Satsuma Smashes Funding Goal With $217M Raise, Becomes UK’s #2 Bitcoin Holder

0

0

Satsuma Technology PLC, a London-listed AI infrastructure company, has closed a $217.6 million fundraising round, 64% above its original target. Interestingly, it accepted 1,097.29 Bitcoin BTC $114 044 24h volatility: 0.8% Market cap: $2.27 T Vol. 24h: $35.07 B from investors as part of the funding.

The raise was supported by top digital asset investors, including ParaFi, Pantera Capital, Kraken, and Digital Currency Group, making it one of the most significant fundraisers for a Bitcoin-focused UK company.

🚨JUST IN: 🇬🇧 Satsuma Technology closes a massive £163.7M ($217.6 million) raise, 64% above target, with backing from ParaFi, Pantera, DCG, Kraken, and others.

1,097 BTC accepted as part of the funding, boosting its #Bitcoin treasury strategy. They should now have 1,125.85 BTC… pic.twitter.com/URQrVtkEaQ

— NLNico (@btcNLNico) August 6, 2025

Satsuma will use the raised capital to grow operational capacity, expand Satsuma’s operational teams, and continue pioneering work in decentralized AI. A portion of the funds will remain in fiat to ensure operating stability, while the rest will support its Bitcoin treasury strategy.

The move expands Satsuma’s Bitcoin holdings to a total of 1,125.85 BTC, worth around $128 million. The BTC is held by its Singapore-registered subsidiary, Satsuma Pte.

CEO Henry K. Elder said the oversubscribed round validates the company’s new crypto based corporate model, fusing BTC with decentralised AI.

“The fact that many chose to subscribe in the first-ever bitcoin subscription in London speaks to their trust in our ability to innovate and execute,” he writes.

Growing Appetite for Corporate Bitcoin in the UK

Satsuma now ranks as the second-largest corporate holder of Bitcoin in the UK, just behind The Smarter Web Company, which holds 2,050 BTC. Phoenix Digital Assets holds third place with 247 BTC.

Bluebird Mining Ventures, a UK-based gold mining firm, also recently announced its intention to adopt Bitcoin as its primary treasury reserve asset.

The UK has recently taken steps to welcome digital assets more openly. In May 2025, the government introduced draft legislation aiming to create a comprehensive regulatory framework for crypto assets.

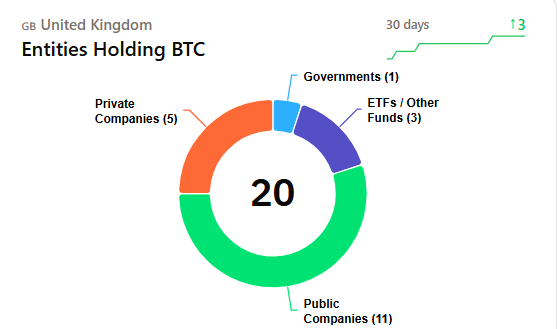

As per the data by BitcoinTreasuriesNet, 20 UK-based entities currently hold Bitcoin. This includes 11 public companies, 5 private firms, 3 ETFs or funds, and 1 government entity, up by 3 in the past 30 days.

Distribution of UK-based entities holding BTC | Source: BitcoinTreasuriesNet

At the time of writing, Bitcoin is trading around $114,154 with no loss or gains in the past day. Although the cryptocurrency is currently 7.46% below its all-time high of $123,000, it has still gained 108% over the last year.

The post Satsuma Smashes Funding Goal With $217M Raise, Becomes UK’s #2 Bitcoin Holder appeared first on Coinspeaker.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.