Crypto ETF News: Bitcoin ETF Inflows Surge While Ethereum ETFs Suffer Third Day of Outflows

0

0

The post Crypto ETF News: Bitcoin ETF Inflows Surge While Ethereum ETFs Suffer Third Day of Outflows appeared first on Coinpedia Fintech News

On September 24, the US spot Bitcoin ETF saw a combined inflow of $241.00 million, while Ethereum ETFs continued their day 3 streak of outflow. It recorded a total net outflow of $79.36 million, as per the SoSoValue report.

Bitcoin ETF Breakdown

After two consecutive days of experiencing huge sell-offs, Bitcoin ETFs finally managed to record an inflow of $241.00 million. BlackRock IBIT led with $128.90 million, and Ark and 21Shares ARKB followed with $37.72 million.

Additional gains were made by Fidelity FBTC, Bitwise BITB, and Grayscale BTC of $29.70 million, $24.69 million, and $13.56 million, respectively. VanEck HODL also made a smaller addition of $6.42 million in inflows.

Despite the inflows, the total trading value of the Bitcoin ETF dropped to $2.58 billion, with total net assets $149.74 billion. This marks 6.62% of Bitcoin market cap, slightly higher than the previous day.

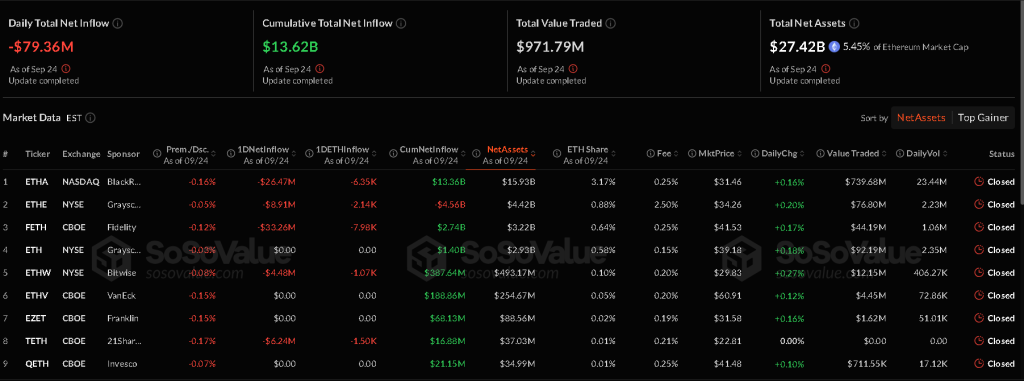

Ethereum ETF Breakdown

Ethereum ETFs saw a total outflow of $79.36 million, with Fidelity’s FETH leading with $33.26 million. BlackRock ETHA also experienced heavy selling pressure of $26.47 million, followed by Grayscale’s ETHE $8.91 million. 21Shares TETH and Bitwise ETHW also posted smaller withdrawals of $6.24 million and $4.48 million, respectively.

The total trading value of Ethereum ETFs dropped below a billion, reaching $971.79 million. Net assets came in at $27.42 billion, representing 5.45% of the Ethereum market cap.

Market Context

Bitcoin is trading at $111,766, signalling a 4.6% drop compared to a week ago. Its market cap has also dipped to $2.225 trillion. Its daily trading volume has reached $49.837 billion, showing mild progress there.

Ethereum is priced at $4,011.92, with a market cap of $483.822 billion, showing a sharp decline. Its trading volume has also slipped to $37.680 billion, reflecting a slow market.

Due to heavy outflow this week, Bitcoin and Ethereum’s prices are experiencing price swings. Crypto analysts from Bloomberg warn the market to brace for further volatility.

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

FAQs

On September 24, Bitcoin ETFs had a total trading value of $2.58 billion with $241 million in inflows. Ethereum ETFs saw a lower trading value of $971.79 million, with a total net outflow of $79.36 million.

BlackRock’s IBIT led Bitcoin ETF inflows with $128.90 million. For Ethereum ETFs, Fidelity’s FETH was the primary contributor to outflows, recording a $33.26 million withdrawal.

Prices are experiencing swings due to heavy outflows from ETFs this week, which impact market liquidity and investor sentiment, leading to increased volatility.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.