Why These Altcoins Are Trending Today — March 10

1

0

The cryptocurrency market has resumed its decline today, with bearish momentum weighing on several assets. Amid the broader downturn, some altcoins are attracting attention from traders.

Among the top trending tokens are SuperRare (RARE), Sonic (S) (formerly FTM), and Ondo (ONDO).

SuperRare (RARE)

RARE, the governance token of the on-chain art marketplace SuperRare, is one of today’s trending altcoins. It currently trades at $0.096, surging 88% over the past 24 hours.

A soaring trading volume has accompanied RARE’s double-digit gains. This has totaled $521.75 million in the past day, climbing by almost 2000%.

When a surge in trading volume accompanies an asset’s price rally, it indicates strong market participation and conviction behind the price movement.

RARE’s high trading volume signals increased buying pressure, reducing the likelihood of a quick reversal due to weak buying pressure. If demand strengthens further, RARE’s price could breach resistance at $0.109 to reach $0.142.

RARE Price Analysis. Source: TradingView

RARE Price Analysis. Source: TradingView

Conversely, if buying pressure dips, the token’s price could lose recent gains and plunge to $0.074.

Sonic (prev. FTM) (S)

S is another altcoin that has attracted traders’ attention. Unlike RARE, S is down 1.3% in the past day, mirroring the broader market dip. Trading at $0.45 at press time, S is down 34% in the past seven days.

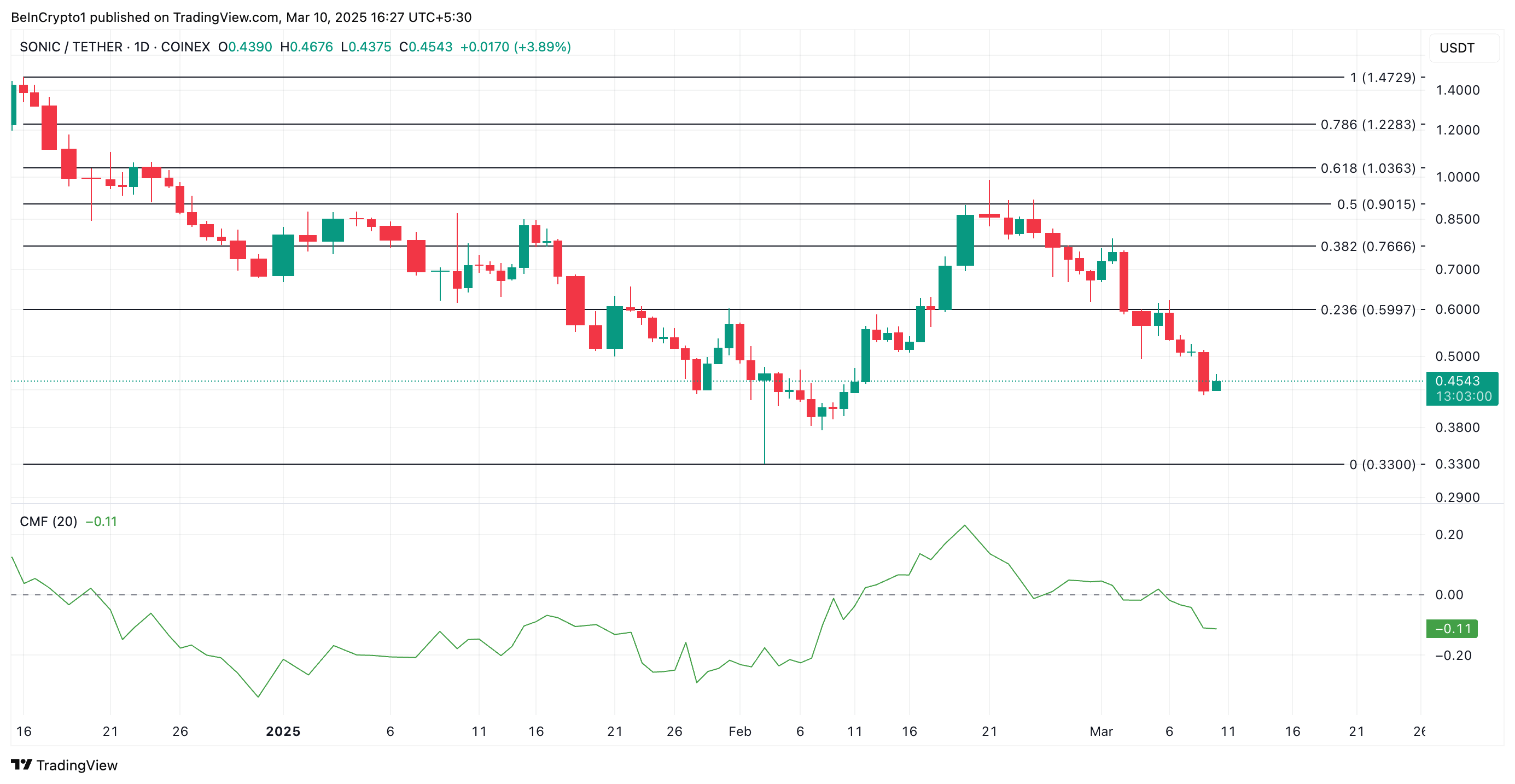

On the daily chart, S’ negative Chaikin Money Flow (CMF) reflects the weakening demand for the altcoin. It is currently in a downward trend at –0.11.

An asset’s CMF measures its buying and selling pressure by analyzing price and volume over a specific period. When its value dips below zero, it signals increasing selling pressure. This suggests that S could face further declines if buyers remain elusive.

S could drop to its year-to-date low of $0.33 in this scenario.

S Price Analysis. Source: TradingView

S Price Analysis. Source: TradingView

On the other hand, if the bulls regain dominance, they could trigger a rally to $0.59.

Ondo (ONDO)

ONDO has extended its price decline by another day, falling 5% in the past 24 hours. As of this writing, the RWA-based altcoin trades at $0.87.

On the daily chart, ONDO’s Relative Strength Index (RSI) is 37.56. This indicator measures an asset’s overbought and oversold market conditions. It ranges between 0 and 100, with values above 70 indicating that the asset is overbought and could witness a correction. Converesly, values below 30 indicate oversold conditions and hint at a potential rebound.

At 37.56, ONDO’s RSI indicates that the asset is in a weak momentum phase but not yet in oversold territory. This means there is room for more price decline in the near term. If this happens, ONDO could fall to $0.70.

ONDO Price Analysis. Source: TradingView

ONDO Price Analysis. Source: TradingView

However, if demand spikes, ONDO’s value could rally toward $1.

1

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.