook.

Trump’s Tariff Reversal: A Bold Move to Avert Economic Depression

Facing mounting pressure from within his administration and alarming signals from financial markets, President Trump made a pivotal decision: to roll back some of the very tariffs he had previously championed. The Wall Street Journal report highlights that while Trump was initially prepared to endure short-term economic pain to achieve his trade objectives, the looming threat of an economic depression became a red line. This reversal wasn’t a sign of weakness, but rather a strategic adjustment to prevent a far more catastrophic economic outcome.

Key factors influencing this dramatic shift included:

- Dire Warnings from Economic Advisors: Reports suggest that economic advisors within the White House, including Treasury Secretary Scott Bessent and National Economic Council Director Kevin Hassett, played crucial roles in conveying the severity of the economic risks.

- Collapsing Bond Markets: Kevin Hassett specifically pointed to the “collapsing bond markets” as a major influence. A sharp spike in Treasury yields signaled deep investor unease and a potential credit crunch, amplifying recessionary pressures.

- Market Turmoil: The stock market was experiencing significant volatility and downward pressure, reflecting growing anxiety among investors about the direction of the economy. This market turmoil likely served as a stark and public indicator of the economic pain being inflicted by the tariffs.

This moment underscores the immense power of presidential decisions on the economy and the markets. Just as policy can instigate downturns, decisive action, even reversals, can act as a powerful corrective force.

How Did the Market Rebound After the Tariff Rollback?

The immediate aftermath of Trump’s tariff rollback was nothing short of electrifying for the markets. It triggered a powerful market rebound, demonstrating just how sensitive investor sentiment was to the trade policy environment. The numbers speak volumes:

- S&P 500 Soars: The S&P 500 index, a key benchmark of US stock market performance, experienced its best single-day gain since 2008. This surge reflected a massive release of pent-up optimism and relief among investors.

- Investor Confidence Returns: The rollback signaled a de-escalation of trade tensions, which, in turn, boosted investor confidence. The fear of a deepening trade war and its recessionary consequences diminished, encouraging investors to re-enter the market.

- Bond Market Stabilization: The bond market, which had been flashing warning signals, also stabilized. Treasury yields eased, indicating a reduction in immediate economic risk perception.

This rapid market turnaround serves as a compelling example of how policy changes can directly and swiftly impact investor behavior and market valuations. It also highlights the interconnectedness of trade policy, investor confidence, and overall market health.

Understanding Trump Tariffs and Their Broader Impact on Trade Policy

The saga of Trump’s tariffs and their subsequent partial reversal offers valuable lessons about trade policy and its real-world consequences. It’s not just about economics in theory; it’s about how decisions in Washington D.C. can ripple across global markets and impact everyday businesses and individuals. Here are some key takeaways:

| Aspect | Impact of Trump Tariffs | Impact of Tariff Reversal |

|---|---|---|

| Business Costs | Increased due to import taxes | Potential decrease as tariffs are reduced |

| Consumer Prices | Likely to rise, reducing purchasing power | Potential stabilization or slight decrease |

| Market Volatility | Increased due to policy uncertainty | Decreased as policy becomes more predictable |

| Global Trade Relations | Strained, with increased risk of trade wars | Potential for improved relations and stability |

For cryptocurrency enthusiasts, this episode is a reminder that while the crypto market operates with its own dynamics, it is not entirely isolated from traditional financial markets and global economic trends. Major shifts in trade policy, like tariff implementations or reversals, can influence broader market sentiment, which can indirectly affect crypto asset valuations and investor behavior within the digital asset space.

Trump Tariffs: Lessons Learned and Future Implications?

Looking back at the Trump tariff episode, what actionable insights can we glean? Firstly, it underscores the profound interconnectedness of global economies and the sensitivity of markets to trade policy. Secondly, it demonstrates that even seemingly strong policy stances can be adjusted when faced with tangible economic threats like a potential economic depression. Finally, it highlights the critical role of informed economic advisors in shaping presidential decisions during times of economic uncertainty.

For investors, whether in traditional markets or cryptocurrencies, this episode is a powerful reminder to:

- Stay Informed: Keep abreast of major policy developments, especially in areas like trade, as they can have significant market implications.

- Diversify: Diversification across asset classes can help mitigate risks associated with policy-driven market fluctuations.

- Consider Macroeconomic Factors: Recognize that macroeconomic trends and policy decisions can influence all markets, including the cryptocurrency market.

In conclusion, Trump’s tariff reversal was a fearless move made to avert a potentially disastrous economic depression. It triggered a significant market rebound, showcasing the immediate impact of policy adjustments on investor confidence and market dynamics. This event serves as a critical case study in modern economic policy and its far-reaching consequences.

To learn more about the latest crypto market trends, explore our article on key developments shaping Bitcoin price action.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.