Record Bitcoin Whale Wallets Growth: Is BTC’s Next Rally Around the Corner?

0

0

Bitcoin price remains in the lights with wallets with 100 to 1,000 BTC cashing in record high. It means that Bitcoin is being accumulated aggressively by big investors, a group more commonly referred to as whales.

As millions of dollars’ worth of BTC are stored in Bitcoin wallets, experts are awaiting a rise in the price in the future with enthusiasm. The growth in the activity of whales is feeding on the markets.

Surge in Bitcoin Whale Wallets

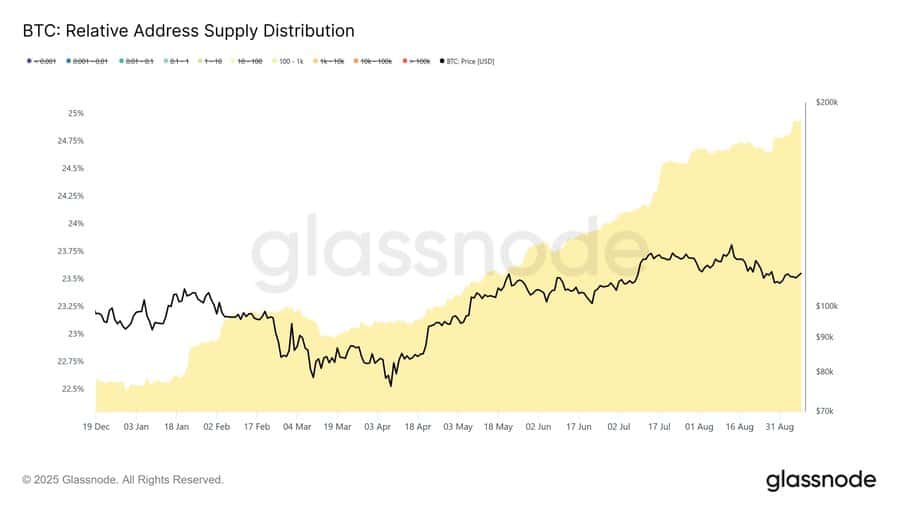

The amount of Bitcoins in wallets that hold between 100 and 1,000 BTC has hit an all-time high. Such a rise in wallet piping implies that institutional investors and early adopters continue to increase their hold in Bitcoin by a significant margin. Such an action is an indication of renewed belief in the long-term value of Bitcoin.

Whale activity is very important in influencing the price action of Bitcoin. To a large extent historically, the announcement of large remaining institutions who are buying in large numbers usually indicates that the market is bullish.

Also Read: Bitcoin Price at Risk? Over 3 Million Coins May Be Lost Forever

The booth in whale wallets shows that such big investors are expecting the prices of Bitcoin to increase. This has a possibility of adding more Bitcoin, whereby the price is likely to increase in coming months.

Future Bitcoin Price Outlook

Bitcoin could not respond immediately but the growth of the number of whale wallets is a good indicator of confidence. The supply of Bitcoin falls in most cases due to a decrease in the selling pressure which is occasioned by the behavior of these whales. Consequently, a supply-demand imbalance may potentially drive the price of Bitcoin upwards in the future provided the demand keeps going up.

Consolidation Before Major Moves

The growth in the volume of whale wallet activity coincides with an extended period of consolidation of the market. Large investors tend to buy a lot more Bitcoin at low-volatility periods.

| Month | Minimum Price | Average Price | Maximum Price | Potential ROI |

|---|---|---|---|---|

| September | $113,006.50 | $119,593.49 | $126,180.47 |

12.7%

|

| October | $114,173.11 | $118,616.05 | $123,058.98 |

9.9%

|

| November | $114,743.94 | $118,369.02 | $121,994.10 |

9%

|

| December | $109,155.42 | $113,414.54 | $117,673.66 |

5.1%

|

It is a trend that has generally occurred prior to significant price changes in the Bitcoins market. Current accumulation patterns have typically led up to bullish runs, and might imply that the present-day period may be preluding a price boom.

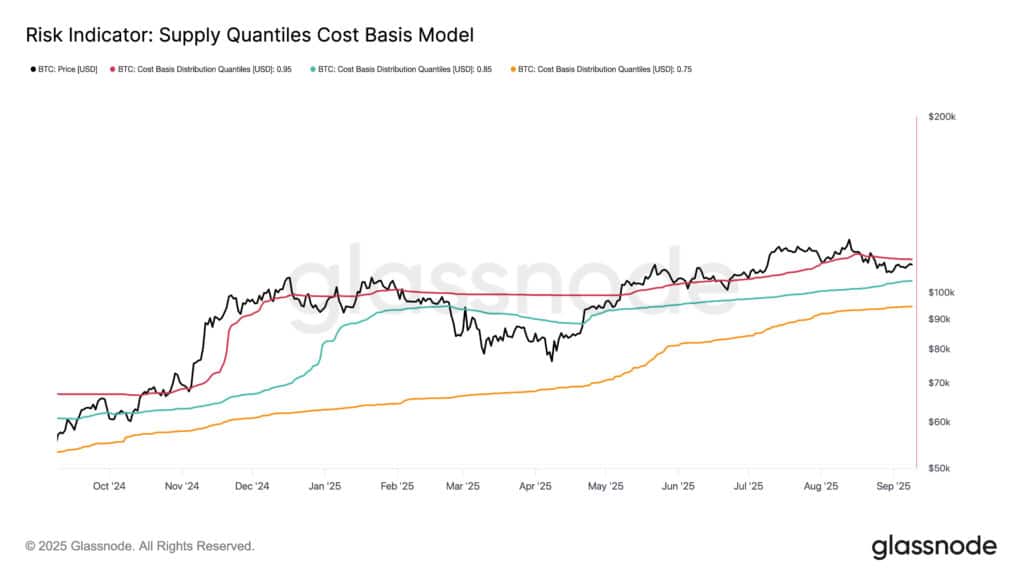

The price of Bitcoin has demonstrated a fluctuating price of between 108k and 113k. Bitcoin has been hard pressed to reclaim their former all-time high since the middle of August. Such fall in value has cast doubt as to whether the cryptocurrency is in a bear market.

The areas of concern among the analysts are the key areas of assistance. In case Bitcoin plunges to lower than 104.1k, it may indicate down turn further. Nonetheless, the breakoutabove 114.3k would denote fresh buyer interest and a possible jump.

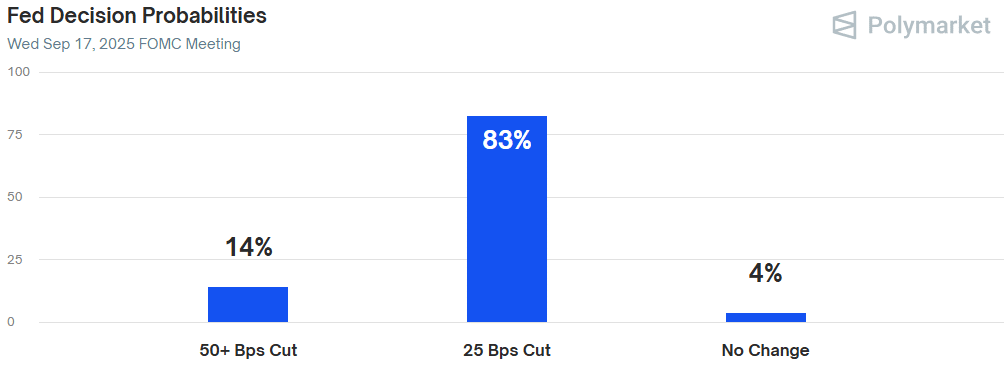

Prediction Markets and Bitcoin Price Trends

Prediction markets are also adding to the uncertainty surrounding Bitcoin price in the short term. Polymarket bettors are assigning an 83% chance of a 25-basis-point cut on September 17, with slim chances for a deeper move or no change.

Beyond that, October expectations are fragmented, with nearly even probabilities for another cut or a pause. This divergence in predictions explains why volatility, although absent now, is unlikely to stay that way. These external market conditions could influence Bitcoin price, further adding to the ongoing uncertainty.

Long-Term Market Outlook

Even with the fluctuation that has been experienced over the recent past, the growth of whale wallets is an indication of great faith in the long-term prospects of Bitcoin. Bitcoin has investors who think that its value will rise in future.

The bitcoin hoarding of whales supports the thought that the underlying of Bitcoin is sound. Consolidation is possibly carried out to an estimated degree in the present time and investors are poised towards earning in the future.

The acting of whales is not the sole contributor to the price of Bitcoin. Market sentiment is also provided by other indicators like the flow of ETF along with the building up of mineral.

These trends show that the general market predicts positively of Bitcoin in the future. These factors have been evolving and may present the ideal opportunity whereby, Bitcoin gets the right break to come out of the range it is in.

Whale Wallets and Price Trends

The move by these big holders to accumulate more implies that they anticipate that Bitcoin will be able to gain value.

This is a common action that precedes huge price advances. It is hoped that, with this current surge in the number of whale wallets that Bitcoin will be able to overcome its price resistance and extend on its ascent moving forward.

Conclusion

The history of a massive rise in the number of Bitcoin whale wallets symbolizes the future belief in price changes of this cryptocurrency. The greater the Bitcoin in wallets (that is, with lower transactions), the less the selling pressure it has on a market.

A persistent increase in demand would mean that Bitcoin will gain a lot of value. Despite its volatile price, the fact that the amount of active whales increases is a significant sign that the momentum towards the future has a positive trend.

Also Read: Bitcoin Price Eyes $115K as Global Bond Yields Hit Multi-Year Highs

Summary

The new rise in Bitcoin wallets with the 100-1,000 BTC is an indication of increasing trust of the long-term value of Bitcoin, with large sums being gathered by institutional traders and whales.

This activity implies a positive uphill pattern of the market, put the pressure in selling diminishes, and even move the price of a Bitcoin to the upside. The price volatility stays at the moment, but the sale of whale wallets provides forecast of gaining profits in the future.

Appendix: Glossary of Key Terms

Whale: Large investors who hold significant amounts of Bitcoin.

Bitcoin Price: The current market value of one Bitcoin.

Wallet: A digital storage space for cryptocurrencies.

Market Consolidation: A phase where Bitcoin price stabilizes within a narrow range.

ETF: Exchange-Traded Fund, often tied to Bitcoin investments.

Quantile: A statistical measure used to gauge Bitcoin price profitability range.

Bullish Trend: Market movement that predicts rising prices.

FAQs for Bitcoin price

1- What does the surge in whale wallets mean for Bitcoin price?

The surge indicates growing confidence among large investors, often signaling potential price increases.

2- Who are the main holders in Bitcoin whale wallets?

Institutional investors, early adopters, and crypto-native funds typically hold significant Bitcoin amounts.

3- How does whale activity affect Bitcoin price?

Whale activity often leads to reduced selling pressure and could push Bitcoin price higher if demand continues to rise.

4- What is the significance of Bitcoin recent price range?

Bitcoin’s price remains volatile, with key support levels determining whether it will rebound or continue downward

Read More: Record Bitcoin Whale Wallets Growth: Is BTC’s Next Rally Around the Corner?">Record Bitcoin Whale Wallets Growth: Is BTC’s Next Rally Around the Corner?

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.