Nasdaq Files Proposal to List 21Shares Dogecoin ETF

0

0

Highlights:

- Nasdaq has submitted a new proposal to trade 21Shares Dogecoin ETF.

- The stock exchange noted that the shares will trade under Nasdaq Rule 5711(d).

- 21Shares US LLC will serve as the shares sponsor, while a Maryland trust firm will be the trustee.

According to an April 28 filing, the American stock exchange Nasdaq applied for approval to list and trade shares of 21Shares’ Dogecoin (DOGE) Exchange Traded Fund (ETF) with the US Securities and Exchange Commission (SEC). Nasdaq Rule 5711(d) will guide the share transactions. This rule ensures the publication and maintenance of important details, including the trust’s holdings, pricing statistics, and Nasdaq’s listing rules.

In the SEC document, the stock exchange noted that the board-designated senior management approved the recent proposed rule change. Meanwhile, Nasdaq’s staff will inform the board about the new filing, eliminating the need for further approval to progress with the rule change.

BREAKING:

21SHARES HAS FILED

FOR A $DOGE ETF WITH NASDAQ.BULLISH FOR ALTCOINS

pic.twitter.com/cGRK4itjYV

— Ash Crypto (@Ashcryptoreal) April 29, 2025

Nasdaq’s Proposed Dogecoin ETF Shares Structure

According to the SEC document, the trust’s sponsor will be 21Shares US LLC. The Registration statement described the trust as a Maryland statutory entity. It added that the trust will operate under an agreement subject to periodic amendment.

In addition, a third party appointed by either the sponsor or trustee will serve as the trust’s administrator. The trust will operate passively, with its main source of revenue generation coming from tracking Dogecoin’s value. This suggests that the sponsor will not sell DOGE when it appreciates in price or speculatively purchases the token during market dips in anticipation of possible gains.

Also, the trust must meet its investment objectives without using derivatives or other similar arrangements. “The Trust’s investment objective is to seek to track the performance of Dogecoin, as measured by the performance of the CF DOGE-Dollar US Settlement Price Index (“Pricing Benchmark”), adjusted for the trust’s expenses and other liabilities,” the SEC filing explained.

CF Benchmark Limited will estimate the pricing benchmark based on the aggregation of the executed trade flow of leading Dogecoin trading outlets. This pricing will reflect the Dogecoin equivalent in US dollars. Meanwhile, to achieve its investment targets, Nasdaq’s trust will hold Dogecoin, valuing its shares daily based on the price benchmark. Per the SEC document, Coinbase Custody Trust Company, LLC will serve as the trust custodian. Hence, it would hold all the trust’s Dogecoin.

#ETF News: @21Shares files to list their $DOGE ETF on the #NASDAQ. Joins the queue of 73 crypto ETFs now waiting for approval. https://t.co/UtoasmhId4 pic.twitter.com/vgvrjE7O6Y

— MartyParty (@martypartymusic) April 29, 2025

Dogecoin’s Price Reactions

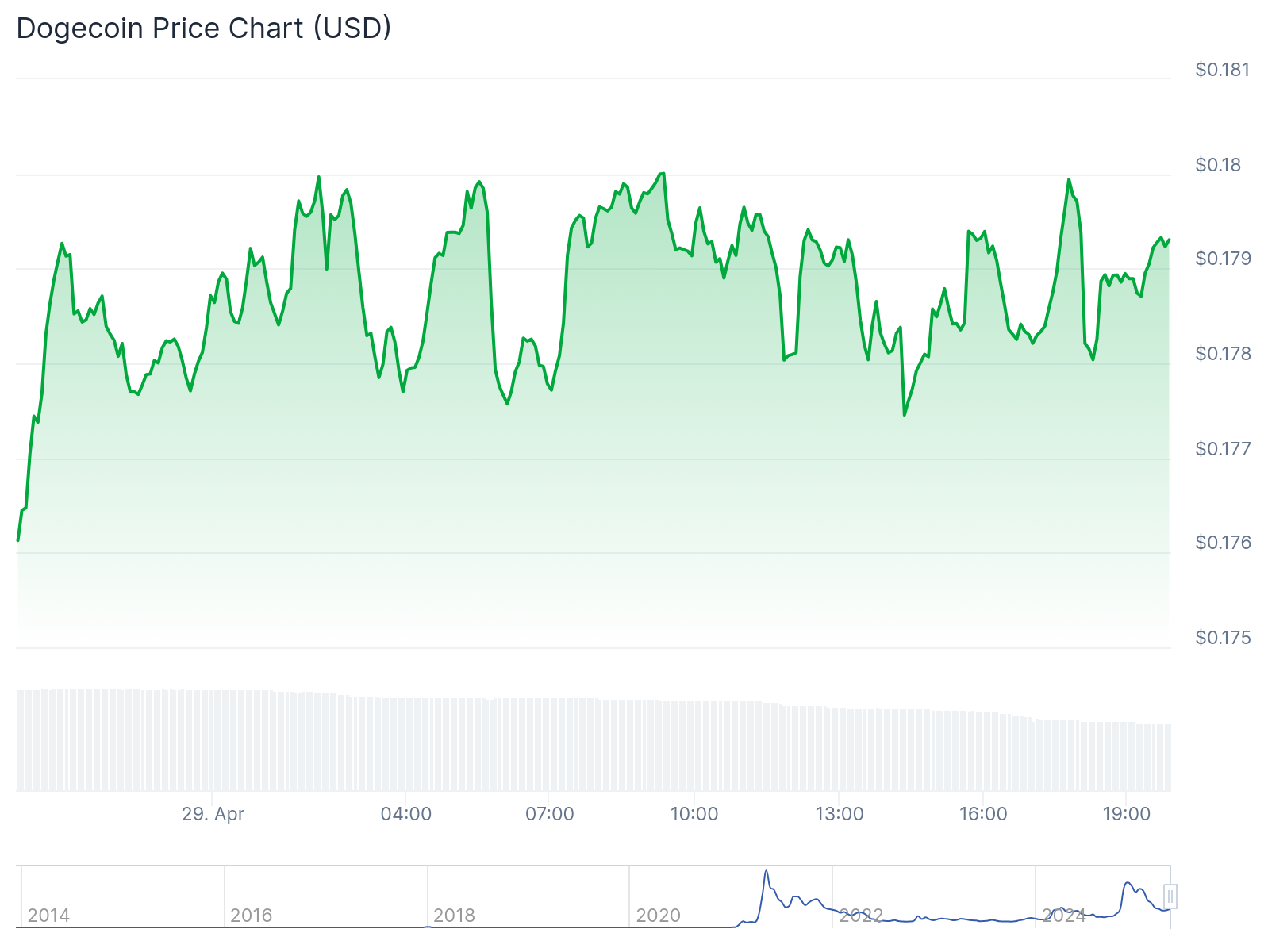

Dogecoin, the world’s most valuable meme cryptocurrency, is up 1.6% in the past 24 hours, trading at approximately $0.1788. In the past week, the meme coin appreciated 3.9%, fluctuating between $0.1712 and $0.1903.

Other extended-period price change variables reflected upswings. For context, DOGE appreciated 15% 14-day-to-date, 6.2% month-to-date, and 26% year-to-date. As a result of the slight upswing, Dogecoin’s market capitalization rose to about $26.67 billion. Despite the subtle price surge, Dogecoin’s 24-hour trading volume dropped 32.17% to approximately $904.22 million.

Nasdaq Requests for Clear Regulatory Guidelines from the SEC

On April 26, Crypto2Community reported that Nasdaq published a comment letter requesting better regulatory guidelines from the SEC. In its letter, the stock exchange highlighted important areas the regulatory body must review to encourage crypto participation among Americans.

Nasdaq emphasized the need for proper digital asset classification. Meanwhile, before its latest filing, the stock exchange presented a similar rule change to the US SEC, requesting approval to list and trade VanEck Avalanche (AVAX) spot ETF.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.