Gas Price Soars 33%, Gaining a Spot Among Top Gainers: Analyst Eyes $10

0

0

Highlights:

- Gas price has spiked about 33% to $2.73 as on-chain metrics indicate strong market sentiment.

- Its trading volume has spiked over 1800%, indicating increased investor confidence.

- Analysts foresee a $10 level in the long term in Gas prices.

Gas prices have rallied about 33% to $2.73, increasing buying activity. Accompanying the price movement is the daily reading volume, which has spiked over 1800%. This indicates increased market activity, hence, intense investor confidence. Gas price has increased 10% in the past week despite the 13% drop in the past month. Gas has notably gained a spot among the top gainers today, boasting intense buying activity.

Top 8 Trading Data on Binance (24h)

Top Gainers:$FORTH +34.82%$ARDR +33.59%$GAS +23.92%

Hot Coins Dipping:$ETH -9.72%$FUN -21.38%$GUN -18.38%

Top Volume:$BTC, $ETH, $XRP lead the charts despite red candles.

Volatility is back—trade smart!#Binance #Crypto… pic.twitter.com/vjarmoktLS

— CryptoResearch (@CryptoRResearch) April 9, 2025

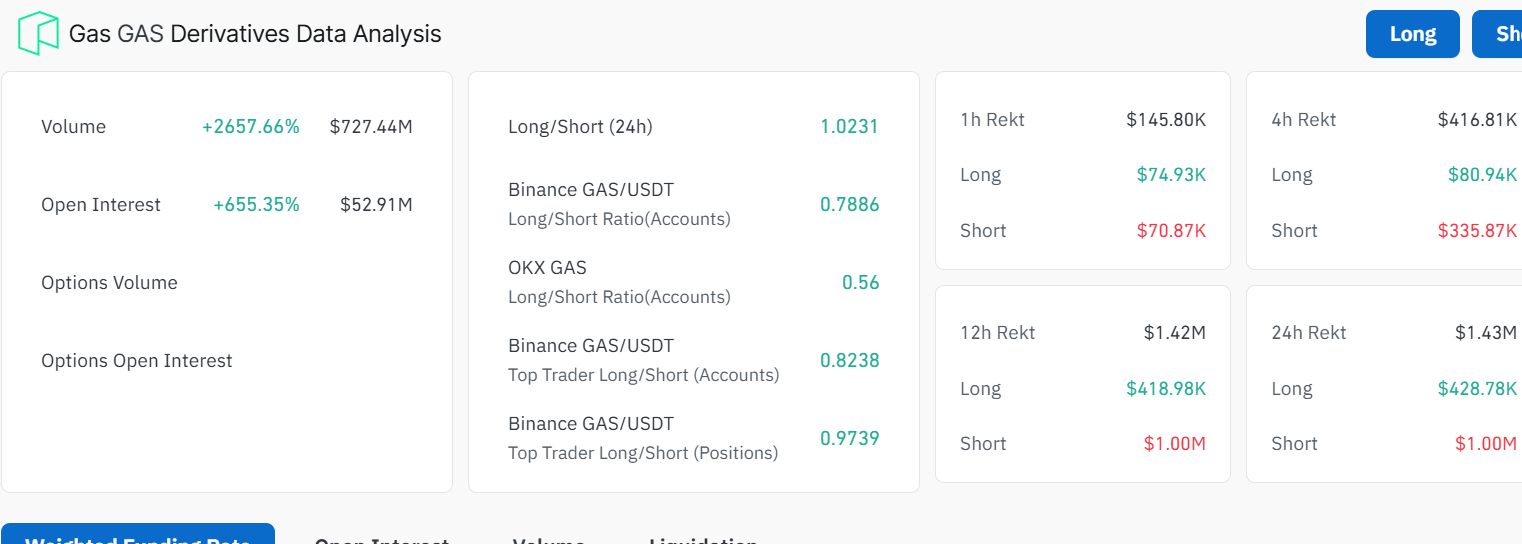

Meanwhile, on-chain analysis shows increased market activity in the GAS market. A quick look at Coinglass data shows a volume and open interest spike of 2657% and 655%, respectively. This indicates intense market activity, causing the recent rebound in Gas price. Moreover, the recent surge suggests a potential for continued price movement to the upside if the bulls keep dominating.

Meanwhile, a crypto trader and analyst has highlighted his next targets in the Gas price. According to Crypto GVR, the Gas price will fluctuate between $1 and $2. However, in the long term, the Gas price will spike to the upside, hitting $10, added the analyst.

$GAS will start reversal in between 1-2$ and then it will hit 10$ in long term hold pic.twitter.com/AVTlZ3jA8c

— Crypto GVR (@GVRCALLS) April 6, 2025

With strong market sentiment and increased investor confidence, how high can the Gas price go? Let’s decrypt more in the technical outlook.

The Gas price has spiked upward in a splendid show of bullish muscle, breaking above the descending parallel channel. It is up 33% from its daily low of $1.94 to $2.73, indicating intense buying pressure. The odds lean toward the bulls, as the bears see nothing but dust. However, can the bulls sustain the momentum?

Gas Price Outlook

A closer look at the daily chart timeframe Gas price shows that the bulls have taken the reins despite the bearish prospect in the market. The bearish sentiment manifests as the Gas price trades below the 50-day MA at $2.96 and the 200-day MA at $4.23.These levels act as immediate resistance barriers, cushioning the bulls against upward movement.

However, with the recent surge, if the bulls keep dominating the market, they could flip the $2.96 immediate resistance into the support zone. A breach and break above this level would rake some bullish sentiment into the market. A decisive close above the 50-day MA will see the bulls target the $3.15, $3.61, and $4.23 resistance keys.

The Relative Strength Index supports the upward movement, which has spiked above the 50-mean level. This is evident as the RSI has hurtled from the 30-undervalued region, currently at 54.49, tilting the odds toward the buyers. Moreover, there is still more room for the upside before the RSI is considered overbought.

On the other hand, if the bears step into the market, the Gas price could fall. If the resistance level at $2.96 proves too strong, the bulls may lose strength, retracing to the $2.43 support level. A deeper correction will see the Gas price drop to around 2.10, $1.94, and $1.80, respectively. In the meantime, traders should closely watch the resistance and support zones to determine the next move in gas prices.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.