0

0

This article was first published on The Bit Journal.

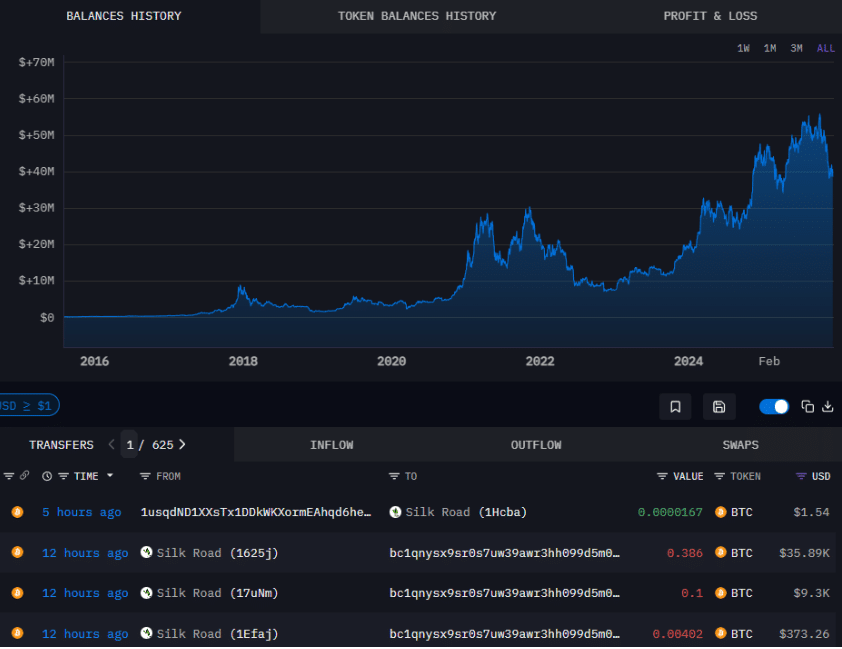

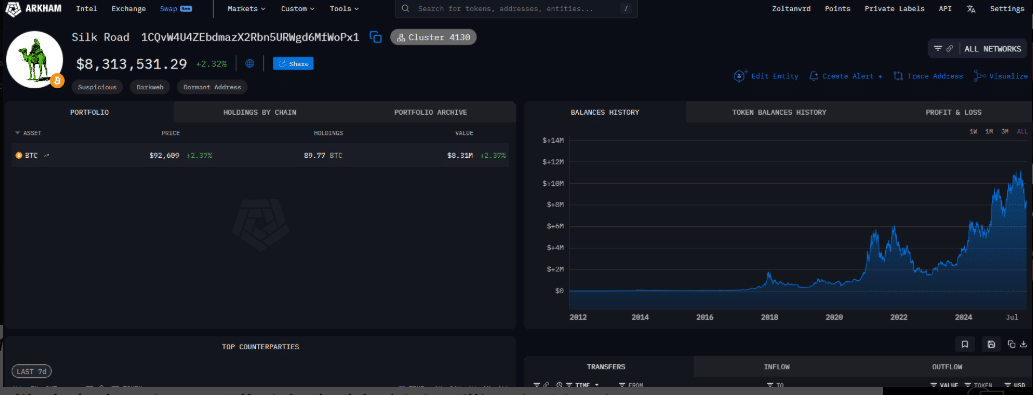

A cluster of Bitcoin wallets tied to the infamous Silk Road marketplace quietly transferred $3.14 million in BTC into a brand-new address this week. The move happened through 176 small transactions, a detail that caught the eye of on-chain analysts who spend their days watching the deeper layers of the network.

What made it stand out was not the dollar amount alone. It was the silence before it. These wallets had not shown meaningful activity in nearly five years. In crypto time, that is a lifetime.

All of the transferred Bitcoin ended up inside one newly created wallet that had no prior history. No test transactions. No exchange connections. Just a clean receiving address that now holds the entire batch.

That detail matters. When whales intend to sell, coins usually move toward exchanges or through mixers. This did neither. Instead, the transfer looked deliberate and contained. More like a reshuffle of storage than an exit.

Even after this move, the larger Silk Road-linked cluster still controls an estimated $38.4 million in BTC. Only a small slice changed hands this time. That alone has kept panic out of the market.

Bitcoin carries a strange kind of memory. Coins mined or traded more than a decade ago never disappear. They just sit quietly, waiting.

Analysts believe several other Silk Road-era wallets remain untouched, including one holding roughly 430 BTC that has not moved in more than 13 years. These wallets form what traders casually call the market’s shadow supply. They do not affect daily price action, yet they loom in the background.

When coins this old suddenly move, it has a way of changing the mood. It reminds traders that early-era supply still exists and that it can resurface with no warning. Even when the numbers are modest, the psychology is never small.

The transfer arrives less than a year after Ross Ulbricht, the founder of Silk Road, received a full presidential pardon. That decision already reopened debate about justice, digital privacy, and the early days of crypto. The wallet movement now adds financial intrigue to a story many thought had settled.

There is no public confirmation linking the recent wallet activity directly to Ulbricht or his circle. Still, the timing feels too precise for markets to ignore. In crypto, coincidence is rarely treated as coincidence.

For now, traders are not watching price charts as much as they are watching wallets.

Three signals matter most in the days ahead: first, whether more funds leave the remaining Silk Road-linked wallets; second, whether any of these coins move toward exchanges third, how the price reacts near key technical levels if new supply does appear.

So far, none of the transferred Bitcoin has touched trading platforms. That is why the market has stayed calm. No rush. No fear spike. Just quiet curiosity.

History offers perspective here. Previous government sales of seized Silk Road Bitcoin entered the market without causing lasting damage. Each case looked dramatic in headlines, yet price absorbed the supply over time.

Silk Road helped shape how the world first understood Bitcoin. It forced regulators, banks, and law enforcement to take crypto seriously. It also showed how money could move without permission.

This latest wallet activity does not change Bitcoin’s future, but it briefly connects the present to that raw early era. The blockchain never forgets, and from time to time, it reminds everyone that its oldest chapters are still written into its spine.

The $3.14 million transfer from Silk Road-linked wallets looks more like a measured repositioning than the start of a sell-off. With tens of millions still parked in related addresses, the story is not finished.

For now, the market watches without fear and without drama. But in Bitcoin, long-silent wallets rarely move without meaning. The next transaction may offer the real answer.

What exactly moved from the Silk Road wallets?

About $3.14 million in BTC was transferred through 176 transactions into a new wallet.

Did this cause a market sell-off?

No. The funds have not reached exchanges, so no confirmed selling has occurred.

Why do old wallets matter so much?

Very old coins can change market sentiment quickly because they signal shifts in long-term holder behavior.

Whale

An entity that controls a large amount of cryptocurrency.

Dormant Wallet

A wallet that has not moved funds for an extended period.

On-chain Data

Transaction and wallet activity are recorded directly on the blockchain.

Exchange Inflow

Movement of crypto from private wallets to trading platforms, often tied to selling intent.

ARKHAM

Read More: Whale Alert: Silk Road Bitcoin Wallets Move $3.14M After Years of Silence">Whale Alert: Silk Road Bitcoin Wallets Move $3.14M After Years of Silence

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.