BlackRock Sells $80M ETH For BTC: Is Ethereum Price Under Pressure?

0

0

Ethereum price fell 14% to $3,800 on Saturday, October 11, doubling Bitcoin’s 7% losses as ETF trading data revealed that BlackRock led Ethereum sell-offs with $80.2 million in net withdrawals on Friday while simultaneously adding more BTC. The sell pressure coincided with turbulent market reactions to President Trump’s new tariffs on China, accelerating crypto liquidations and pushing ETH down to $3,500, its lowest level since August 3.

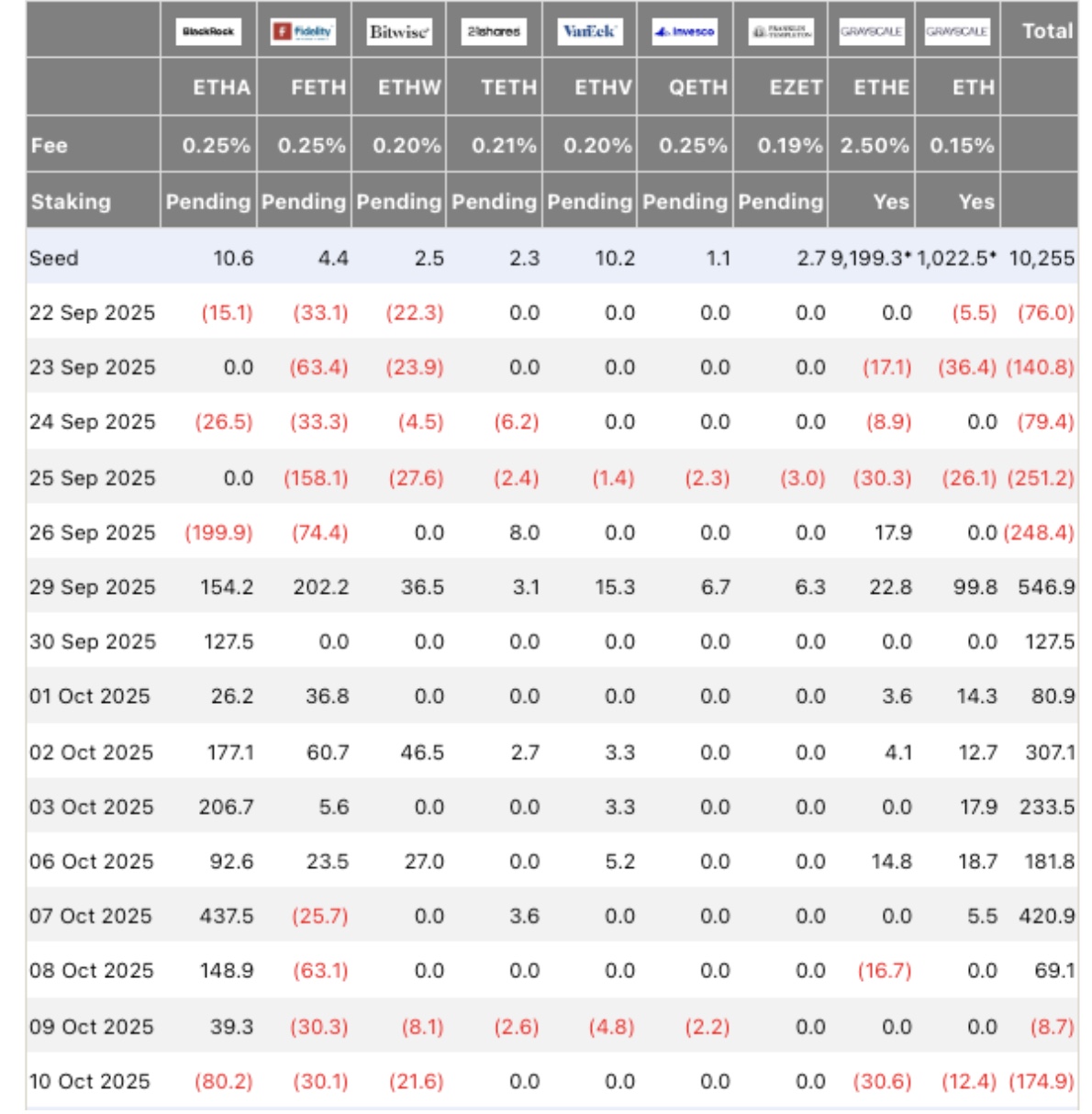

Ethereum ETF Flows (US$m) as of October 10, 2025 | Source: FarsideInvestors

According to FarsideInvestors, Ethereum ETFs recorded aggregate outflows of $174 million on Friday, led by BlackRock’s $80.2 million withdrawals. In contrast, Bitcoin ETFs showed relative strength, with BlackRock’s IBIT ETF attracting $74 million in net inflows, bringing down aggregate BTC ETF outflows to just $4 million on the day.

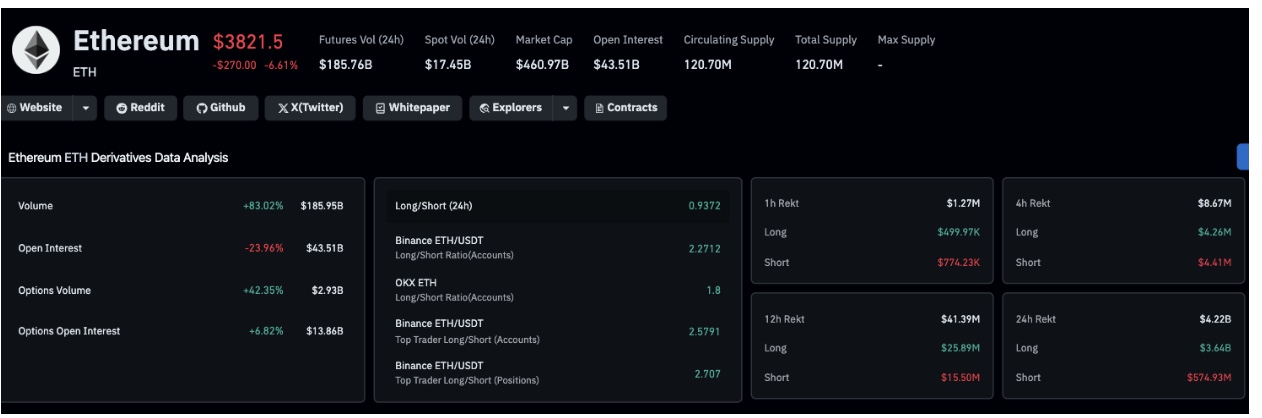

Ethereum Derivatives trading metrics as of Oct 11, 2025 | Source: Coinglass

As the world’s largest asset manager, BlackRock’s trades heavily influence investor sentiment, an effect seen in Ethereum’s sharper downturn. Data from Coinglass shows $3.64 billion in ETH derivatives liquidations over 24 hours, while the long/short ratio dropped to 0.94, reflecting a sudden tilt toward bearish positioning as traders fled ETH amid heightened volatility.

Staking Yield Demand Could Ease Short-Term Pressure on Ethereum Price

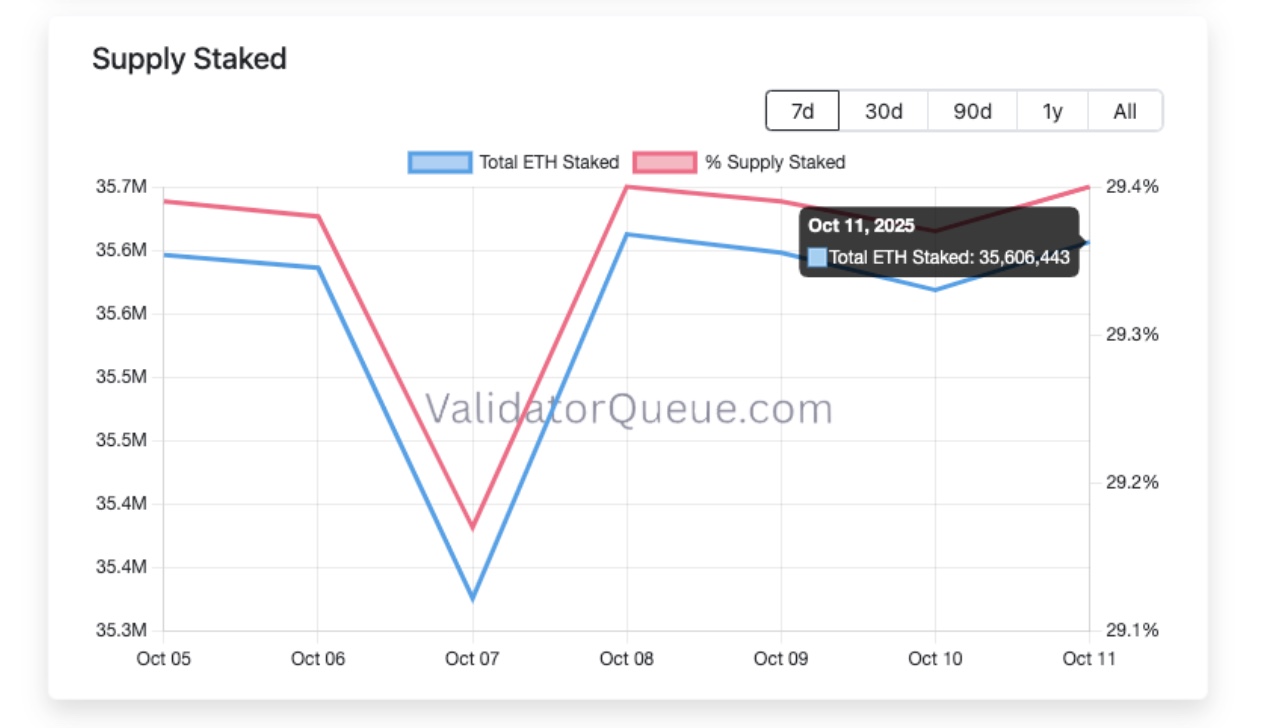

At first glance, BlackRock’s ETF reallocation suggests institutional investors favored Bitcoin’s relative stability over Ethereum amid macro stress. Yet, on-chain data from Ethereum’s Beacon Chain reveals a contrasting trend, as investors appear to be pivoting toward staking yields rather than exiting ETH.

Validator Queue data shows that on Friday, the entry queue surged by 1,356,688 ETH, bringing total staking deposits in progress to 1,386,514 ETH at press time. Meanwhile, the exit queue fell from 2,389,032 ETH to 2,357,676 ETH, indicating fewer validators are choosing to unstake.

Ethereum staking deposits increased by approximately $114 million, while Exit Queue declined $119 million as markets react to President Trump’s latest tariffs on China | Source: ValidatorQueue, Oct 11, 2025

In total, staking deposits increased by 29,826 ETH, worth approximately $114 million, aligning almost precisely with the $80.2 million in BlackRock’s ETF withdrawals. Simultaneously, exit volumes dropped by 31,356 ETH, equivalent to $119 million, within the same 24-hour period.

This divergence suggests a reallocation from non-yield-bearing ETF exposure toward on-chain staking positions, signaling long-term conviction in Ethereum’s network security and passive income potential.

While short-term traders and derivatives participants bore the brunt of Friday’s turbulence, Ethereum’s underlying network infrastructure and staking flows remained positive. Ethereum price has rebounded from intraday lows around $3,500 to reach $3,823 at press time. Steady inflows into Beacon Chain staking contracts signal confidence that may ease near-term downside pressure from Blackrock’s ETF withdrawals.

Best Wallet Presale Hits $16.5M as Ethereum Stakers Eye $4K Rebound

As Ethereum price stabilizes above $3,800 on staking inflows, projects like Best Wallet are emerging as attractive yield alternatives.

With the broader crypto market consolidating after a $19 billion liquidation event. Best Wallet (BEST) offers multi-chain support, smart vaults, and integrated multi-sig security features, giving users institutional-grade control over digital assets.

Best Wallet Presale

At press time, the Best Wallet presale has surpassed $16.5 million, with tokens trading at $0.026. With less than 24 hours before the next price tier unlocks, prospective investors can join the presale via the official Best Wallet website to gain exclusive early-entrant rewards.

The post BlackRock Sells $80M ETH For BTC: Is Ethereum Price Under Pressure? appeared first on Coinspeaker.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.