Bitcoin’s Breaking Point: BTC Below This Price Would Signal Bear Market

0

0

Bitcoin price has faced sharp losses in recent days, reflecting the pressure of a bearish market environment.

The crypto king dipped below key thresholds, sparking fears of a potential bear market structure ahead. While investors are closely watching for signs of reversal, the outlook remains uncertain.

Bitcoin Has A Pain Threshold

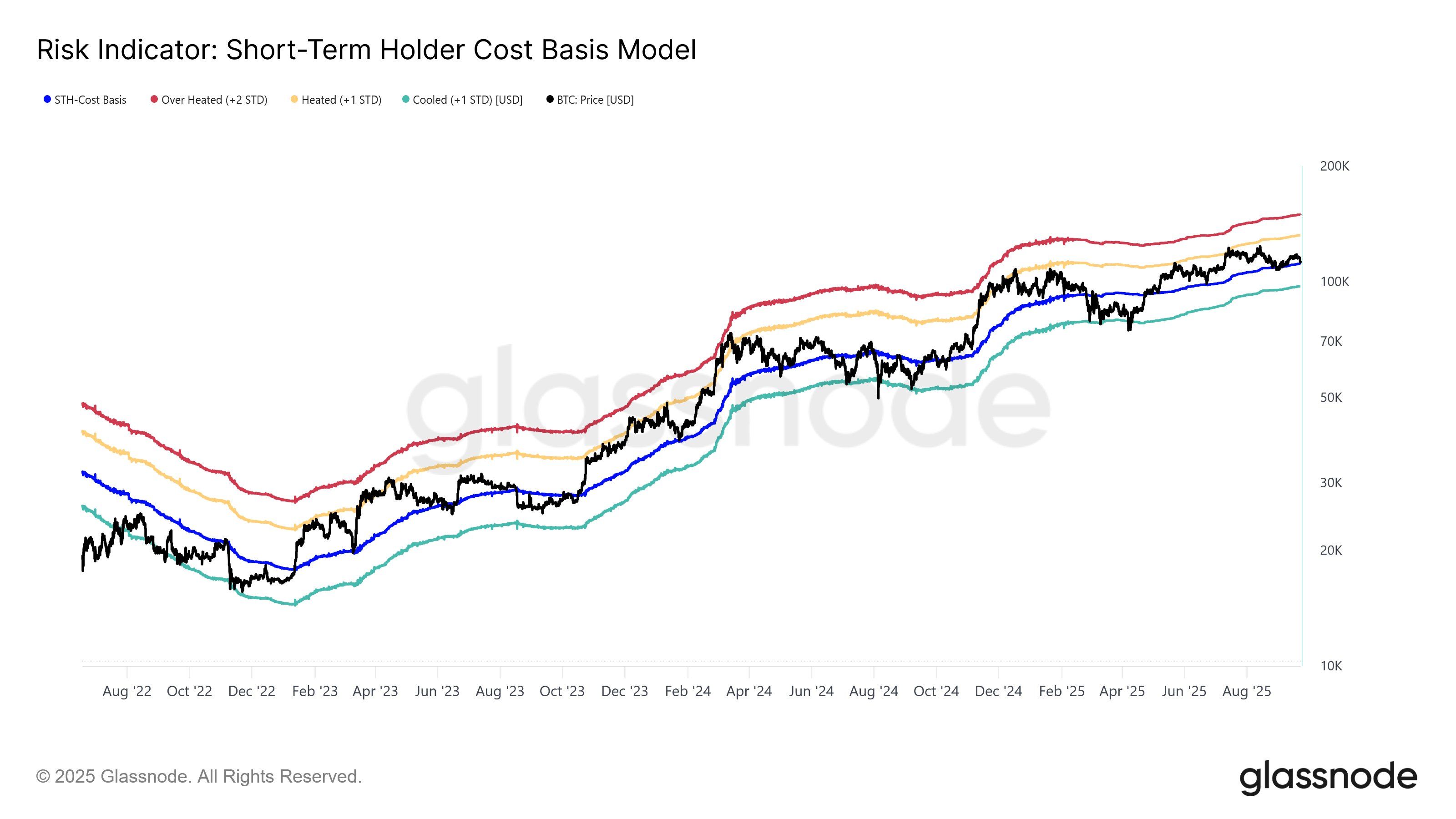

The Short-Term Holder (STH) Cost Basis Model highlights Bitcoin’s vulnerability at the moment. The STH cost basis currently sits at $111,400, meaning that sustained trading below this level could trigger deeper downside pressure. Remaining above this threshold is crucial to avoid further structural weakness.

A decisive break below the cost basis would likely confirm bearish momentum, leading to a larger drawdown for Bitcoin. Such a move could also delay recovery and extend losses across the crypto market.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Bitcoin STH Cost Basis Model. Source: Glassnode

Bitcoin STH Cost Basis Model. Source: Glassnode

Social sentiment surrounding Bitcoin shows a surge in “buy the dip” mentions across major platforms. The indicator recorded its highest level of activity in 25 days, reflecting growing optimism among retail traders. While positive on the surface, this trend often signals the opposite price outcome.

Historically, Bitcoin tends to move against crowd expectations when retail traders anticipate quick rebounds. If optimism remains high at around $112,200, the market may still face more downsides. Once sentiment cools and panic selling occurs, deeper accumulation opportunities may emerge.

Bitcoin Social Volume And Dominance. Source: Santiment

Bitcoin Social Volume And Dominance. Source: Santiment

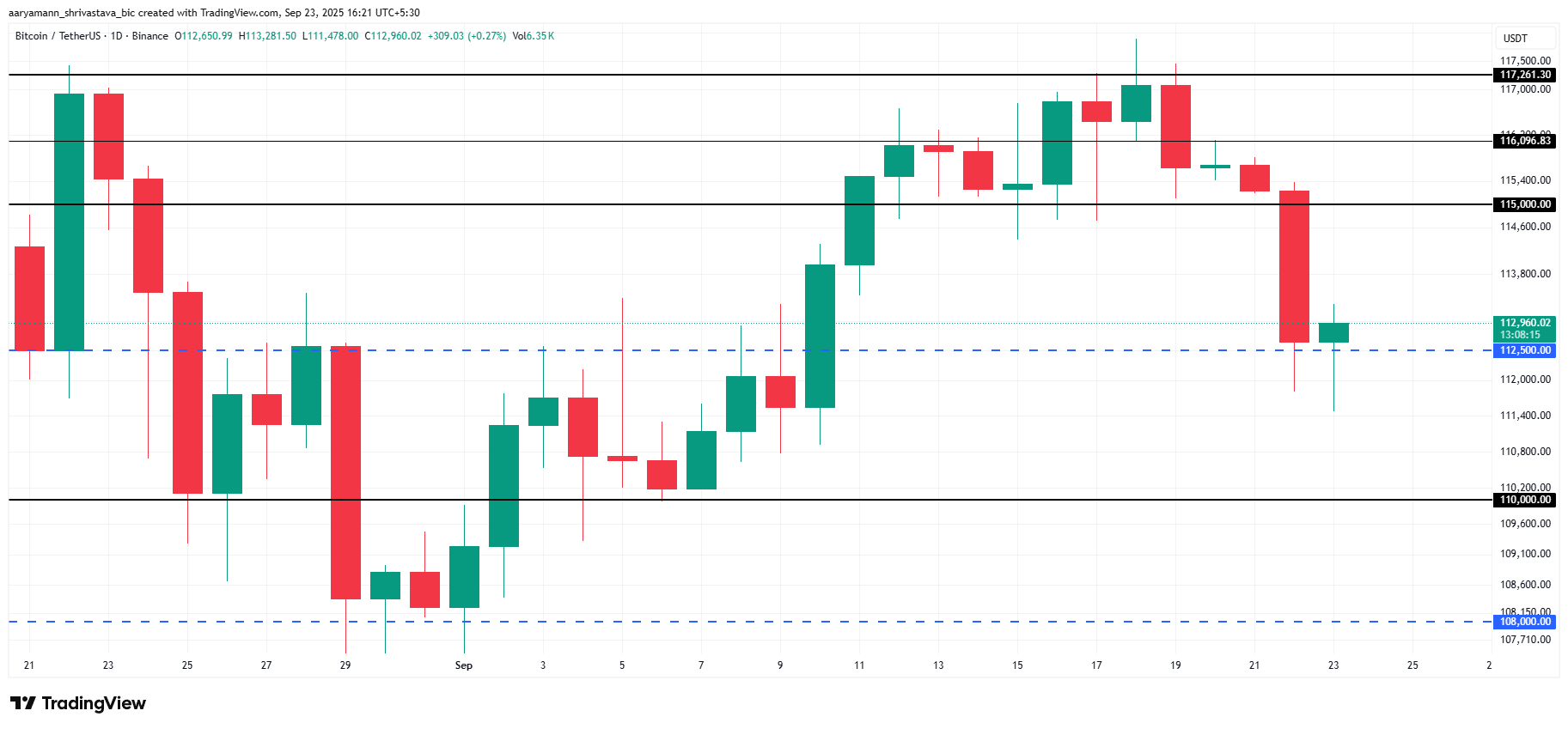

BTC Price Could Bounce Back

At the time of writing, Bitcoin trades at $112,960, holding slightly above the $112,500 support level. Within the last 24 hours, BTC slipped from $115,100 and touched $111,478 during its intra-day low. This volatile action highlights the importance of maintaining current levels.

The crypto king has so far managed to stay above $111,400, the STH cost basis. By securing $112,500 as support, Bitcoin has the potential to bounce back toward $115,000, which would help prevent a bear market structure from taking shape.

Bitcoin Price Analysis. Source: TradingView

Bitcoin Price Analysis. Source: TradingView

However, any renewed selling pressure could drag Bitcoin through $112,500 and toward the $110,000 support. If that occurs, the bullish thesis would be invalidated, and BTC could slide further, officially marking the onset of bearish momentum.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.