Cardano Foundation Allocates $40.5M to Boost Stablecoin Adoption and DeFi Growth

0

0

The Cardano Foundation has unveiled plans to allocate 50 million ADA, worth about $40.5 million, to a new liquidity fund. This initiative aims to expand stablecoin adoption and drive decentralized finance (DeFi) activity on the network.

Cardano’s Push for Deeper Liquidity

The Cardano Foundation argues that one of the biggest challenges in the blockchain ecosystem is the lack of liquidity. With more liquidity, Cardano can improve its adoption rates and generate sustainable revenue for its treasury.

The liquidity fund could potentially return 4% annually to the Cardano treasury. This projection is based on correlations between trading volumes and the total value locked (TVL) on the network.

A deeper liquidity pool can boost trading volumes, which will, in turn, increase yields for the ecosystem.

Also Read: Hashdex Files to Add Solana, Cardano, and XRP to Its Nasdaq Crypto Index ETF

The revenue generated by the liquidity fund will be split. 15% will be converted to ADA and returned to the treasury each month. The remaining 85% will stay within DeFi protocols to compound and support growth.

Cardano’s 2026 Roadmap

The liquidity fund is just one part of a broader vision laid out by the Foundation. Cardano’s updated roadmap includes plans to scale its Web3 adoption team. This team will focus on exchange integrations, tokenized asset partnerships, and enterprise use cases.

By 2026, the Cardano Foundation expects to allocate 2 million ADA, worth about $1.62 million, to its Venture Hub. This program will support startups through partnerships with Draper University, Techstars, and CV Labs.

The Foundation aims to provide direct investments, loans, and technical support to these projects.

Real-World Asset (RWA) Tokenization

Cardano Foundation has already piloted tokenized finance, launching $10 million in real-world assets (RWAs) in collaboration with Members Cap.

Looking ahead, Cardano plans to create formal standards for issuing RWAs and integrate Cloudflare’s x402 payments framework through the Masumi Network.

The push into RWA tokenization is a critical part of Cardano’s efforts to expand its use cases beyond traditional cryptocurrencies. These moves will strengthen the platform’s utility and expand its ecosystem.

Marketing and Global Visibility

In response to increased regulatory challenges and competitive pressures, Cardano is ramping up its marketing efforts. Cardano Foundation has committed to increasing its marketing budget by 12% in 2026.

This increase will fund inbound content, paid media campaigns, and global events that highlight the platform’s capabilities. Cardano plans to showcase its advancements at major industry events, such as TOKEN2049 and Consensus.

| Month | Min. Price | Avg. Price | Max. Price | Potential ROI |

|---|---|---|---|---|

| Sep 2025 | $ 0.801318 | $ 0.899129 | $ 1.05 |

32.80%

|

| Oct 2025 | $ 1.07 | $ 1.15 | $ 1.23 |

54.39%

|

| Nov 2025 | $ 1.19 | $ 1.26 | $ 1.31 |

64.62%

|

| Dec 2025 | $ 1.17 | $ 1.18 | $ 1.19 |

50.08%

|

Cardano Foundation will also co-host community-driven events like the Africa Tech Summit 2026 and Digital Asset 2026 in London to increase Cardano’s visibility in key markets.

Governance Changes and Decentralization

Cardano is also expanding its governance model. To promote decentralization, the Cardano Foundation plans to delegate 220 million ADA to eleven new Adoption and Operations DReps. This move is designed to involve more community members in shaping the future of the network.

This new form of governance follows a successful delegation that gives 140 million ADA to seven Builder Delegated Representatives (DReps). Through the wider distribution of governance, Cardano aims to generate a more involved and decentralized ecosystem.

Cardano’s Market Performance

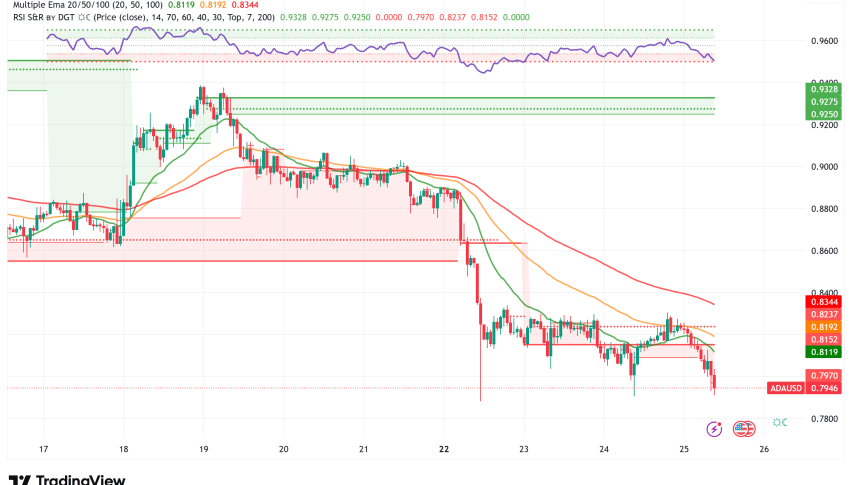

ADA’s price has been volatile in the past few weeks. On the downside, ADA price is trading below the 20-day moving average and the 50-day moving average at $0.871 and $0.86, respectively. Currently exchanging hands for $0.7897.

The long-term trend remains up, as ADA is trading above both its 50-day and 200-day moving averages of $0.871 stronger at $0.735. The RSI, a momentum indicator, is at 36.6 where the oversold level is generally around 30 which could hint towards a slight recovery.

Conclusion

The Cardano Foundation’s new proposal marks an important step towards achieving deeper liquidity and stablecoin adoption on the network. The liquidity fund and governance changes are designed to improve Cardano’s ecosystem, making it more sustainable in the long term.

With plans for further Web3 integration, RWA tokenization, and increased marketing efforts, Cardano is positioning itself for long-term growth. If successful, the liquidity fund could provide a much-needed boost to Cardano’s adoption and revenue generation.

Also Read: Cardano Whales Accumulate 320M ADA in August: Is a $1.50 Breakout Next?

Summary

The Cardano Foundation has proposed allocating 50 million ADA to a new liquidity fund to drive stablecoin adoption and boost DeFi activity. This initiative aims to address liquidity challenges and create sustainable revenue for the Cardano ecosystem.

The proposal includes plans for expanding Cardano’s Web3 adoption, supporting startups, and tokenizing real-world assets. Along with governance reforms and a marketing budget increase, these efforts are designed to position Cardano for long-term growth and adoption.

Appendix: Glossary of Key Terms

Liquidity Fund – A financial reserve aimed at boosting liquidity and adoption of stablecoins and DeFi projects.

DeFi – Financial services using blockchain technology, operating without intermediaries like banks.

Stablecoin – A cryptocurrency designed to have a stable value, often pegged to a fiat currency.

Venture Hub – Cardano’s initiative to support blockchain startups through investments, loans, and technical support.

Web3 – A decentralized web that uses blockchain technology to give users control over their data.

TVL – The total value of assets staked in DeFi protocols.

Frequently Asked Questions (FAQs)

1: What is Cardano’s proposal about stablecoin adoption?

Cardano plans to allocate 50 million ADA to a liquidity fund to drive stablecoin adoption and 2- DeFi activity on the network.

2: How will the revenue from the liquidity fund be used?

The 15% of the revenue will be converted to ADA and returned to the treasury, while 85% will remain in DeFi protocols to support growth.

3: What are Cardano Foundation plans for 2026?

The Cardano Foundation aims to allocate 2 million ADA to its Venture Hub to support blockchain startups and further Web3 adoption.

4: What is Cardano’s strategy for tokenizing real-world assets?

Cardano has piloted tokenized finance and aims to create formal standards for RWA issuance, expanding its use cases beyond traditional cryptocurrencies.

Read More: Cardano Foundation Allocates $40.5M to Boost Stablecoin Adoption and DeFi Growth">Cardano Foundation Allocates $40.5M to Boost Stablecoin Adoption and DeFi Growth

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.