Bitcoin Future at Risk? Experts Discuss the Biggest Threats Over the Next 5-10 Years

0

0

Bitcoin, the pioneering cryptocurrency, has reshaped how people worldwide perceive finance and money. However, as technology advances and external factors evolve, Bitcoin faces structural challenges that could impact its future existence and growth.

A recent discussion among industry leaders highlighted major risks that could pose a black swan event for Bitcoin’s future.

What Is the Biggest Threat to Bitcoin?

Lyn Alden, founder of Lyn Alden Investment, recently asked, “What is the biggest structural risk to Bitcoin in the next 5-10 years?” This question sparked significant attention and responses from investors, experts, and industry leaders, shedding light on pressing concerns.

One of the most frequently mentioned risks is the threat posed by quantum computing. Nic Carter, general partner at Castle Island Ventures, responded concisely: “Quantum.” His answer received widespread agreement.

“I increasingly agree. That was the catalyst for my thread/question, tbh,” Lyn Alden replied to Nic Carter.

Future quantum computers could break the encryption algorithms securing Bitcoin, such as the Elliptic Curve Digital Signature Algorithm (ECDSA), which safeguards Bitcoin wallets. If a sufficiently powerful quantum computer emerges, it could forge digital signatures, allowing attackers to steal Bitcoin from any wallet with an exposed public key.

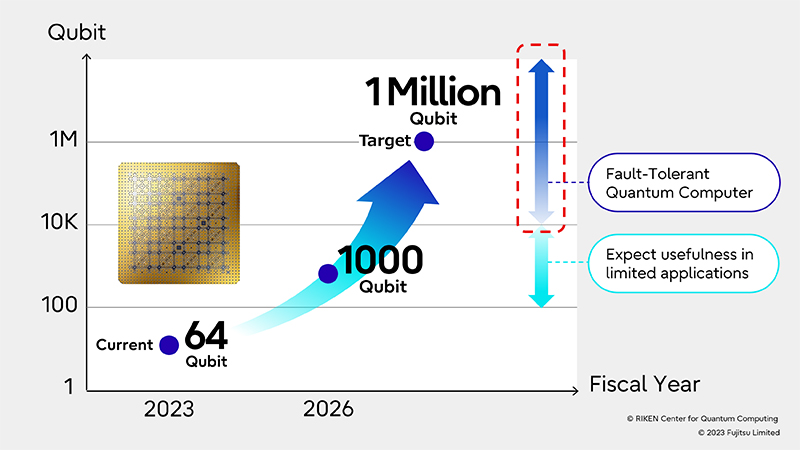

According to research by River, a quantum computer with 1 million qubits could crack a Bitcoin address. Microsoft has claimed that its new chip, named Majorana, is paving the way toward this milestone. This raises an urgent question: how much time does Bitcoin have before it must become quantum-resistant?

Growth of Quantum Computing Qubits. Source: X

Growth of Quantum Computing Qubits. Source: X

While the quantum computing threat is apparent, some argue that a more immediate challenge is whether the Bitcoin community can reach a consensus and implement quantum-resistant solutions in time.

“That’d be not coming to a consensus fast enough on the implementation of a quantum-resistant hashing algorithm,” Stillbigjosh, a former cybersecurity expert at Flutterwave, commented.

However, the founder of BlockTower, Ari Paul, pointed out that Bitcoin’s network faces a more immediate risk as attack costs have dropped significantly.

“Someone shorting 10%+ of BTC’s market cap then spending ~1/10th that to gain 51% control of hash power and mining empty blocks indefinitely, effectively turning off the network. Could fork the PoW algo, but just means the attack on the new network now costs <1/1000th the previous one,” Ari Paul noted.

The Risk of Conflict Between Bitcoin’s Decentralized Nature and Regulatory Oversight

Beyond technical challenges, some investors fear that government and institutional involvement will be Bitcoin’s biggest risk in the next 5-10 years.

“Government and institutional involvement changing the incentives of everything,” Investor Shinobi commented.

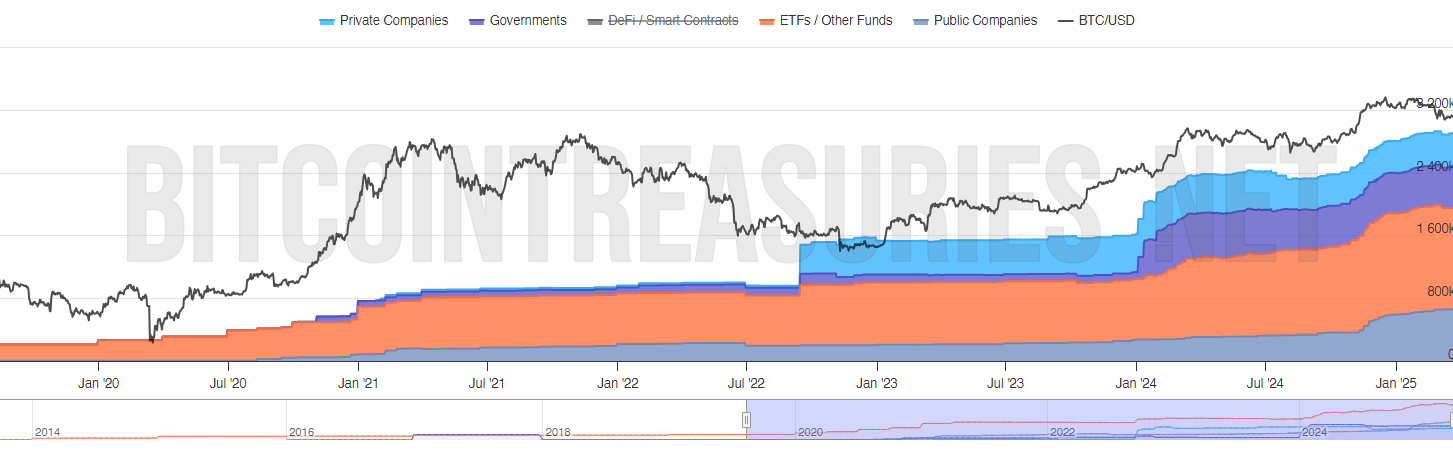

Bitcoin Holdings by Governments, Corporations, and Financial Institutions. Source: BitcoinTreasuries

Bitcoin Holdings by Governments, Corporations, and Financial Institutions. Source: BitcoinTreasuries

Data from BitcoinTreasuries shows that over the past five years, Bitcoin holdings by private companies, public companies, governments, and ETFs have surged more than 12 times, from 210,000 BTC to over 2.6 million BTC. As a result, regulatory intervention could introduce legal pressures or unwanted changes to Bitcoin’s fundamental operations.

“The biggest structural risk is the friction between Bitcoin’s decentralized ethos and the increasing push for centralized regulatory oversight. In essence, as governments and large institutions tighten control and enforce compliance, the network might be forced to compromise on its core principle,” Investor MisterSpread warned.

The discussion sparked by Lyn Alden’s question suggests risks that could trigger black swan events for Bitcoin. It also reflects the growing awareness among industry leaders and investors about Bitcoin’s systemic risks in an era increasingly shaped by political stability and artificial intelligence.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.