Bitcoin Faces Mounting Pressure as BFI Slips Below Neutral Zone

0

0

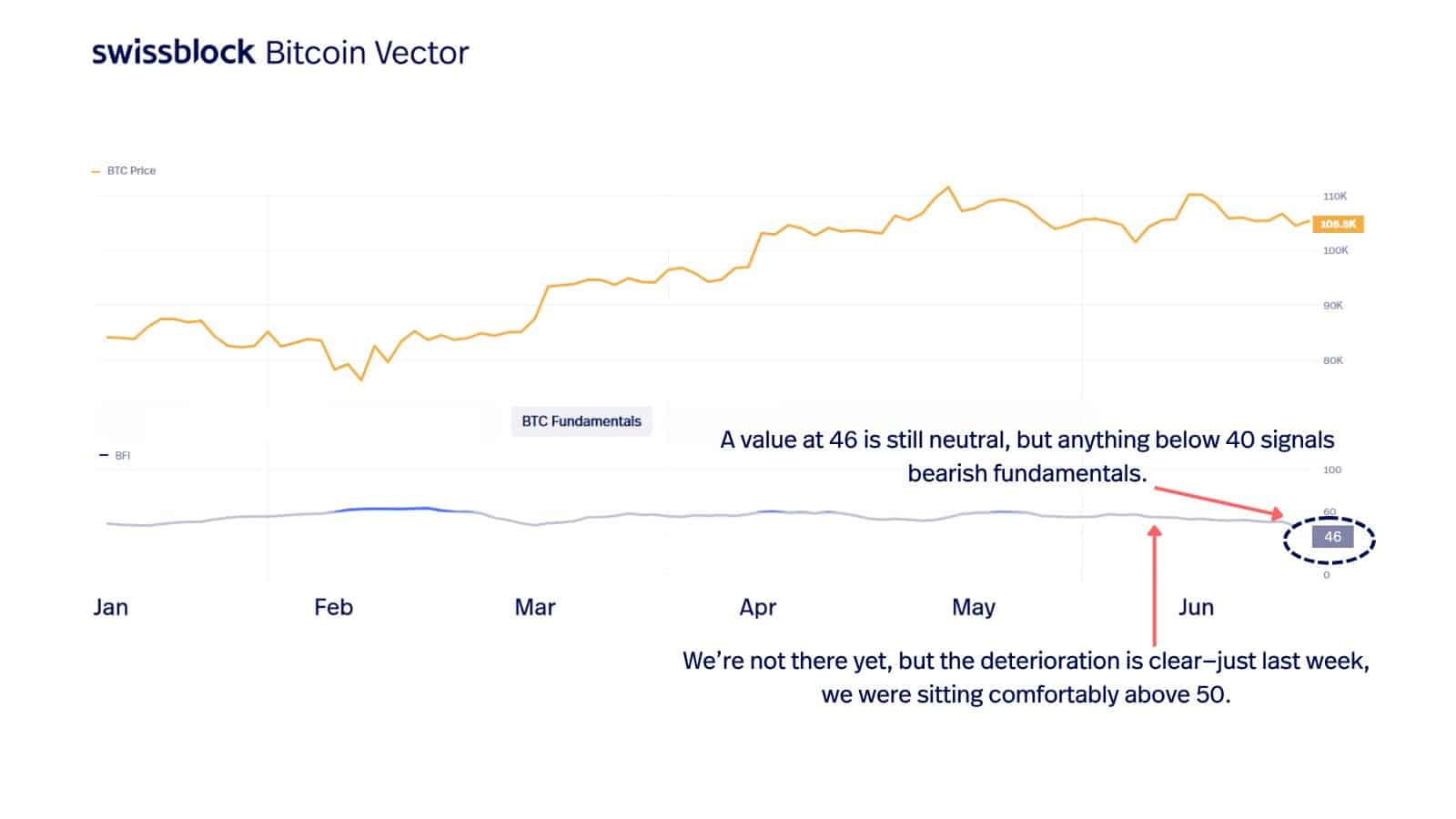

Bitcoin’s recent price movement paints a picture of tranquility, hovering steadily around $104,800. But beneath this calm exterior, a critical indicator is starting to flash warning signals. The Bitcoin Fundamentals Index (BFI), a metric akin to the asset’s “engine health,” has dropped to 46, nearing the psychological support level of 40. While this figure still technically sits in the neutral zone, its downward momentum is raising alarms for experienced market watchers.

The Calm Before a Potential Storm

For casual investors, Bitcoin’s sideways consolidation might seem uneventful. However, seasoned analysts recognize this pattern all too well—low volatility often precedes dramatic market moves. A recent report shared on X (formerly Twitter) by Swissblock Analytics emphasizes that while Bitcoin’s price remains stable, on-chain fundamentals are deteriorating. Trading volumes are declining, network activity is slowing, and institutional inflows into spot ETFs, while still present, are not robust enough to offset the weakening core metrics.

As The Bit Journal highlights, Bitcoin’s price is merely the surface. The real story lies in the underlying data that reflects confidence, participation, and demand.

Will the $100K Support Hold?

The $100,000 support level has proven resilient in recent weeks, largely supported by institutional interest and long-term holders (HODLers). However, if the BFI breaks below 40, the situation could quickly spiral. Analysts warn that such a move might trigger a wave of selling, potentially dragging BTC down to the $92,000–$90,000 range. These levels aren’t just technical—they represent critical psychological thresholds that could incite panic among newer investors and accelerate a broader correction.

Path to Recovery: Can Bitcoin Regain Momentum?

Despite the bearish undertones, hope is not lost. Should the BFI reverse course and climb back above 50, it would suggest renewed internal strength, potentially sparking a fresh rally. In such a scenario, analysts believe Bitcoin could target the $112,000–$115,000 range. The current standoff—between softening fundamentals and sustained institutional demand—has created a tense equilibrium. The direction of the next breakout will likely depend on macroeconomic cues, regulatory developments, and large-scale investor sentiment.

Investor Advisory and Risk Outlook

As always, it’s essential for readers to understand the risks inherent in cryptocurrency investing. Indicators like the BFI provide valuable insights but should not be used in isolation. Bitcoin’s price trajectory can be influenced by a myriad of factors, including regulatory shifts, global liquidity trends, and technological updates. Investors are strongly encouraged to diversify their research, consult with financial professionals, and never base decisions solely on short-term metrics.

Final Thoughts

While the Bitcoin market remains deceptively stable, the drop in its fundamental index is a signal worth monitoring. Whether this leads to a breakdown or a rebound will depend on how internal dynamics evolve in the coming weeks. The Bit Journal will continue tracking these developments closely, providing timely insights into crypto’s ever-changing landscape.

- https://twitter.com/Thebitjournal_

- https://www.linkedin.com/company/the-bit-journal/

- https://t.me/thebitjournal

Follow us on Twitter and LinkedIn and join our Telegram channel to get instant updates on breaking news!

Sources:

-

Swissblock Analytics Report via X, June 2025

-

Glassnode On-chain Data Reports

-

CoinDesk Market Analysis

Read More: Bitcoin Faces Mounting Pressure as BFI Slips Below Neutral Zone">Bitcoin Faces Mounting Pressure as BFI Slips Below Neutral Zone

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.