Solana Breakout Strengthens as Stablecoin Supply Hits Record $15B

0

0

Solana (SOL) extended its bullish momentum on Sunday, October 5, rallying sharply alongside broader gains in the crypto market. The token soared to $236, marking its highest level since September 21 and representing a 150% jump from its yearly low.

According to analysts, this Solana breakout is a sign of new confidence among investors as foundations and institutional inflows get stronger.

Analysts cite a combination of solid fundamentals, technical and increasing institutional demand as the primary reasons behind the recent run. According to market indicators, this Solana breakout has the potential to result in a new record high before the year is over.

Stablecoin Expansion Fuels Solana Breakout Momentum

The massive growth in the use of stablecoins on its network is one of the largest drivers of the Solana breakout. According to DeFi Llama data the total supply of stablecoins on Solana has skyrocketed to an all-time high of $15 billion, dramatically increasing compared to a year to date bottom of $5.4 billion.

The most significant of them is USD Coin (USDC), which has assets of $10.76 billion on Solana. Tether (USDT) comes next at $2.45 billion followed by PayPal USD (PYUSD) at $614 million.

This consistent rise of stablecoins highlights the importance of Solana as a leading blockchain to implement DeFi fast and cheap transactions, which further contributes to the ongoing SOL breakout and the underlying long-term viability.

Solana Staking ETF Gains Massive Momentum

Another significant trigger leading to the Solana breakout has been institutional demand, which is reflected by the blistering success of the REX-Osprey SOL + Staking ETF (SSK). The fund was initiated in July and has already garnered more than $404 million assets under management (AUM).

Performance of the SSK ETF suggests that U.S. investors are eager to invest in the staking-based yield opportunities linked to Solana. In comparison, the inflows of Bitcoin and Ethereum ETFs have exceeded $74 billion since their launch last year.

Also read: Solana ETF Approval Now a Sure Thing, Says Bloomberg Analyst

Solana Nears Critical Technical Resistance Zone

Analysts assume that the possible approval of other Solana ETFs by SEC potentially later this month will prolong the current Solana breakout by attracting new institutional capital.

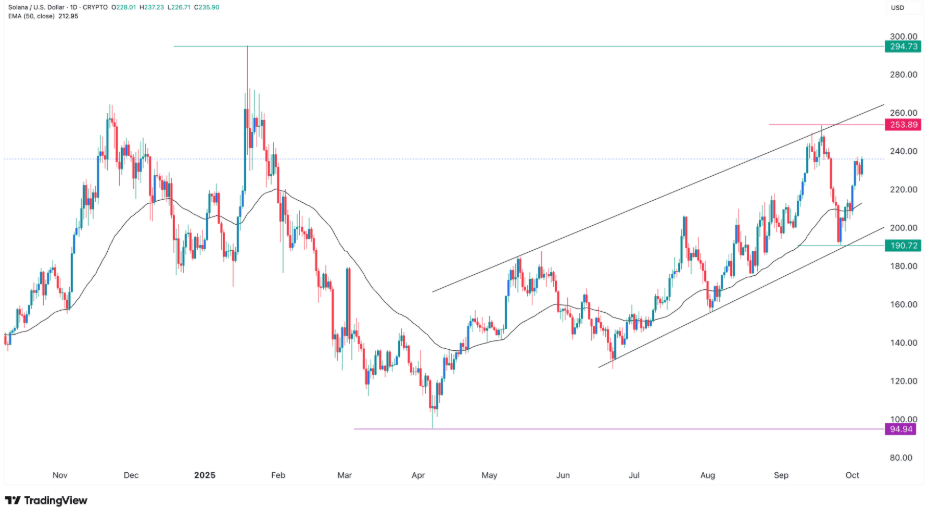

Technically, the Solana breakout came when the token hit a low of $190 on September 26, which corresponded to the bottom side of its upwards price pattern. SOL since has broken past its 50-day and 100-day exponential moving averages (EMAs) a traditional bullish indicator.

At this point, SOL is moving to the higher end of the rising channel towards $253. Analysts observe that a validated SOL breakout of this resistance may provide the way to $295 and may provide a new all-time high.

New Alpenglow Update Enhances Solana Efficiency

Moving forward, the next Alpenglow update, likely to be released in the next few months, will likely bring additional increases to the network scalability and efficiency of Solana. Such a move would provide the ongoing Solana breakout with further momentum, bringing in more developers and investors to the ecosystem.

As stablecoins grow in adoption, ETF flows are increasing faster, and technical indicators are positive, the Solana breakout is one of the most notable uptrends in the 2025 crypto market that puts Solana at the center of the highest performing digital assets.

Also read: Solana Breakout Potential Grows After Key Support Bounce

Conclusion

Based on the latest research, Solana’s continued momentum reflects a powerful mix of rising institutional demand, expanding stablecoin adoption, and strong technical performance. As the upcoming upgrade of Alpenglow is likely to increase its scalability, analysts say that the current Solana breakout can make the token reach new high records, and it will continue to be among the best-performing cryptocurrencies in 2025.

Stay up to date with expert analysis and price predictions by visiting our crypto news platform.

Follow us on Twitter and LinkedIn, and join our Telegram channel to be instantly informed about breaking news!

Summary

Solana extended its strong uptrend on October 5, surging to $236 its highest level since September 21 and 150% above its yearly low. The rally is driven by the record growth of stablecoins on its network, increased inflows in ETFs, and high institutional interest. As the Alpenglow upgrade and optimistic technical action nears, analysts expect Solana to hit a new high record price by the end of the year.

Glossary of Key Terms

Solana (SOL):

High-speed blockchain for DeFi and dApps.

Solana Breakout:

Strong upward surge in Solana’s price trend.

Stablecoin:

Crypto pegged to stable assets like USD.

USD Coin (USDC):

Dollar-backed stablecoin popular on Solana.

Tether (USDT):

Largest USD-pegged stablecoin in crypto.

PayPal USD (PYUSD):

PayPal’s regulated dollar-backed stablecoin.

DeFi:

Blockchain-based finance without intermediaries.

ETF:

Tradable fund tracking crypto asset prices.

Solana Staking ETF (SSK):

Fund offering returns from staked Solana.

Alpenglow Upgrade:

Upcoming Solana update boosting scalability.

Frequently Asked Questions About the Solana Breakout

1. What’s driving the Solana breakout?

Strong ETF inflows, rising stablecoin use, and bullish market sentiment are powering Solana’s recent surge.

2. How do stablecoins affect Solana?

Record stablecoin activity boosts liquidity, fueling DeFi growth and supporting Solana’s breakout momentum.

3. What is the Solana Staking ETF?

The REX-Osprey SSK ETF attracts major inflows, signaling rising institutional interest in Solana.

4. Will the Alpenglow upgrade help Solana?

Yes, it’s expected to improve scalability and efficiency, further supporting the Solana breakout.

Read More: Solana Breakout Strengthens as Stablecoin Supply Hits Record $15B">Solana Breakout Strengthens as Stablecoin Supply Hits Record $15B

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.