3 US Crypto Stocks to Watch Today

0

0

Crypto US stocks are back in focus today as Coinbase (COIN), Core Scientific (CORZ), and MARA Holdings (MARA) all trade higher ahead of key earnings events.

COIN is gaining in pre-market action following a strong Q4 and anticipation of a bullish Q1 print. CORZ just posted mixed Q1 results—revenue fell sharply, but net income surged on non-cash gains. Meanwhile, MARA is set to report later today, with investors watching closely to see if it can reclaim the $15 level for the first time since March.

Coinbase (COIN)

Coinbase (COIN) stock closed slightly lower by 0.17% in yesterday’s session but is showing strength in the pre-market today, up 4.19%.

The move comes ahead of the company’s highly anticipated earnings call later today, following a strong Q4 performance where Coinbase posted $2.3 billion in revenue and $1.3 billion in net income—triggering a 10% surge after the announcement.

The company also highlighted international expansion into Argentina and India and took a bold political stance by supporting the Trump administration and pledging to shape U.S. crypto regulation.

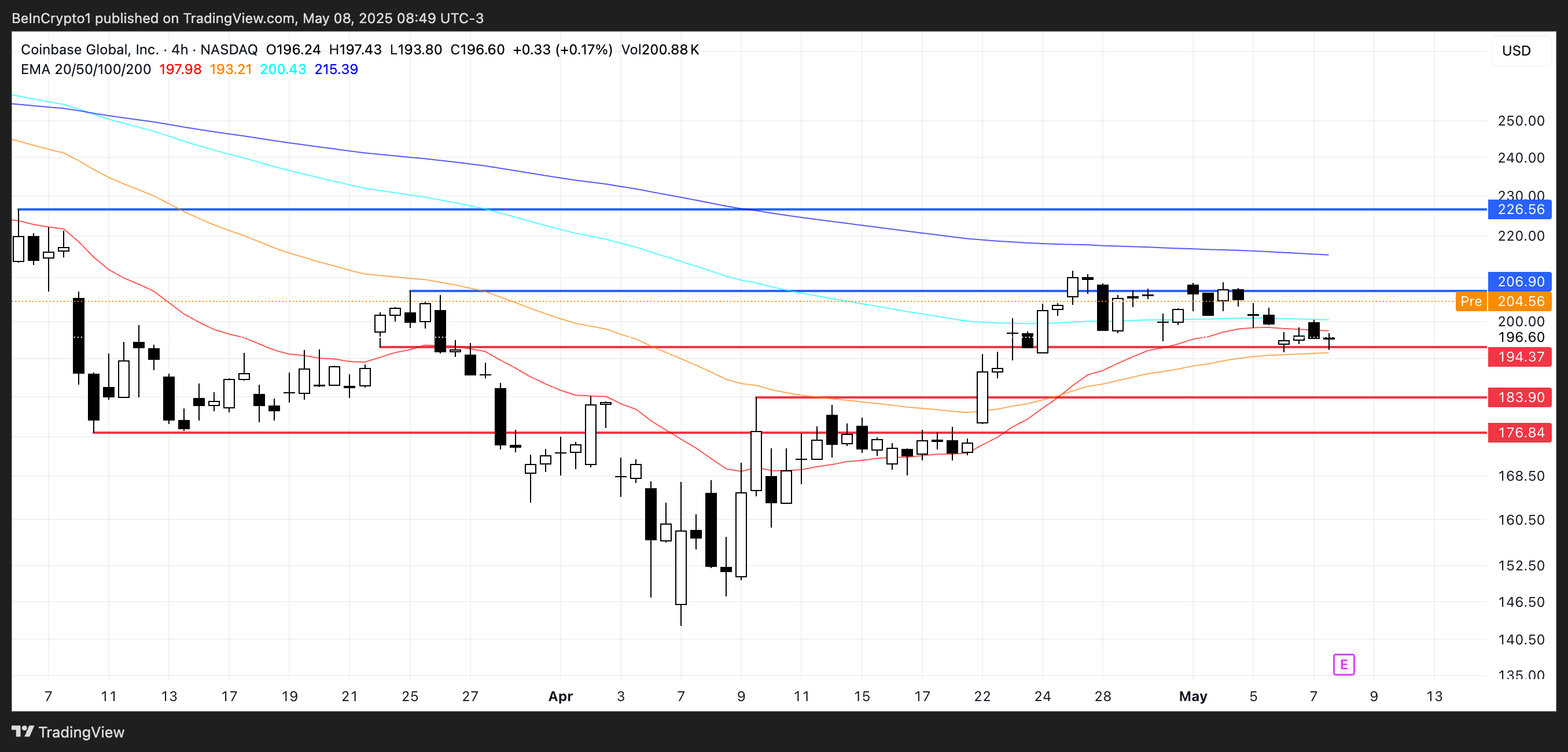

COIN Price Analysis. Source: TradingView.

COIN Price Analysis. Source: TradingView.

Alex Rudolph, Market Analyst at IG, says analysts expect Coinbase to post 30% year-over-year revenue growth in Q1 2025, reaching $2.14 billion. This is mainly driven by rising crypto prices and stronger trading volumes.

The big question is whether Coinbase can keep the momentum while growing revenue beyond trading. Transaction revenue remains key, totaling $1.077 billion in both Q1 and Q4 2024. For Q1 2025, analysts expect it to rise to $1.357 billion—a 26% increase from the previous quarter.

Still, the stock hasn’t broken above the $206.9 resistance level. If support at $194 fails, downside targets are $183 and $176. A strong earnings call today could spark a breakout, especially if revenue or guidance exceeds expectations.

Core Scientific (CORZ)

Core Scientific (CORZ) closed yesterday down 1% but is bouncing back in pre-market trading with a 5.06% gain.

The company released its Q1 2025 results, reporting a 55.7% revenue drop to $79.5 million, largely due to reduced Bitcoin mining output following the April 2024 halving.

Despite the decline, net income surged 175.6%, boosted by a $621.5 million non-cash adjustment and lower interest expenses. The company is shifting focus toward high-density colocation, particularly through its CoreWeave partnership, aiming for $360 million in annualized revenue by 2026.

CORZ Price Analysis. Source: TradingView.

CORZ Price Analysis. Source: TradingView.

Operationally, the picture remains mixed—Core reported a $42.6 million operating loss and a negative adjusted EBITDA of $6.1 million.

Still, optimism remains with $778.6 million in liquidity and a long-term strategy focused on high-performance computing infrastructure. Technically, CORZ is testing key levels: a strong earnings print could push the stock toward $9.45, with a breakout above $10 possible if momentum continues.

On the other hand, the $8.49 support remains critical—if that level fails, downside risks point to $7.99 and $7.50.

MARA Holdings (MARA)

MARA Holdings is showing strength ahead of its earnings call today. It closed up 1.37% yesterday and gained 4.20% in pre-market trading.

If momentum continues, MARA could challenge the $14.68 resistance level—breaking above it would pave the way for a move to $16.24, its highest price since early March.

MARA Price Analysis. Source: TradingView.

MARA Price Analysis. Source: TradingView.

If today’s results disappoint, MARA could fall back to test support at $12.06. A deeper drop might push the stock down to $9.82.

Simply Wall Street reports the average analyst price target was cut by 10% on May 5, now sitting at $19.46—still about 46% above yesterday’s $13.33 close.

MARA is expected to post a net loss of $0.68 per share, compared to earnings of $1.87 per share a year ago.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.