Bitcoin Boom Likely as Bond Yields Surge - Yes, You Read That Correctly

0

0

Hardening government bond yields, especially on U.S. treasury notes, have traditionally been viewed as a headwind for bitcoin (BTC) and other risk assets.

However, recent persistent resilience in treasury yields suggests a different story — one driven by factors that could be bullish for bitcoin, according to analysts.

The U.S. data released Tuesday showed the consumer price index (CPI) rose 0.2% month-on-month for both headline and core in April, below the 0.3% readings expected. That resulted in a headline year-on-year inflation reading of 2.3%, the lowest since February 2021.

Still, prices for the 10-year treasury yield, which is influenced by inflation, dropped, pushing the yield higher to 4.5%, the highest since April 11, according to data source TradingView.

The so-called benchmark yield is up 30 basis points in May alone and the 30-year yield has increased to 4.94%, sitting near the highest levels of the last 18 years.

This has been the theme of late: Yields remain elevated despite all the news about tariff pause, the U.S.-China trade deal and slower inflation. (The 10-year yield surged from 3.8% to 4.6% early last month as trade tensions saw investors sell U.S. assets)

The uptick in the so-called risk-free rate usually sparks fears of rotation of money out of stocks and other riskier investments such as crypto and into bonds.

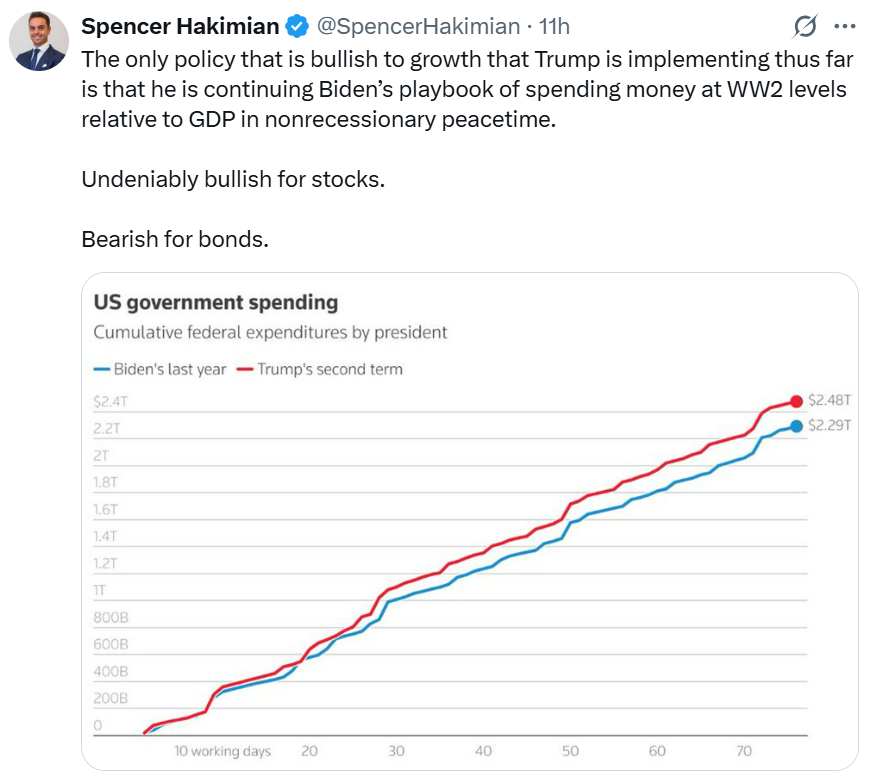

The latest yield surge, however, stems from expectations for continued fiscal expansion during President Donald Trump's tenure, according to Spencer Hakimian, founder of Tolou Capital Management.

"Bonds down on a weak CPI day is telling [of] fiscal expansion like crazy," Hakimian said on X. "Everyone plays to win the midterm. Debt and deficits be damned. It's great for Bitcoin, Gold, and Stocks. It's terrible for Bonds."

Hakimian explained that Trump's tax plan would immediately add another $2.5 trillion to the fiscal deficit. In other words, the fiscal policy under Trump will likely be just as expansionary as under Biden, acting as a tailwind for risk assets, including bitcoin.

The details of the tax cut plan reported by Bloomberg early this week proposed $4 trillion in tax cuts and about $1.5 trillion in spending cuts, amounting to a fiscal expansion of $2.5 trillion.

Arif Husain, head of global fixed income and chief investment officer of the fixed income division at T. Rowe Price, noted that fiscal expansion will soon become the overriding focus for markets.

"Fiscal expansion may be growth supportive, but most importantly, it would likely put even more pressure on the treasury market. I am now even more convinced that the 10‑year U.S. treasury yield will reach 6% in the next 12–18 months," Husain said in a blog post.

Sovereign risk

Per Pseudonymous observer EndGame Macro, the persistent elevated Treasury yields represent fiscal dominance, an idea first discussed by economist Russel Napier a couple of years ago and Maelstrom's CIO and co-founder, Arthur Hayes, last year, and repricing of U.S. sovereign risk.

"When the bond market demands higher yields even as inflation falls, it’s not about the inflation cycle it’s about the sustainability of U.S. debt issuance itself," EndGame Macro said on X.

The observer explained that higher yields create a self-reinforcing spiral of higher debt servicing costs, which call for more debt issuance (more bond supply) and even higher rates. All this ends up raising the risk of a sovereign debt crisis.

BTC, widely seen as an anti-establishment asset and an alternative investment vehicle, could gain more value in this scenario.

Moreover, as yields rise, the Fed and the U.S. government could implement yield curve control, or active buying of bonds to cap the 10-year yield from rising beyond a certain level, let's assume 5%.

The Fed, therefore, is committed to buy more bonds every time the yield threatens to rise beyond 5%, which inadvertently boosts liquidity in the financial system, galvanizing demand for assets like bitcoin, gold and stocks.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.