Solana Price Soars 2% as Trading Volume Surges 19% with Key Technical Showing Buy Signal

0

0

Highlights:

- The price of Solana soars 2%, trading at $153 amid a 19% surge in trading volume.

- Technical indicators show buy signals with RSI nearing oversold and TD Sequential suggesting a short-term rise.

- Derivatives volume rises 15%, with bullish long-to-short ratios indicating trader optimism.

Solana price has kicked off with a 2% surge in the month of June, showing signs of life, as it trades at $153. The trading volume has notably soared 19% to $2.72B, indicating a surge in market activity. Despite the positive outlook, SOL is down 13% in the past week, as bulls try to regain momentum. What’s next for the Solana price in June? Let’s decrypt more!

Solana Price Technical Indicators Highlight Buy Signals

The daily price chart of Solana shows valuable technical information. Solana price broke below the support zone at $157, aligning with the 50-day MA, now exchanging hands at $153. A medium- to long-term indicator at the 200-day MA is sitting at $179.44, showing the longer-term trend is still reluctant.

Momentum providers show a combination of excitement and uncertainty. With the Relative Strength Index (RSI) at 39.97, Solana’s price is headed toward oversold territory and may soon bounce higher as a result. Furthermore, the Moving Average Convergence Divergence (MACD) suggests a potential decrease in price as the blue line is below the orange signal line.

Meanwhile, Ali Martinez, a popular analyst, has highlighted a TD buy signal in SOL. According to the analyst, Solana’s price looks ready to bounce with the TD Sequential flashing a buy signal on the 12-hour chart!

#Solana $SOL looks ready to bounce with the TD Sequential flashing a buy signal on the 12-hour chart! pic.twitter.com/C3uVWwyZPj

— Ali (@ali_charts) June 1, 2025

Derivatives Market Activity Shows Increased Volume and Bullish Positioning

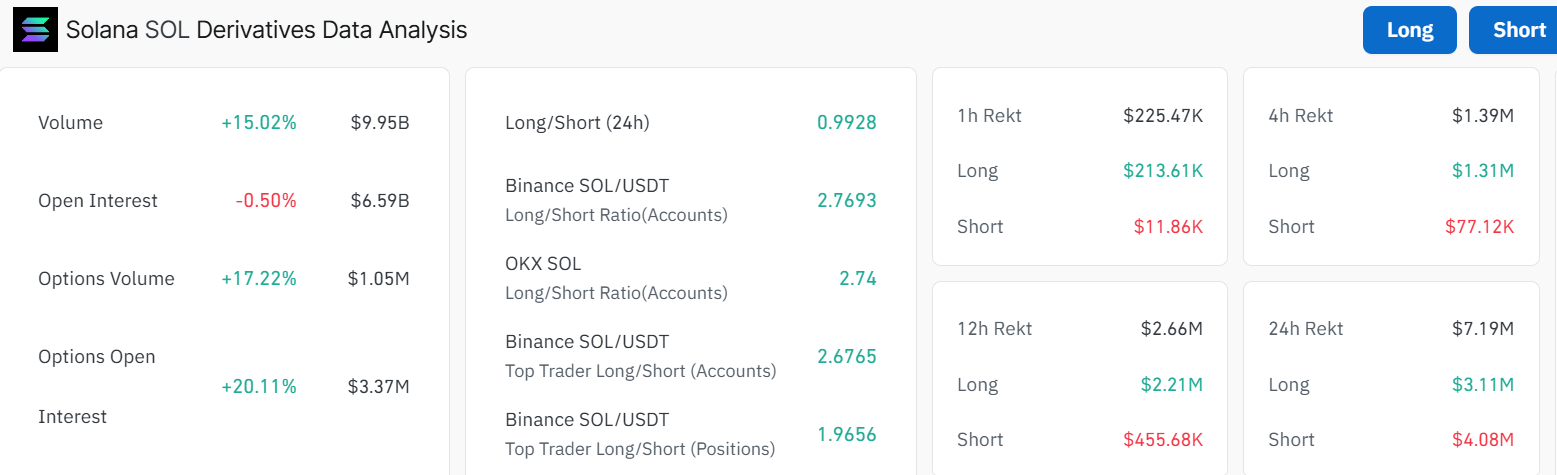

Derivatives trading on Solana is following interesting trends as well. In the past day, volumes have gone up by 15.02% to almost $9.95 billion, which suggests more trader activity. Even though open interest dropped a bit by 0.5%, to $6.59 billion, options volume and open interest gained 17.22% and 20.11%, respectively. These show a trend towards people being more interested in trading and hedging beyond the basics.

Short positions are fewer than long positions on most major exchanges, showing traders are optimistic. Binance’s SOL/USDT pair gives a sign that there are 2.7693 accounts with longs more than shorts, which is closely matched by OKX and Binance’s top traders at 2.74 and 2.68, respectively. This shows that a big part of the market expects prices to go up.

What’s Next for SOL?

Since the RSI is very close to oversold and the TD Sequential indicator just sold, a price rise is likely for SOL, especially if it breaks above the 50-day moving average. As the long-to-short ratios are moving up and options activity is on the rise, it shows traders taking positions for gains, reflecting an increase in their confidence.

If Solana price sustains the recent upside and flips the 50-day MA into support, the bulls could target the $164, $174, and $180.A close above the $197 resistance mark will open the doors for further upside towards $200.

On the downside, if the bears capitalize on the bearish MACD, the Solana price could consolidate or drop further. In such a case, the $151, $147, and $143 support zones will be in line to absorb the potential pressure. Meanwhile, several key indicators show that SOL could recover soon, giving investors and traders watching the smart contract platform chances to benefit.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.