UMA token outlook dims as whale manipulates Trump-Ukraine vote on Polymarket

0

0

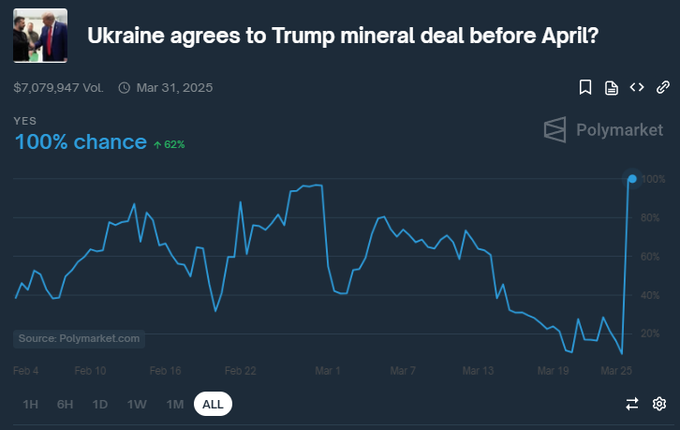

Decentralized prediction platform Polymarket is under fire amid market manipulation involving a $7M bet.

Users forecasted whether Ukraine would sign a mineral deal with the United States before April.

Meanwhile, the chances of “Yes” results soared intensely to 100% between 24 March and 25.

The remarkable jump happened despite zero validation of the agreement.

Details show a large UMA holder used 5 million tokens (around 25% of the overall voting power) to influence the voting outcome across several accounts.

Meanwhile, the manipulation forced “Yes” results, with the UMA whale netting substantial profits.

Polymarket confirmed that the whale rigged the results but maintained it would not refund victims since “it was not a platform failure.”

Polymarket’s no-refund rule

Polymarket’s no-refund policy has sparked debates, with many criticizing the betting platform.

Users anticipated refunds as the losses involved market manipulation.

Nevertheless, Polymarket states that governance mechanisms, which functioned as designed, impacted the outcome, not technical glitches.

We are aware of the situation regarding the Ukraine Rare Earth Market. This market resolved against the expectations of our users and our clarification. Unfortunately, because this wasn’t a market failure, we are not able to issue refunds.

One user believes the incident is beyond a governance issue as it revealed an oracle integrity catastrophe.

The manipulative move raised debate about UMA governance as whales can determine voting results.

The event could prompt UMA and other blockchain ecosystems to revise their governance models to prevent such exploits.

Abed trusts quadratic voting would resolve the governance issues.

He slammed token-based voting as whales control decisions, leading to plutocracy.

Quadratic voting involves distributing voting powers evenly by making extra votes more expensive.

Such an approach would prevent wealthy players from influencing outcomes.

Some believe Polymarket should introduce safety mechanisms such as strict verifications for high-stakes betting and one-user-one-vote.

However, these incidents reveal obstacles associated with balancing transparency and decentralization.

The Polymarket result manipulation reflects the need for enhanced governance protocols that prevent user exploitation while maintaining DeFi’s core principles.

UMA price outlook

The altcoin maintained uptrends amidst Polymarket’s controversy.

It gained over 3% in the past 24 hours to trade at $1.42.

UMA’s prevailing performance mirrors the prevailing broad market revivals.

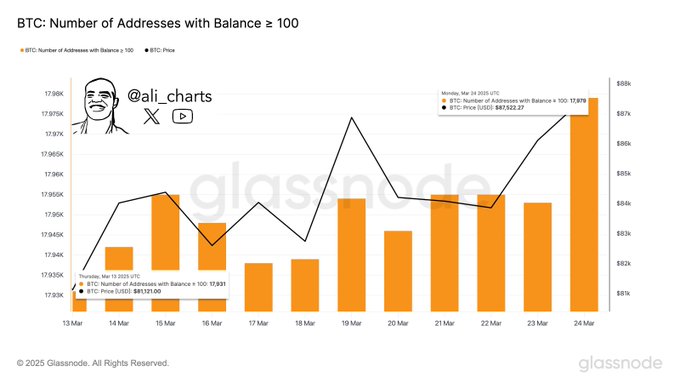

Bitcoin trades at $88K as it closes in on the crucial obstacle at $90,000.

The renewed interest from new large-scale investors signals trust in BTC’s continued surges.

Analyst Ali Chart (quoting Santiment’s data) observed that 48 new wallets hold over 100 Bitcoin assets.

Significant accumulation by whale entities hints at bullish moves in Bitcoin’s near-term price actions.

Broad-based rallies will likely absorb UMA’s anticipated volatility and support steady uptrends.

The post UMA token outlook dims as whale manipulates Trump-Ukraine vote on Polymarket appeared first on Invezz

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.