Ethena and Sui Launch Synthetic Dollar suiUSDe

0

0

This article was first published on The Bit Journal.

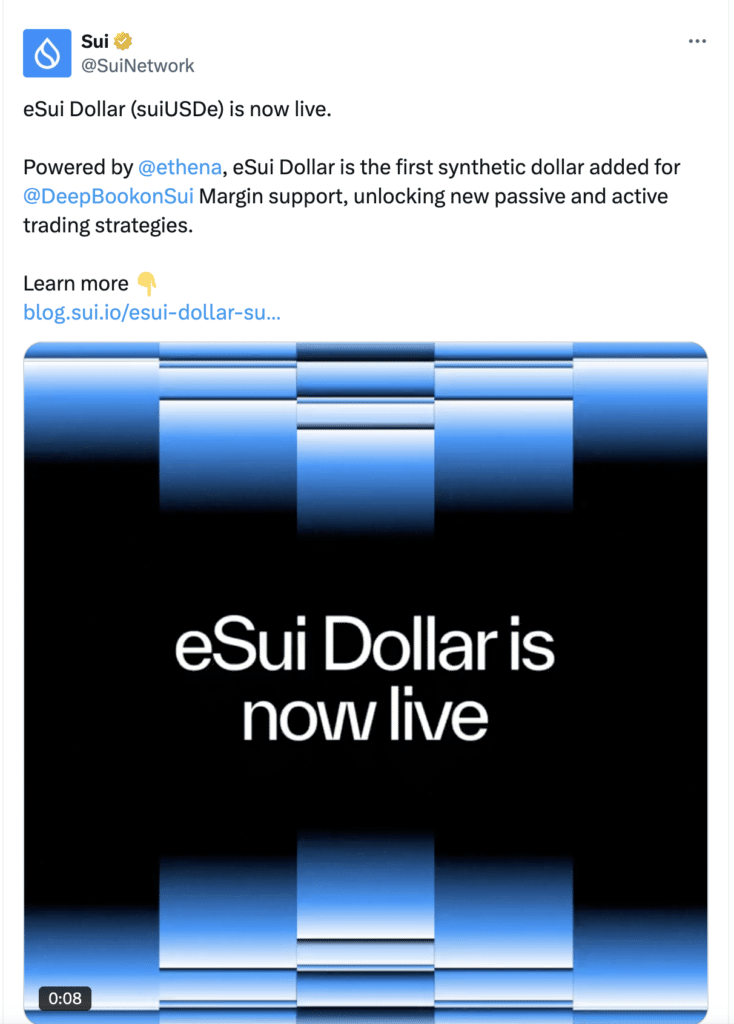

The Ethena-backed suiUSDe launch on Sui mainnet in 2026 has quickly become one of the most talked-about developments in decentralized finance. As stablecoins continue to dominate on-chain trading, lending, and yield farming, this Sui synthetic dollar stablecoin represents a bold step toward financial efficiency. The Ethena-backed suiUSDe launch on Sui mainnet combines advanced blockchain infrastructure with innovative risk management.

Many analysts now view this milestone as a defining moment for the Sui blockchain DeFi expansion. With rising institutional interest and strong ecosystem backing, this Sui mainnet stablecoin update signals a shift toward more scalable and transparent digital finance solutions.

Understanding the Ethena-Backed suiUSDe Launch on Sui Mainnet

The Ethena-backed suiUSDe launch on Sui mainnet introduced a synthetic dollar asset built directly into the Sui ecosystem. Unlike traditional stablecoins backed by cash reserves, this model relies on crypto-collateral and hedging strategies. This approach mirrors the broader Ethena USDe on Sui blockchain framework, which aims to reduce counterparty risk.

The Ethena-backed suiUSDe launch on Sui mainnet also benefits from Sui’s high-speed architecture. Faster transactions, lower fees, and native integration make it attractive for traders and developers. For many observers, this represents a serious attempt to redefine how digital dollars function in decentralized environments.

What Is suiUSDe on Sui Blockchain and Why It Matters

What is suiUSDe on Sui blockchain? At its core, suiUSDe is a synthetic dollar designed for stability and liquidity. The Ethena-backed stablecoin Sui operates through derivatives-based hedging and decentralized custody. This structure aims to maintain its dollar peg even during volatile market conditions.

The Ethena-backed suiUSDe launch on Sui mainnet positions this asset as a central pillar for lending, trading, and yield protocols. In practical terms, it allows users to hold a dollar-equivalent asset without relying on centralized banking systems. This independence is what makes the Sui ecosystem stablecoin model especially appealing to DeFi-native participants.

How suiUSDe Works on Sui Network

How suiUSDe works on Sui network revolves around automated risk management and transparent collateral systems. The Ethena-backed suiUSDe launch on Sui mainnet integrates smart contracts that manage hedging positions and liquidity pools. These contracts balance exposure across multiple markets, aiming to protect the stablecoin’s peg.

The system constantly adjusts positions based on price movements and funding rates. This dynamic structure separates it from older stablecoins that rely solely on fiat reserves. For DeFi developers, this creates new building blocks for financial products. The result is a stable yet flexible asset tailored for modern blockchain finance.

Comparing suiUSDe With Traditional Stablecoins

A major talking point in Sui DeFi stablecoin news is how suiUSDe compares to established players like USDT and USDC. Traditional stablecoins depend heavily on centralized custodians and banking relationships. By contrast, the Ethena-backed suiUSDe launch on Sui mainnet emphasizes on-chain transparency and automated controls.

The suiUSDe vs USDe Ethena comparison shows that Sui’s version benefits from native network integration. Lower latency and reduced bridging risks improve capital efficiency. While centralized stablecoins still dominate volume, the Ethena-backed stablecoin Sui model appeals to users seeking decentralized alternatives with fewer intermediaries.

Institutional Backing and the Ethena Labs Sui Partnership

The Ethena Labs Sui partnership plays a crucial role in reinforcing credibility. Institutional involvement signals long-term commitment and technical reliability. The Ethena-backed suiUSDe launch on Sui mainnet is supported by infrastructure providers, liquidity partners, and ecosystem funds.

This backing helps stabilize early adoption phases and supports the development of advanced tools. Market observers often compare this strategy to early Ethereum DeFi bootstrapping efforts. Strong partnerships reduce execution risks and encourage enterprise-grade participation. In an industry where trust remains fragile, institutional alignment strengthens confidence in this Sui mainnet stablecoin update.

Yield Opportunities and the suiUSDe Yield Vault

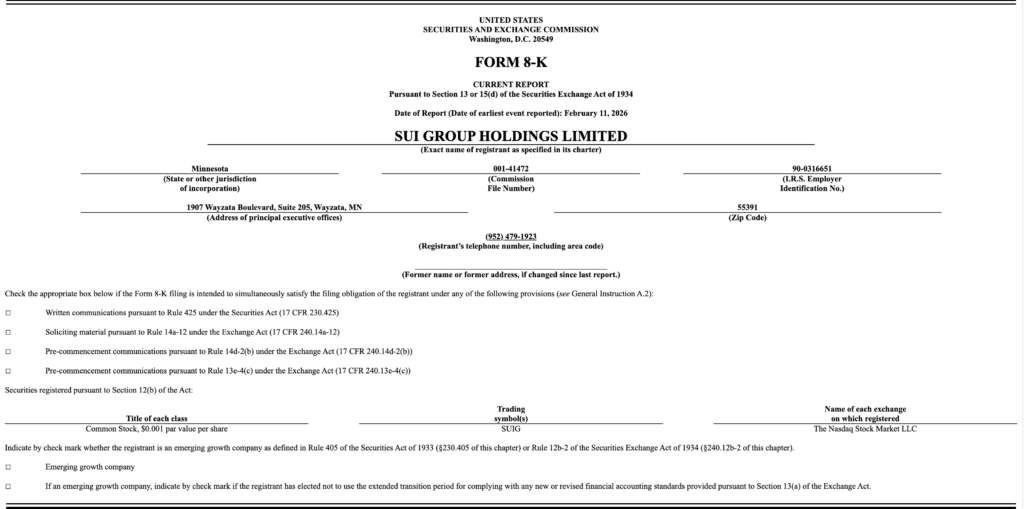

Ethena-backed suiUSDe launch on Sui mainnet brings more than just a new stablecoin; it introduces real, structured yield opportunities through the suiUSDe yield vault. Seeded with $10 million by SUI Group Holdings and managed via Ember Protocol, the vault enables users to earn returns through staking, liquidity provision, and derivatives strategies. Institutional confidence is reinforced by an official SEC 8‑K filing, which confirms the vault deployment, operational framework, and launch details.

This combination of transparency, legal verification, and predictable returns makes the suiUSDe yield vault highly appealing to both retail and institutional participants. Investors can now engage with confidence, knowing the protocol offers institutional-grade oversight while expanding Sui DeFi opportunities.

Market Impact and Sui Blockchain DeFi Expansion

The Ethena-backed suiUSDe launch on Sui mainnet has accelerated overall Sui blockchain DeFi expansion. Increased liquidity attracts developers, which leads to more applications and deeper markets. This virtuous cycle strengthens network effects. Lending platforms, decentralized exchanges, and derivatives protocols now integrate suiUSDe as a base asset.

The Sui ecosystem stablecoin serves as a pricing benchmark for on-chain activity. As adoption grows, transaction volumes and total value locked continue rising. This momentum positions Sui as a serious competitor to established DeFi networks in 2026.

Risk Factors and Investor Safety Considerations

Is suiUSDe safe for DeFi investors? This remains a critical question. While the Ethena-backed suiUSDe launch on Sui mainnet emphasizes transparency, synthetic assets inherently carry market and execution risks. Sudden volatility, liquidity shortages, or smart contract vulnerabilities could affect stability.

Risk management systems aim to mitigate these threats, but no protocol is immune. Investors should evaluate collateral structures, audit reports, and governance models. Responsible participation requires understanding how suiUSDe works on Sui network and monitoring real-time performance metrics. Informed decision-making remains essential.

Regulatory Context and Global Adoption

Regulation continues shaping stablecoin adoption worldwide. The Ethena-backed suiUSDe launch on Sui mainnet occurs amid evolving compliance frameworks in the United States and abroad. Synthetic dollars occupy a gray area between commodities, securities, and payment instruments.

This uncertainty creates both opportunities and challenges. On one hand, decentralized structures reduce reliance on banks. On the other hand, regulatory scrutiny could intensify. The Sui mainnet stablecoin launch 2026 reflects broader industry efforts to align innovation with compliance. Long-term success will depend on proactive engagement with policymakers.

Competitive Positioning in the 2026 Crypto Landscape

By 2026, competition among blockchain ecosystems is fierce. Ethereum, Solana, and Layer-2 networks continue expanding. Against this backdrop, the Ethena-backed suiUSDe launch on Sui mainnet gives Sui a strategic advantage. Native stablecoin infrastructure improves user retention and capital flow.

The Ethena-backed stablecoin for Sui DeFi supports complex financial instruments that require stable settlement layers. Analysts increasingly view this as a differentiator. In crowded markets, specialized financial primitives often determine which networks thrive.

Conclusion: A Turning Point for Sui and DeFi

The Ethena-backed suiUSDe launch on Sui mainnet represents a defining chapter in decentralized finance. By combining synthetic stability, institutional partnerships, and native integration, this initiative strengthens the Sui ecosystem’s financial foundation. It supports scalable lending, efficient trading, and sustainable yield generation. While risks remain, transparent governance and advanced risk controls enhance resilience.

As adoption grows, the suiUSDe stablecoin launch could become a cornerstone asset in next-generation DeFi. Stakeholders, developers, and investors should continue monitoring performance metrics, protocol updates, and regulatory developments to make informed strategic decisions, ensuring they leverage the expanding Sui DeFi opportunities effectively.

Appendix: Glossary of Key Terms

Synthetic Stablecoin: A digital asset designed to track fiat value using crypto collateral and hedging.

DeFi: Decentralized finance applications operating without centralized intermediaries.

Yield Vault: A smart contract that aggregates funds to generate optimized returns.

Total Value Locked (TVL): The total capital deposited in DeFi protocols.

Hedging Mechanism: A strategy used to offset market risk.

Smart Contract: Self-executing code deployed on a blockchain.

Liquidity Pool: A reserve of tokens used for trading and lending.

Collateralization: Securing an asset with deposited value.

Frequently Asked Questions About Ethena-Backed suiUSDe Launch on Sui Mainnet

What is the main goal of suiUSDe?

The goal is to provide a decentralized, stable digital dollar for Sui-based financial applications.

How is suiUSDe different from USDT or USDC?

suiUSDe uses synthetic hedging mechanisms instead of traditional fiat reserves.

Can suiUSDe be used for lending and trading?

Yes, it is integrated into multiple Sui DeFi platforms for lending, margin trading, and yield.

Is suiUSDe suitable for long-term holding?

Suitability depends on individual risk tolerance and understanding of synthetic asset models.

Where can performance data be tracked?

Users can monitor metrics on blockchain explorers and major crypto analytics platforms.

Reference

Read More: Ethena and Sui Launch Synthetic Dollar suiUSDe">Ethena and Sui Launch Synthetic Dollar suiUSDe

0

0

Tüm kripto, NFT ve DeFi varlıklarınızı tek bir yerden yönetin

Tüm kripto, NFT ve DeFi varlıklarınızı tek bir yerden yönetinKullanmaya başlamak için portföyünüzü güvenli bir şekilde bağlayın.