A16z-Backed Entropy to Close Operations, Return Investor Funds After 4-Year Run

0

0

This article was first published on The Bit Journal.

The Entropy crypto startup is winding down operations and returning its remaining capital to investors, ending a multi-year attempt to build security-first infrastructure for onchain users.

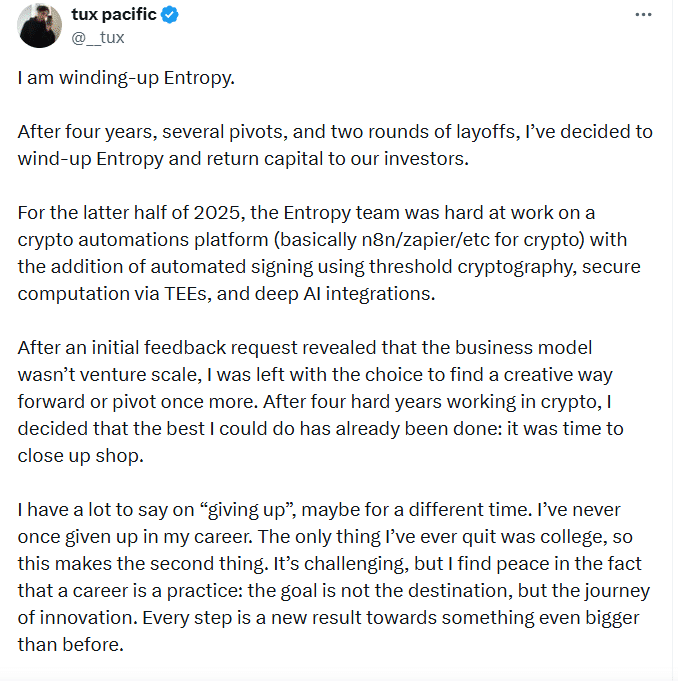

The announcement came directly from founder and CEO Tux Pacific in a public post on X, where Pacific said the team had reached the point where the product no longer had a realistic path to becoming a venture-scale business. After years of work, multiple pivots, and two rounds of layoffs, the company chose to close rather than stretch out another reinvention that might not change the outcome.

At a time when crypto founders are being pushed to prove revenue earlier and ship faster, Entropy’s shutdown reads like a real-world reminder: strong engineering alone does not guarantee a lasting company. Markets reward momentum, but businesses still live or die on fit, distribution, and repeatable demand.

A refund decision that stands out in crypto

Unlike many failed projects that fade into silence, the Entropy crypto startup is taking a cleaner exit by giving back what remains. That move matters because it sits in sharp contrast to the way some web3 ventures collapse, leaving token holders, users, or partners stuck holding the bag.

Pacific framed the choice as a straightforward responsibility. If the company could not justify continued spending without a clear path to growth, then the most honest outcome was to return funds and close the chapter.

While full details of the refund timeline were not laid out in the post, the message was unambiguous: the business is ending, and the priority now is to unwind properly.

Why the Entropy crypto startup could not scale

For venture-backed companies, the phrase “venture scale” is not a slogan. It is the standard investors quietly measure everything against, especially in infrastructure plays. A product can be respected, even loved by a niche group, and still fail the math if it cannot grow into a large market fast enough.

That tension seems to be where the Entropy crypto startup landed. Pacific said the team tried multiple directions, but each route hit the same wall: a lack of scalable traction.

In crypto, distribution can be brutal. Custody and security tools may be essential, but they are often hard to sell because their value only becomes apparent when something goes wrong. Users want safety, yet many only pay attention to it after a painful lesson. That creates a market where the need is real, but urgency is inconsistent, and that inconsistency can starve a startup.

From self-custody vision to automation ambitions

Entropy originally emerged with a clear narrative: reduce reliance on centralized custodians and give users stronger control over their assets. In that era, trust issues around custody were not theoretical. Hacks and failures had made self-custody feel like the safer side of the trade.

Later, the Entropy crypto startup shifted toward a newer idea, building crypto automation workflows that could simplify on-chain actions the way business automation tools simplify office work. The concept fit the moment, since crypto users increasingly manage complex routines across wallets, protocols, and networks.

But even a strong idea can struggle when the average user feels overwhelmed by too many options. In practice, automation products need clean onboarding, obvious outcomes, and recurring usage. Without that, they become “nice to have” utilities rather than must-have daily tools.

The funding backdrop and what it signals now

Entropy’s story also reflects how quickly the funding environment has changed. The company raised $25 million in a 2022 seed round led by a16z, at a time when capital flowed more freely into crypto infrastructure bets.

That type of backing can accelerate development, but it also sets expectations. A large round buys time, yet it also raises the bar for outcomes. Investors typically want to see product-market fit turning into measurable growth, not just continued building.

Now, the Entropy crypto startup is joining a longer list of well-funded teams that discovered the hard truth: the leap from “good product” to “big company” is not automatic, even with serious capital behind it.

What this means for builders, investors, and users

For founders, the Entropy decision highlights a painful but useful lesson. If customers are not pulling the product into their lives, forcing more pivots can become expensive theatre. Shutting down early can be less damaging than chasing traction that never arrives.

For investors, the Entropy crypto startup exit reinforces how important market timing and clear business models have become. In today’s cycle, investors increasingly reward teams that can show revenue pathways, not only technical advantage.

For everyday users, the bigger takeaway is about risk awareness. Crypto infrastructure can look polished on the outside, but startups are still startups. A tool can be safe, and still disappear if it cannot sustain a business.

Conclusion

The shutdown of the Entropy crypto startup is not a scandal or a sudden collapse. It is a deliberate decision after years of building, testing, and trying to find a model that fits both users and venture expectations. In a market that often celebrates endless optimism, choosing a clean refund and an orderly wind-down is a rare moment of discipline. The result may sting for the team, but it offers clarity for everyone watching: crypto companies still have to earn durability the old-fashioned way, with real adoption and repeatable value.

FAQs

Why is Entropy shutting down?

Entropy is shutting down because the company could not find a scalable business model that matched venture growth expectations after multiple pivots and layoffs.

Will investors actually get refunded?

The founder has publicly said remaining capital will be returned to investors as part of the wind-down, though the exact process and timing may vary.

Was Entropy hacked or insolvent?

No public claim suggests a hack. The shutdown was described as a business decision tied to growth limits, not a security failure.

What kind of product was Entropy building?

Entropy began as a self-custody and security-focused project, then later explored crypto automation workflows designed to make onchain actions easier.

Glossary of Key Terms

Self-custody: Holding crypto in a wallet controlled by the user, not a centralized exchange or custodian.

Custodian: A company that stores and safeguards digital assets on behalf of clients.

Product-market fit: The point where a product satisfies real demand and grows through consistent user adoption.

Venture scale: Growth potential large enough to justify venture capital investment and target returns.

Pivot: A strategic shift in product direction or business model based on market feedback.

Runway: The amount of time a startup can keep operating before it runs out of funding.

Wind-down: The structured process of closing a business, settling obligations, and ending operations responsibly.

References

Read More: A16z-Backed Entropy to Close Operations, Return Investor Funds After 4-Year Run">A16z-Backed Entropy to Close Operations, Return Investor Funds After 4-Year Run

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.