Bitcoin Miner CleanSpark Announces $100M Bitcoin-Backed Credit Facility with Two Prime

0

0

CleanSpark, Inc. (Nasdaq: CLSK), a major player in the US Bitcoin BTC $109 172 24h volatility: 3.9% Market cap: $2.18 T Vol. 24h: $72.70 B mining sector, has established a new $100 million Bitcoin-backed credit facility with Two Prime, an institutional lender. The agreement, announced on Sept. 25, pushes CleanSpark’s total collateralized lending capacity to $400 million, marking a significant step in its capital growth strategy.

With the credit, they plan to accelerate data center expansion, strengthen high-performance computing (HPC) initiatives, and support the company’s Digital Asset Management team in optimizing its Bitcoin treasury. Currently, they have more than 12,000 BTC in their treasury, which they have been accumulating since January 2025, when they had 10,000 BTC.

“I am proud that we have so effectively utilized our treasury balance of nearly 13,000 bitcoin to finance growth through responsibly sized leverage with excellent partners like Two Prime, at a market-leading cost of capital,” said Gary A. Vecchiarelli, CleanSpark’s Chief Financial Officer and President.

Bitcoin-Backed Financing Gains Traction Among Major Miners

The Two Prime facility represents CleanSpark’s second significant Bitcoin-backed funding this week. Earlier, the company announced another $100 million line of credit, arranged with Coinbase Prime. This trend reflects a growing interest among miners in leveraging digital assets for financing and preserving shareholder value, rather than relying on equity offerings to raise capital. The strategy supports operational growth while maintaining exposure to Bitcoin’s price movements, according to their press release.

— CleanSpark Inc. (@CleanSpark_Inc) September 25, 2025

Two Prime CEO Alexander Blume welcomed CleanSpark’s move, stating the partnership demonstrates growing confidence in using Bitcoin as collateral for institutional lending. Other large miners, such as Riot Platforms, are also tapping similar credit options, underscoring Bitcoin’s evolving role in corporate finance.

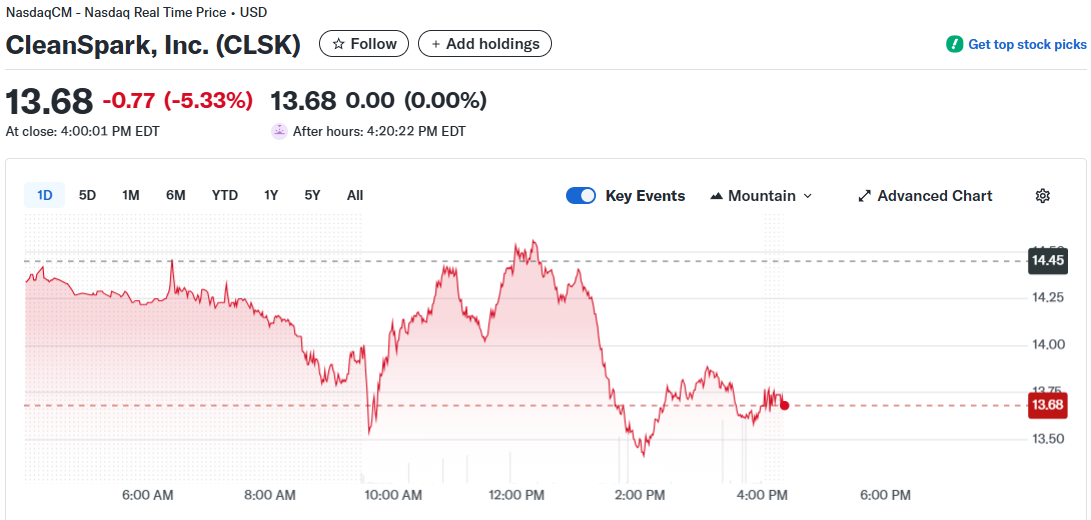

CLSK Shares Show Minimal Response Despite Significant Funding News

CleanSpark’s financial news was met with a muted response in equity markets. As of Sept. 25, CLSK shares traded at $13.68, down from $14.85 earlier in the week and not far from a recent after-hours peak of $14.44 following the announcement of the credit facility with Coinbase Prime. Trading volume surged past 36 million shares, more than tripling the daily average from earlier in September, according to Yahoo Finance.

Graphic of stock price for CLSK. Source: Yahoo Finance

The stock has climbed dramatically since mid-September, reflecting investor optimism about CleanSpark’s ability to expand without shareholder dilution. In the past month, CLSK has gained just over 52%. The company’s market cap remains near $3.9 billion.

CleanSpark’s move to secure more non-dilutive financing comes as public miners continue to increase their share of Bitcoin’s total network hashrate, have recently enjoyed high valuations in the market, and corporate Bitcoin reserves remain elevated. The company’s decision is expected to accelerate infrastructure growth and strengthen its treasury management, supporting broader industry trends of diversification and capital-efficient expansion.

The post Bitcoin Miner CleanSpark Announces $100M Bitcoin-Backed Credit Facility with Two Prime appeared first on Coinspeaker.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.