Investors Sell $420 Million Solana Bought Out Of FOMO; Stumps Price Recovery

0

0

Solana has recently faced a decline in price, followed by a brief attempt to recover its losses. However, the lack of patience among investors has been evident in their behavior, leading to selling pressure that could negatively impact the altcoin’s price.

As Solana struggles to find solid support, investor sentiment plays a crucial role in determining its future price movement.

Solana Investors Are Skeptical

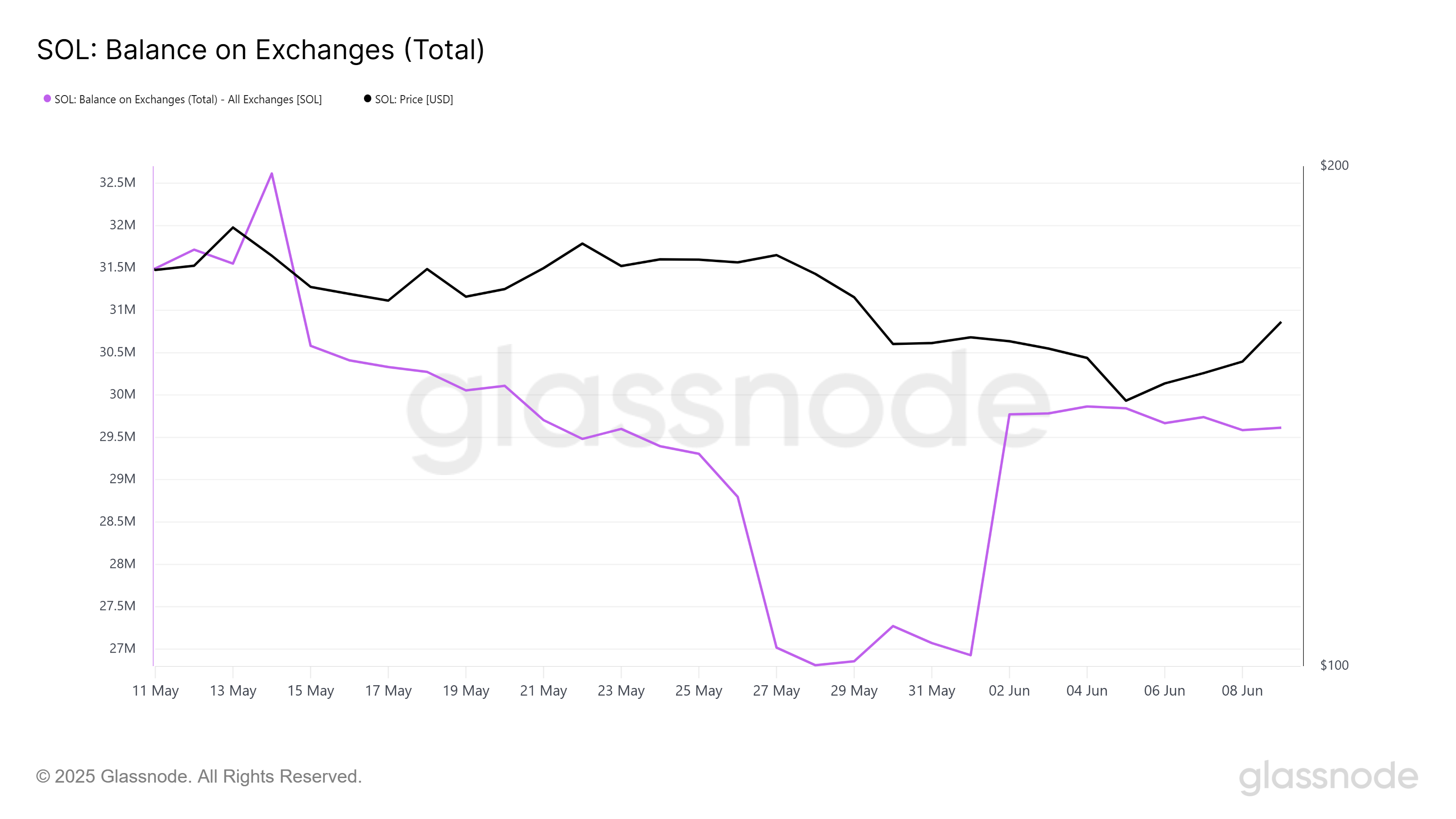

Solana’s exchange balances show an inflow of 2.7 million SOL, worth more than $423 million, in the last nine days. The initial price decline this month prompted investors to sell before the situation worsened, securing their positions.

Interestingly, 2.71 million SOL were purchased within five days from May 23 as the price rose, suggesting FOMO (fear of missing out) accumulation. This supply, bought out of speculation, has now been largely sold off, impacting Solana’s price recovery.

The large inflow and subsequent outflow reflect the volatile sentiment in Solana’s market. Investors who jumped in during the price spike have now opted to sell, causing a cycle of buying and selling that hampers price stability.

Solana Exchange Balance. Source: Glassnode

Solana Exchange Balance. Source: Glassnode

Solana’s macro momentum is somewhat improving, though technical indicators like the Relative Strength Index (RSI) still suggest that the market remains in a bearish phase. The RSI shows that the overall bearish momentum is slowly subsiding, but the indicator has not yet crossed the neutral mark into support.

This shift is crucial for confirming a reversal into bullish territory. Until this happens, Solana’s price remains uncertain, with the possibility of further declines if investors’ sentiment does not strengthen.

Solana RSI.. Source: TradingView

Solana RSI.. Source: TradingView

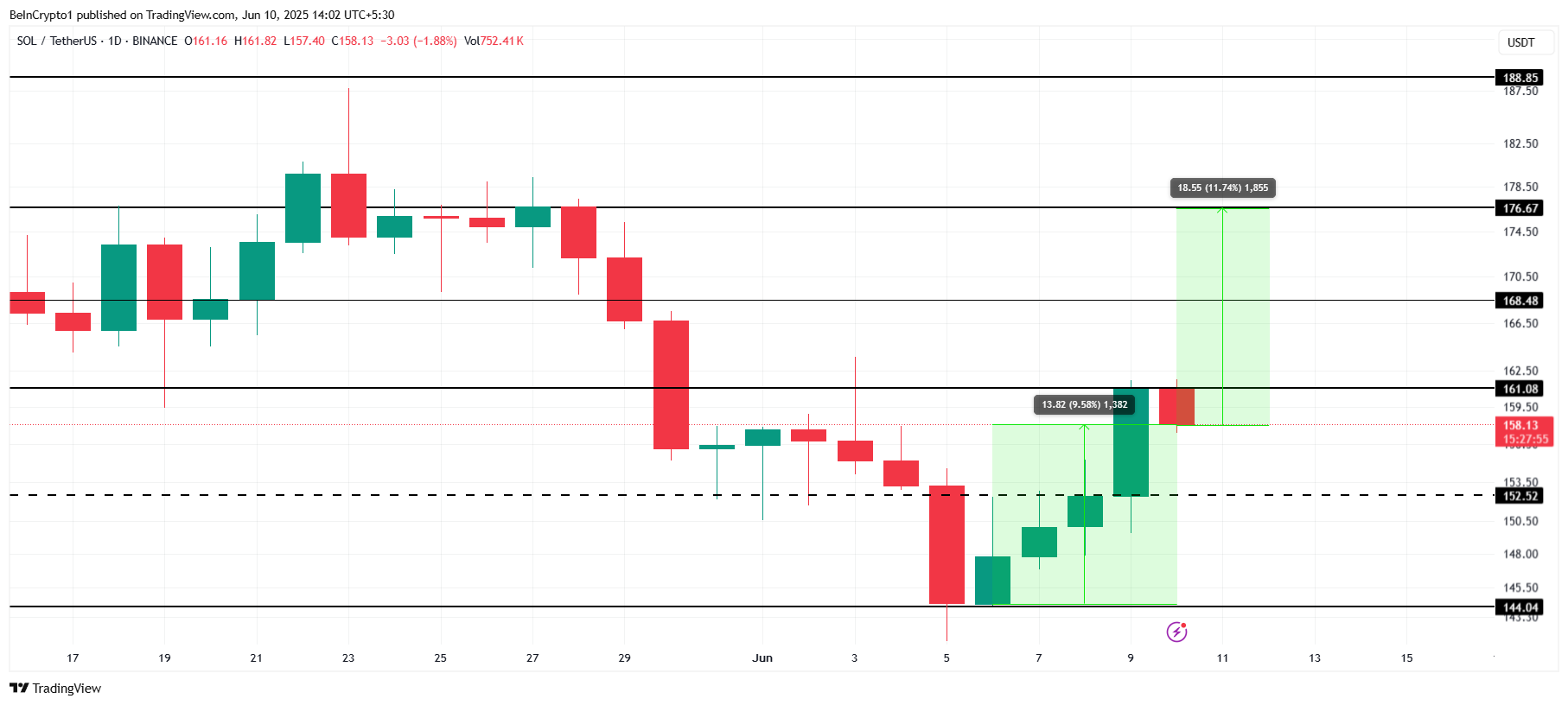

SOL Price Faces Resistance

Solana is currently trading at $158, showing a 9.5% rise over the last few days. However, it remains just below the critical resistance level of $161.

For Solana to move higher and target the next price point of $176, it must first break through this resistance. SOL needs to rise 11% to make it to $176, and this move would signal a solid recovery if the momentum continues.

If selling pressure persists and Solana fails to breach $161, it could slide back to the $152 or $144 range. This would suggest a continuation of the downtrend, with investors continuing to sell off their holdings. Such a decline would set back Solana’s progress and delay a possible recovery.

Solana Price Analysis.. Source: TradingView

Solana Price Analysis.. Source: TradingView

On the other hand, if broader market conditions turn bullish, Solana could secure $161 as a new support level. A successful rise above this resistance could see Solana move toward $168, invalidating the bearish thesis and strengthening investor confidence.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.