XRP Surges Past $2 as ‘Tokenisation’ Set to Hit $18.9T by 2033: Reports

0

0

The post XRP Surges Past $2 as ‘Tokenisation’ Set to Hit $18.9T by 2033: Reports appeared first on Coinpedia Fintech News

A new report from Ripple and Boston Consulting Group (BCG) is making waves in the financial world, and it’s got some bold predictions. Titled “Approaching the Tokenisation Tipping Point,” the report forecasts that the tokenisation of real-world assets could explode into an $18.9 trillion market by 2033. That’s a massive shift, and it’s already having an impact on XRP, which has just crossed the crucial $2 mark.

But here’s the burning question—could $2.25 be the next milestone?

Stick with us as we break down the key insights from this report and explore what’s driving XRP’s rise.

Ripple and BCG Predict Explosive Tokenisation Growth

The Ripple-BCG report predicts that the tokenisation of real-world assets will grow from $0.6 trillion in 2025 to $18.9 trillion by 2033.

The report asserts that tokenisation will revamp the entire financial system of the world. It explains how it will work miracles in the areas of fractional ownership, instant transfer and regulatory compliance.

The report also highlights XRP’s potential to become a major player in this new tokenised financial environment. As one of the top cryptocurrencies by market value, XRP is already showing strong market performance. Over the past year, XRP has risen by an impressive 238.2%.

XRP Price Analysis

At the beginning of 2025, XRP was trading at $2.08. On January 16, it reached an all-time high of $3.399. Between January 1 and 17, the price grew by about 57.94%. However, since January 18, XRP has been in decline, falling by around 37.36%.

The market has been moving within a descending trendline since mid-January, holding back further upward movement.

April Volatility: Highs, Lows, and Rebounds

On April 1, XRP was priced near $2.09. It jumped to $2.2322 on April 2 but dropped by the end of the day to $2.0229. Between April 3 and 5, it managed a 5.92% rebound, but this was followed by a 16.16% correction from April 6 to 8.

There was strong buying pressure on April 9, but it wasn’t enough to recover fully from the earlier dip.

Currently, XRP stands at $2.06, holding just above the important $2 support level. Over the past 24 hours, the price has climbed 1.7%.

So, Is Momentum Building?

XRP’s Relative Strength Index (RSI) on the daily chart has risen to 46.12, after hitting a low of 32.12 on April 8. This suggests that buying interest is growing and momentum may be shifting in favor of the bulls.

The 200-day Exponential Moving Average (EMA), currently at $1.9506, is acting as a strong support level. Still, for a lasting upward trend to begin, XRP needs to break above the descending trendline that has capped its rallies since January.

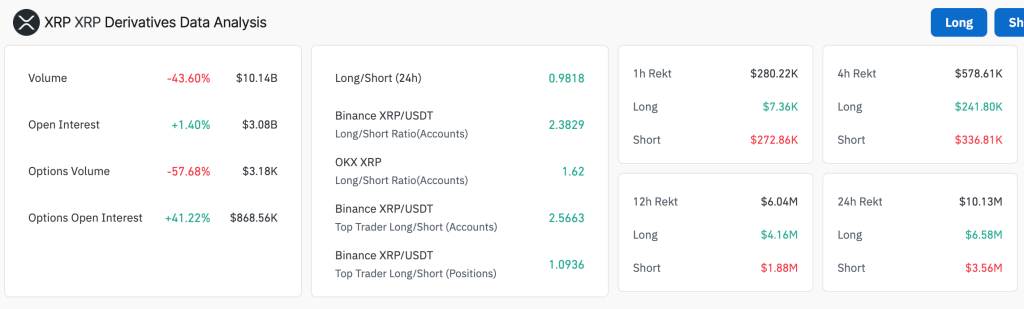

XRP Liquidation and Derivatives Data Analysis

Market data shows that short liquidations, worth $336,810, are significantly higher than long liquidations at $241,800. This indicates that traders betting against XRP are being forced out of their positions.

At the same time, open interest in XRP derivatives has increased by 1.4% to $3.08 billion, suggesting that more capital is entering the market.

Crypto-Friendly Policies Under Trump

Since Donald Trump began his second term as President of the United States, the political climate has become more favorable for crypto. His administration has taken several steps to support the industry:

- A dedicated crypto task force has been set up to create a clear regulatory framework

- New laws have been introduced to block the IRS from collecting certain crypto-related tax data

- The long-running legal battle between the SEC and Ripple has finally been resolved

The Trump administration has also placed pro-crypto leaders in important roles, many of whom are directly or indirectly connected to the cryptocurrency sector.

Global Risks Remain Despite Local Optimism

Even with strong domestic support, the crypto market isn’t immune to global economic challenges. Trump’s aggressive tariff strategy has caused disruptions across asset markets, including crypto.

While the administration recently paused the full rollout of these tariffs for 90 days, tensions with China have increased. New, tougher tariffs have been imposed on Chinese imports, and the long-term effects of this trade conflict remain uncertain.

What’s Next: Can XRP Break Through?

In summary, XRP’s push toward $2.25 depends on whether it can break above the descending trendline that has limited its recent gains. A strong daily close above this resistance level, along with support from the rising RSI and the 200-day EMA, could mark the beginning of a sustained uptrend.

However, traders should remain cautious. Macroeconomic uncertainty and technical resistance near past highs could still pose short-term challenges.

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.