Galaxy Digital’s Crypto Startups Fund Raises $113 Million, Aims to Back Up to 30 Projects

0

0

Bloomberg recently reported that Michael Novogratz’s Galaxy Asset Management unit has raised $113 million for a new venture fund targeting early-stage crypto startups.

The fund, named Galaxy Ventures Fund I LP, plans to build a portfolio in crypto software, infrastructure, and financial applications.

Galaxy Unveils $113 Million Crypto Fund Amid Venture Capitals Renewed Interest

BeInCrypto reported that the firm introduced Galaxy Ventures Fund I LP in April. The fund has already allocated money to startups like Ethena, Monad, and Plume. Galaxy Digital Holdings plans to build a portfolio of 30 investments and raise $150 million by next year.

Galaxy Digital Holdings has invested between $30 million and $50 million annually into various crypto ventures. Last year, Galaxy moved its investment group into the asset management division and launched Galaxy Ventures Fund I to attract outside investors.

Read more: How To Fund Innovation: A Guide to Web3 Grants

General Partner Mike Giampapa stated that the firm is betting on a long-term transition where blockchains handle most transactions. The fund plans to invest between $3 million and $5 million per project, although these amounts may vary.

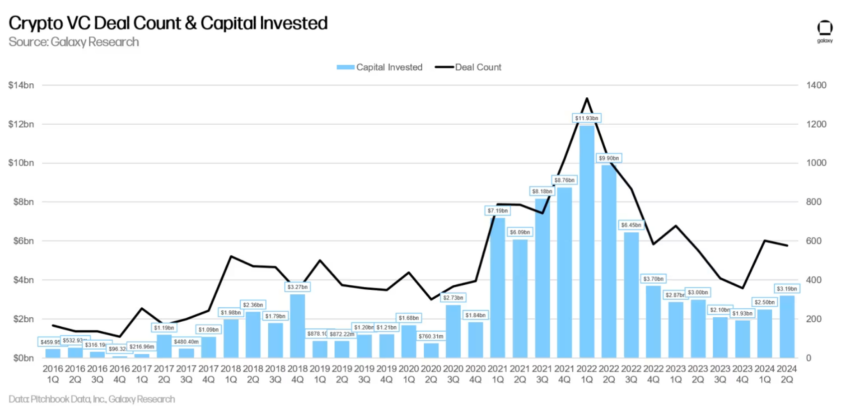

This initiative reflects a broader trend of increased venture capital investments in the crypto sector. According to a June report from Galaxy Digital Research, in Q2 2024, venture capitalists invested $3.19 billion into crypto and blockchain-focused companies. This marks a 28% increase quarter-over-quarter despite a slight decrease in deals.

Read more: Crypto Hedge Funds: What Are They and How Do They Work?

Crypto VC Deal Count and Capital Investment. Source: Galaxy Digital

Crypto VC Deal Count and Capital Investment. Source: Galaxy Digital

This surge in investment is driven by crypto-native catalysts, such as Bitcoin exchange-traded funds (ETFs) and emerging technologies like restaking and Bitcoin Layer 2 solutions. Pressures from startup bankruptcies, regulatory challenges, and macroeconomic factors also shape the crypto industry.

“Allocators may be preparing to return in earnest due to the resurgence of liquid crypto, potentially leading to increased venture capital activity in the latter half of the year,” the report reads.

0

0