Binance holds 102% BTC reserves for 30 straight months – Snapshot reveals

0

1

- Binance holds 616,886 BTC against 604,410 BTC in customer liabilities, maintaining a 102% BTC Reserve Ratio.

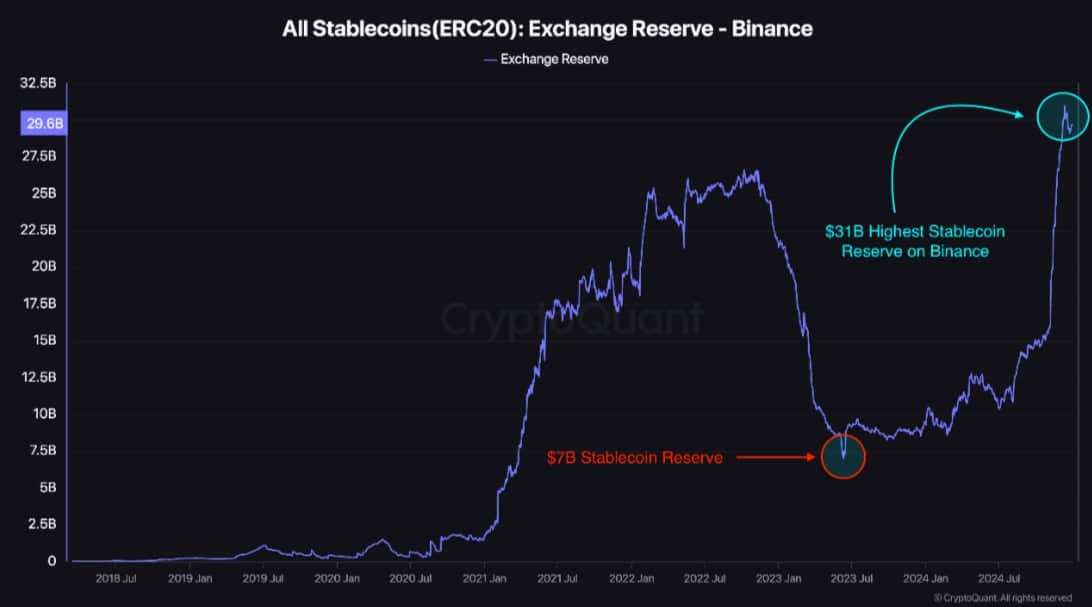

- Stablecoin reserves also climbed to $31 billion by January 2025, strengthening overall liquidity.

Since the collapse of FTX, on-chain transparency has become a benchmark for exchange credibility.

In line with transparency measures, Binance has revealed its proof of reserve data every month since 2022.

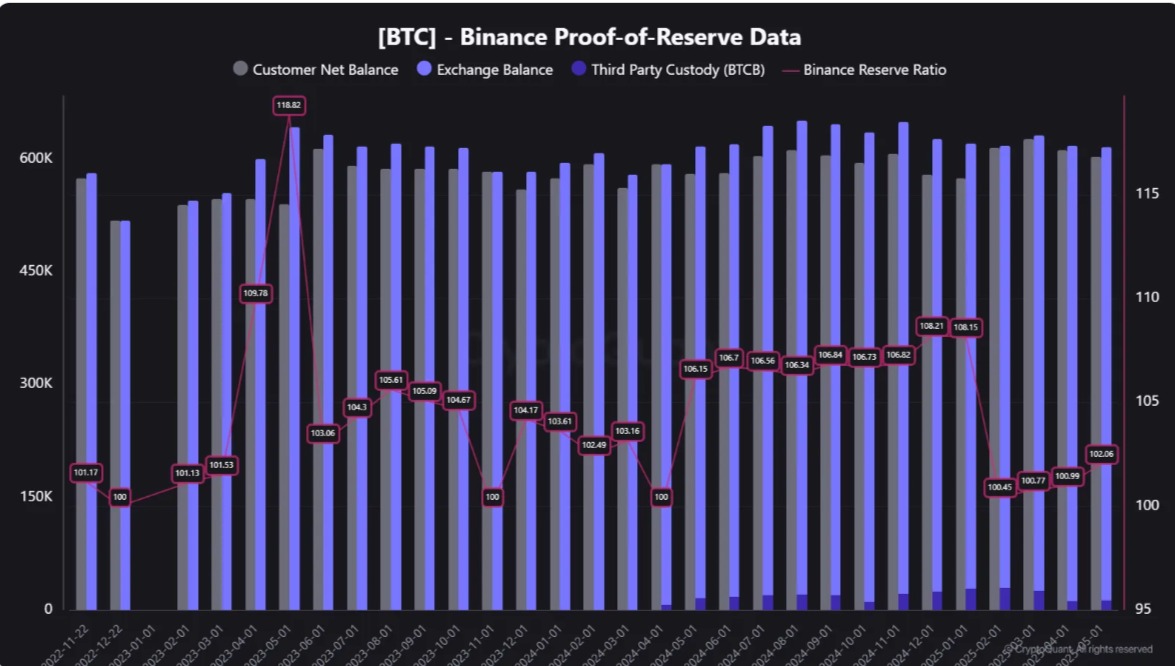

According to the latest report, Binance, the largest crypto exchange, has maintained a Bitcoin Reserve Ratio above 100% for 30 consecutive months.

According to CryptoQuant, Binance currently holds 616,886 BTC against customer net balances of 604,410 BTC, bringing its BTC Reserve Ratio to 102%.

This includes 603,374 BTC on Binance’s exchange wallets and 13,512 BTC held by third-party custodians.

Significant asset holdings are crucial because they fully back all customer funds and provide assurance.

After investors lost their money in the FTX and Mt. Gox incidents, there has been an increasing demand for crypto exchanges to disclose their holdings, with on-chain trackers continually validating this data.

Binance has taken the lead in making this information publicly available, which helps to build confidence among customers and users.

The rising reserves indicate strong asset backing and a commitment to transparency. As a result, customers, investors, and holders on Binance can feel secure against potential market uncertainties in the future.

In fact, over the past year, Binance’s reserves have experienced exponential growth as the company continues to secure customers’ investments through BTC and stablecoin reserves.

As of March 2025, Binance has recorded 29 consecutive months running holding above 100%.

Moreover, Binance’s stablecoin reserves have continued rising. As of January 2025, reserves climbed to $31 billion, strengthening the platform’s liquidity position.

This dual reserve growth in both BTC and stablecoins helps secure investor capital and cushions the exchange against extreme market volatility.

Why this matters for crypto as a whole

Undoubtedly, a positive and rising BTC reserve for Binance, the largest crypto platform on trading volume, plays a vital role in building more trust and confidence.

Thus, investors will have more confidence in the crypto exchange and the whole crypto market.

Significantly, signals the growth in the whole market where investors cannot lose their funds over fraudulent exchanges.

More importantly, this puts pressure on other exchanges to adopt similar practices, shifting the market toward more accountability.

0

1

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.