Bitcoin Flashes Signs of $100K Retest: Can BTC Price Meet Buying Demand?

0

0

The post Bitcoin Flashes Signs of $100K Retest: Can BTC Price Meet Buying Demand? appeared first on Coinpedia Fintech News

After dropping due to Donald Trump’s tariff plans, which caused an intense market sell-off, Bitcoin is making a strong comeback. It’s now approaching $100,000, its highest level since late February. But fears of a recession could slow down this momentum unless the U.S. and China start talking about tariffs soon. Additionally, the mixed on-chain signals might increase volatility for the $100K level.

Bitcoin’s On-chain Metrics Create Mixed Sentiment

How the tariff talks go could play a big role in whether the economy heads into a recession and in where Bitcoin’s price goes next. Many experts are hoping that trade discussions in May will help calm economic worries. Still, Bitcoin might keep rising even if a recession hits. In the past 24 hours, around $34 million in Bitcoin trades were closed out. Buyers ended $8.5 million in positions, while sellers had to close $25.4 million in bets against Bitcoin.

Also read: Bitcoin Price Prediction 2025, 2026 – 2030: When Will BTC Hit $100k?

Bitcoin is getting close to retesting the $100K mark as investor confidence grows. In the last two weeks of April, large investors bought around $4 billion worth of Bitcoin. At the same time, spot Bitcoin and Ethereum ETFs saw strong inflows, with over $3.2 billion entering the market last week. BlackRock’s Bitcoin ETF alone brought in nearly $1.5 billion, its biggest weekly gain this year.

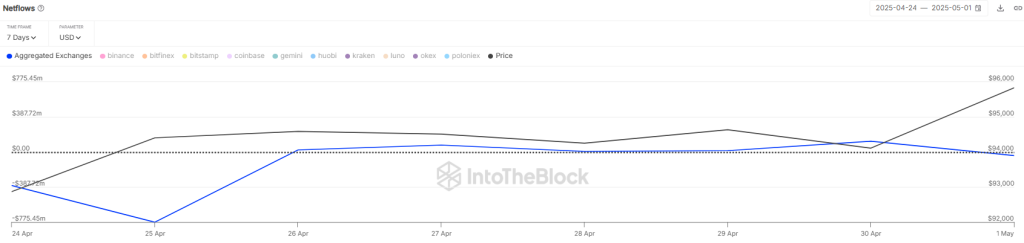

Additionally, Bitcoin’s netflow is currently negative by $39.79 million, meaning more Bitcoin is being moved out of exchanges than into them. This suggests that more investors are choosing to store their Bitcoin in private wallets instead of keeping it on exchanges. It’s a sign that people are holding onto their coins, which can reduce selling pressure and support Bitcoin’s recovery.

However, Bitcoin risks a “notable increase” in selling pressure around $100K. Glassnode warns that if Bitcoin’s price keeps rising, long-term holders might start selling. Their profits are now close to 350%, a level where they’ve typically sold in the past. If Bitcoin crosses $100K, it could trigger a wave of selling from these older investors.

What’s Next for BTC Price?

Buyers are breaking through Fib levels and they continue to hold the price above EMA trend lines. Bears are now defending any further surges above $98K as BTC faced a rejection recently. As of writing, BTC price trades at $97,182, surging over 0.7% in the last 24 hours.

The rising 20-day moving average at $96,892 and a strong RSI suggest Bitcoin still has room to move higher. If it breaks above $99,500, the price could quickly jump to the key $100,000 level. Sellers will likely put up a strong fight there, but if buyers succeed, Bitcoin might climb to around $103,000.

Also read: Top 8 Bitcoin Price Predictions for 2025 from Institutions You Can’t Miss

On the flip side, sellers may try to drag the price back to the 20-day moving average, which is an important support level. If Bitcoin bounces there, the uptrend stays strong. But if it drops below, it could fall further toward the 50-day average at $92.8K.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.