Donald Trump’s Bitcoin Strategy for US $35 Trillion Debt Faces Skepticism

0

0

Former US President and Republican candidate Donald Trump continues to champion Bitcoin as he campaigns for re-election this November.

In a recent statement, Trump suggested that Bitcoin could be instrumental in addressing the United States’ substantial national debt.

Trump Suggests Using Bitcoin to Pay Off US National Debt

In an interview with Fox News’ Maria Bartiromo, Trump implied that Bitcoin could potentially eliminate the US’s $35 trillion foreign debt. He argued that this digital asset, if adopted and supported effectively, could benefit the nation.

“Who knows? Maybe we’ll pay off our $35 trillion dollars, hand them a little crypto check, right? We’ll hand them a little bitcoin and wipe out our $35 trillion,” Trump stated.

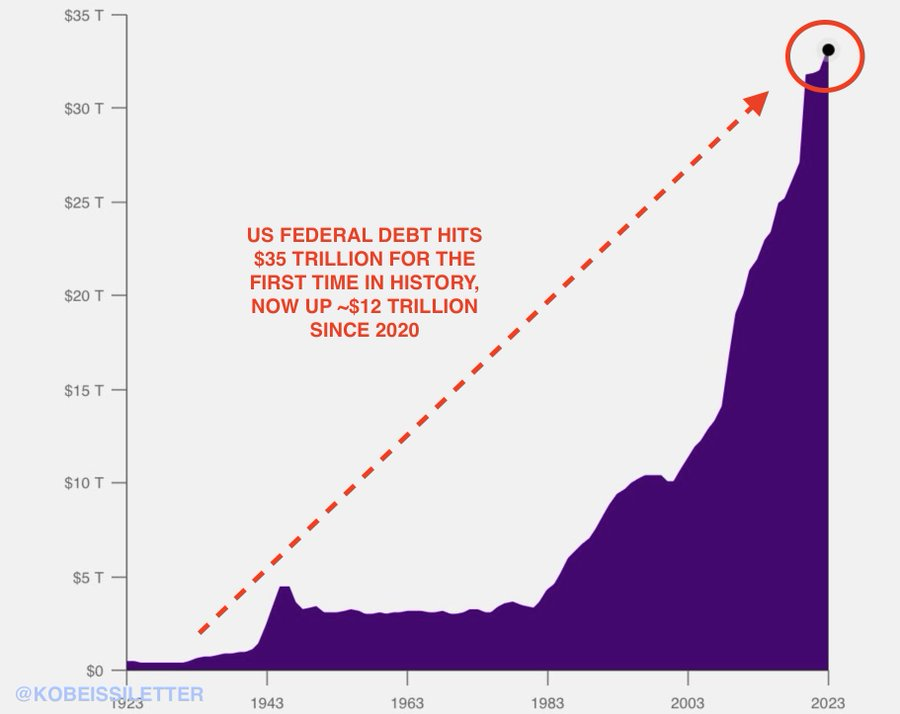

The US national debt has been a major topic of discussion, especially since surpassing $35 trillion. According to market analysis platform Kobeissi Letter, the US has accumulated approximately $12 trillion in federal debt since 2020. The current deficit spending as a percentage of GDP is now at levels seen during World War II.

“In other words, the US has added around $280 billion in federal debt each month since January 2020. This equates to about $105,000 in federal debt per person in the country,” the firm noted.

Read more: Who Owns the Most Bitcoin in 2024?

US National Debt. Source: Kobeissi Letter

US National Debt. Source: Kobeissi Letter

Indeed, the idea of using Bitcoin to reduce national debt is not entirely new. It aligns with the Bitcoin Act bill introduced by Senator Cynthia Lummis, which proposes creating a strategic Bitcoin reserve and authorizing the US Treasury to acquire 1 million BTC over five years.

Crypto enthusiasts like David Bailey, CEO of Bitcoin Magazine, support this concept. Bailey believes Bitcoin could address the US national debt within a few epochs. However, financial experts remain doubtful. They argue that Bitcoin’s market capitalization would need to surpass $35 trillion to make this feasible.

“Selling off 35 TRILLION dollars worth of Bitcoin would collapse the market and cause BTC to drop to $0. And… this would require China and other countries to even WANT Bitcoin as a debt repayment.. do people not know how the world works?,” an investor wrote on X.

Meanwhile, Trump’s comments follow his keynote speech at the Bitcoin 2024 conference in Nashville, where he advocated for a more significant role for digital assets in the US economy. His speech underscored his growing interest in the crypto sector and its potential benefits.

Read more: Crypto Regulation: What Are the Benefits and Drawbacks?

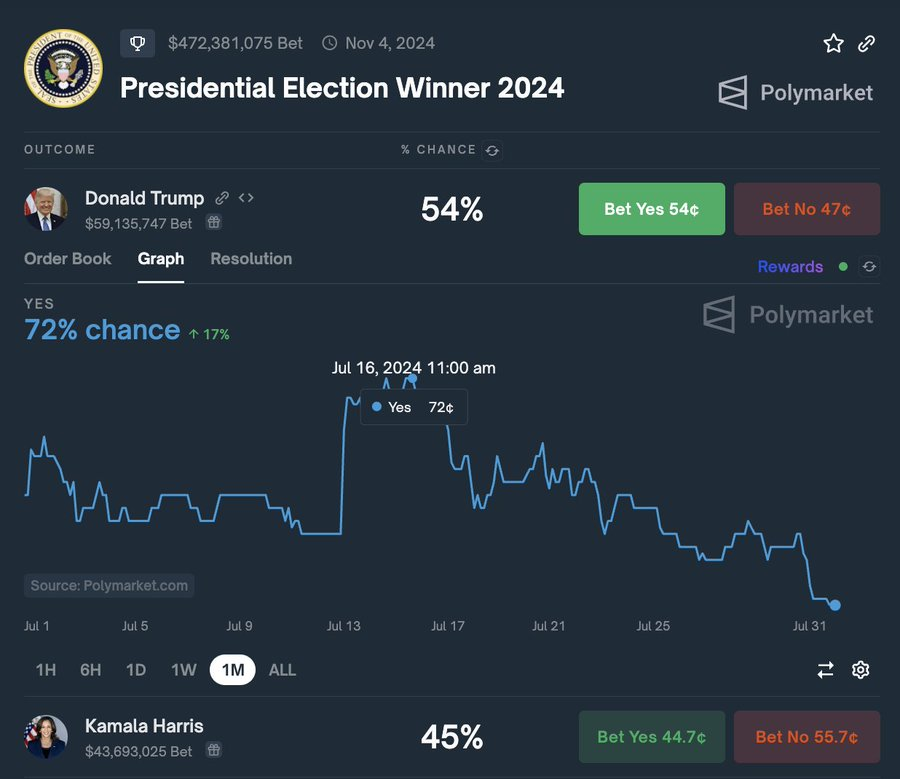

Donald Trump’s Election Odds. Source: Polymarket

Donald Trump’s Election Odds. Source: Polymarket

This debate comes amid a decline in Trump’s chances of winning the presidential election, which have dropped to 54% from a peak of 72% in July. His main rival, Vice President Kamala Harris, has gained traction and recently secured her first major crypto executive endorsement from Uphold’s co-founder, J.P. Theriot.

0

0