Crypto prices today: BTC, ETH, XRP and SOL weaken as leverage unwinds

0

0

The market opened softer on Friday, October 31, with risk appetite cooling after a burst of long liquidations. Crypto prices fall as live pricing shows Bitcoin near $109,700, down about 1.6 percent on the day, while the total crypto market value drifts lower. Funding rates have eased and open interest has slipped, a tell that leverage is backing off after a busy week.

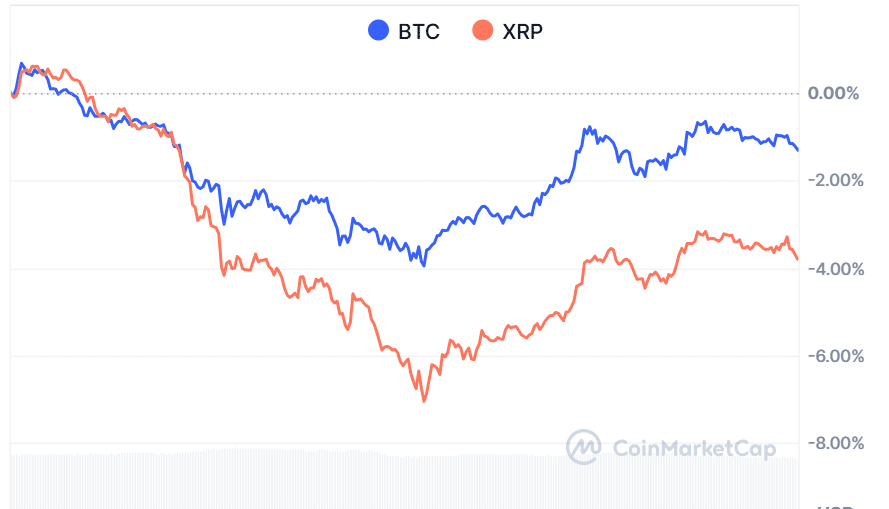

Bitcoin (BTC)

Bitcoin trades around $109,700 after a quick fade from the prior session high. The day’s drawdown follows nearly $900 million in marketwide liquidations over 24 hours, the bulk from longs. That deleveraging pins BTC in a tight range. “The most likely outlook is we are rangy between 100 and 120 or 125, unless we take out the top side,” Mike Novogratz said this month, adding that holding 100 remains key support.

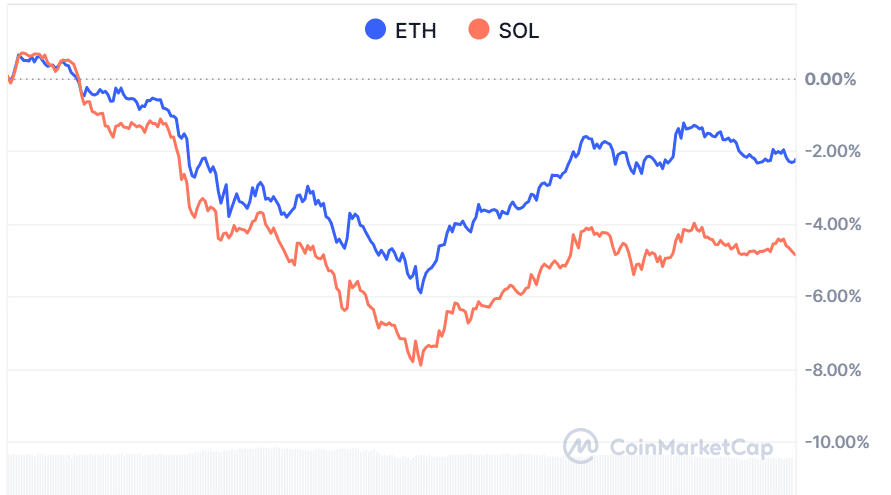

Ethereum (ETH)

ETH changes hands near $3,835 after a 2 to 3 percent dip, with 24-hour lows under $3,700 and highs just below $3,945. Spot volumes are elevated, yet derivatives positioning is lighter than earlier in the week. Traders point to a neutral relative strength profile and slightly negative funding, which fits a “cooling, not cracking” tape.

XRP (XRP)

XRP trades close to $2.48 with daily losses of around 4 percent. Liquidations on XRP outpaced several peers during the overnight move, adding pressure as momentum traders stepped aside. Even so, the circulating float and rising on-chain activity provide a floor when volatility spikes, keeping the pair anchored to the mid-$2 zone for now.

Solana (SOL)

SOL sits near $185, off roughly 5 percent in 24 hours. The move mirrors broad risk reduction across high beta assets. SOL’s volumes remain thick, but open interest has cooled, which usually reduces whipsaws after sharp swings. If liquidity stabilizes, the network’s active dApp flow often helps price recover faster than the market.

Macro pressure and what comes next

The Federal Reserve cut rates by 25 basis points on October 29, but Chair Jerome Powell said “a further reduction in the policy rate at the December meeting is not a foregone conclusion.” That cautious line trimmed the initial boost to risk assets and helped trigger a classic sell-the-news shakeout. Policy paths in the Gulf followed with 25-bp trims, which should slowly filter through regional liquidity.

The liquidation picture

Data show about $890 million in 24-hour liquidations, with longs taking most of the hit. Bitcoin accounted for roughly $310 million, Ethereum about $195 million, Solana near $69 million, and XRP close to $42 million. Open interest dropped to about $159 billion, and the average RSI sits near 40, signaling neutral momentum after the flush.

Bottom line

Price action looks more like a mid-cycle purge than a trend break. BTC holds the six-figure shelf. ETH keeps its core range intact. SOL and XRP feel heavy but not broken. If funding stays neutral and macro signals stop surprising, liquidity can creep back. As Novogratz put it, the market likely chops between $100,000 and $125,000 unless a fresh catalyst arrives.

Frequently asked questions

Q: Why did prices fall today

A: A cluster of long liquidations hit overnight after the Fed’s cautious tone and a crowded leverage build-up earlier in the week. That forced exits and pushed prices lower together.

Q: What levels matter most for Bitcoin right now

A: Market depth and recent commentary point to support near $100,000 and resistance in the $120,000 to $125,000 area. A clean break above the top band would invite trend traders back.

Q: Does the Fed cut help crypto

A: Lower rates can help over time, but the message matters. Powell’s “not a foregone conclusion” on December limited the immediate boost.

Glossary of key terms

Open interest: The total value of outstanding futures and perpetual contracts that have not been closed. Falling open interest after a selloff implies deleveraging rather than strong new shorts.

Funding rate: A periodic payment between longs and shorts on perpetual swaps that nudges price toward spot. Slightly negative funding tells that longs are less aggressive and shorts are paying less to stay in.

Liquidation cascade: A chain reaction where price drops trigger forced closures, which push price lower again and cause more liquidations until leverage resets and order books stabilize.

Read More: Crypto prices today: BTC, ETH, XRP and SOL weaken as leverage unwinds">Crypto prices today: BTC, ETH, XRP and SOL weaken as leverage unwinds

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.