ZachXBT Sounds Alarm on Crypto Crime Supercycle as Hacks Escalate in 2025

0

0

Blockchain investigator ZachXBT has raised alarms about an intensifying “crime supercycle” within the crypto industry.

He attributed the escalation to a combination of meme coin launches by politicians and the dismissal of several court cases, both of which have contributed to enabling and amplifying criminal behavior in the space.

ZachXBT Warns of Escalating Crypto Crime

In the latest post on X (formerly Twitter), ZachXBT stressed that the crypto industry has always had the potential for misuse and exploitation. However, the situation has worsened recently.

“The crime supercycle is indeed very real. It has noticeably increased since politicians launched meme coins and numerous court cases were dropped, further enabling the behavior,” the post read.

The investigator highlighted that many cryptocurrency protocols continue to collect fees despite over 50% of their transaction volume involving stolen funds. Influencers and key opinion leaders (KOLs) who promote fraudulent projects face no repercussions, enabling a culture of impunity.

Moreover, he added that the courts sometimes side with those who exploit smart contracts due to outdated laws that are not equipped to handle modern blockchain-related issues.

“Government agencies could probably have made $50-100 million issuing fines to all of the influencers/projects who never disclosed paid ads over the years (is illegal in many jurisdictions but just never prosecuted). If they had spent time regulating it instead of going after open-source developers or blue-chip decentralized protocols. Only is prevalent bc there’s never really been repercussions,” ZachXBT added.

Meanwhile, he explained that the sector both enables and exposes crime. ZachXBT pointed out that blockchains’ complete transparency makes illicit activities easier to track and trace.

However, the large amounts of money flowing through the crypto space also attract negligent teams, some of whom may inadvertently allow bad actors, like North Korean hackers, to exploit these opportunities.

“Laundering groups and small OTC brokers have seemingly won the battle for Lazarus Group after successfully laundering recent hacks (Bybit, DMM Bitcoin, WazirX, etc) with ease,” he remarked.

ZachXBT estimates that the “Black U” market on the Tron blockchain is worth between $5 billion and $10 billion. He added that most activities remain untraceable.

The sleuth expressed skepticism about reforming the system. He questioned whether action would be taken only after widespread financial losses. He also warned of long-term ramifications if short-term gains continue to overshadow ethical considerations.

“If you ever wanted the opportunity to extract from the industry there’s not been much of a better time. Take a chance what’s the worst thing that could happen if everyone’s already doing it?” he stated.

His warning comes amid a surge in scams and hacks affecting the industry. According to PeckShield, approximately 20 significant crypto hacks were reported in May 2025. These hacks caused total losses of $244.1 million, which marks a 39.29% decrease from the previous month, April.

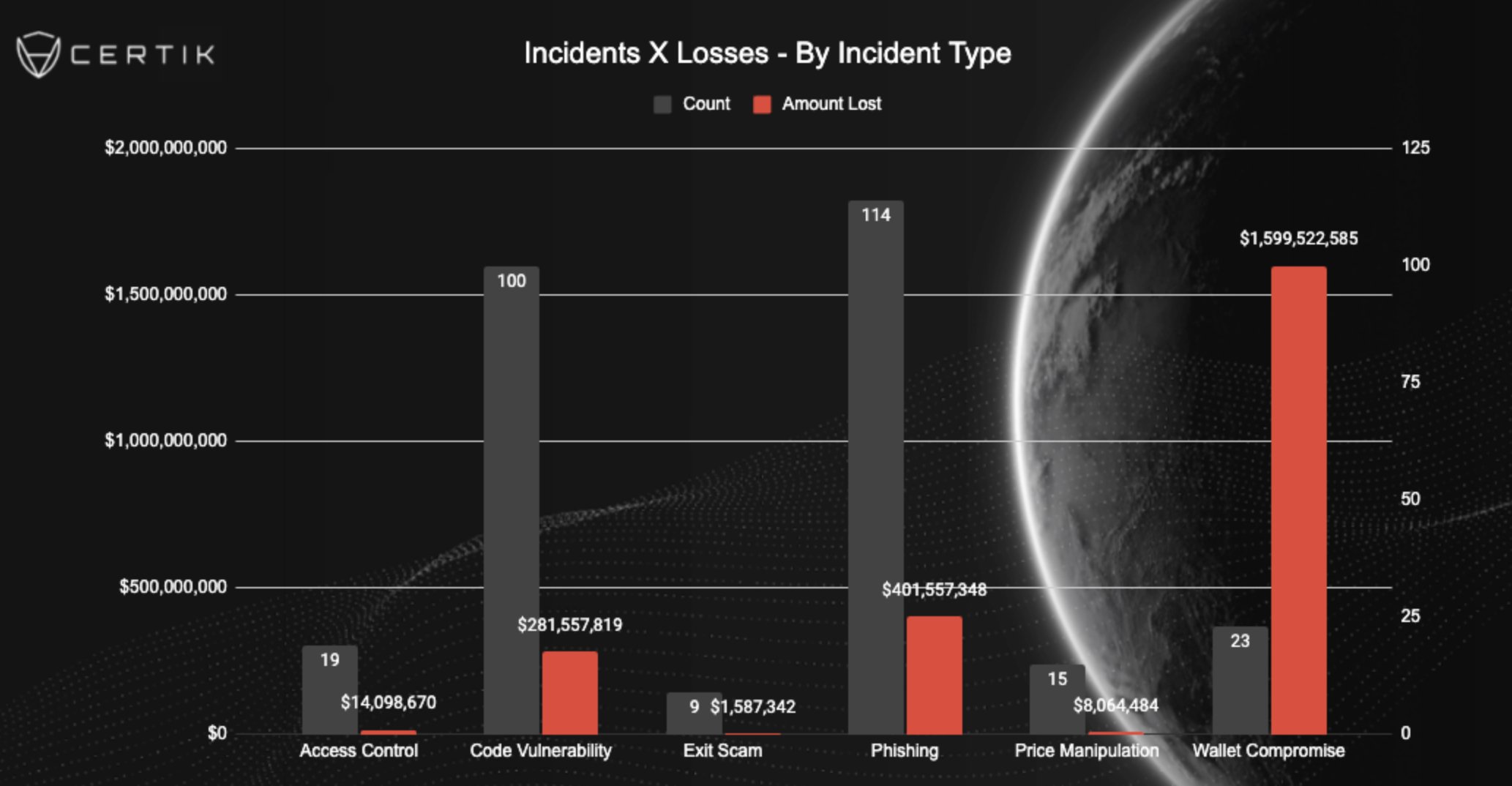

Additionally, Certik reported that so far in 2025, hackers stole over $2.1 billion through cryptocurrency-related attacks.

Crypto Crime in 2025. Source: X/Certik

Crypto Crime in 2025. Source: X/Certik

“The majority of losses have come from wallet compromises and phishing, with an increase in data leaks its important to remain vigilant,” the post read.

BeInCrypto also reported two major hacks at the beginning of June, which caused total losses of $15 million. These figures underscore the urgency of ZachXBT’s call for vigilance.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.