Why the Fed’s Tokenization Conference in October Could Define the Future of Finance

0

0

According to recent announcements, the Fed tokenization conference will take place this October, marking one of the most significant steps yet in connecting traditional markets with blockchain-based finance.

The event will focus on tokenization, stablecoins, and AI-powered payments; all key areas that could reshape how money moves in the coming years.

What’s on the Table at the Fed Tokenization Conference?

Tokenization, Stablecoins, and Payments

Depending on how bonds or real estate can be tokenized, this Fed tokenization conference will provide insights into several other issues, such as stablecoin regulation, AI in payments, and the relationship between DeFi and TradFi.

Also read: Fed Supports Pro-Crypto Regulation a Transformative Future as Banks Gain Regulatory Clarity

Voices from the Fed

Fed Governor Christopher Waller underscored the significance of the conference, saying:

“Innovation has been a constant in payments to meet the changing needs of consumers and businesses.”

This follows the Fed’s ongoing research into tokenization, smart contracts, and AI applications in financial systems.

The Growth of Tokenization

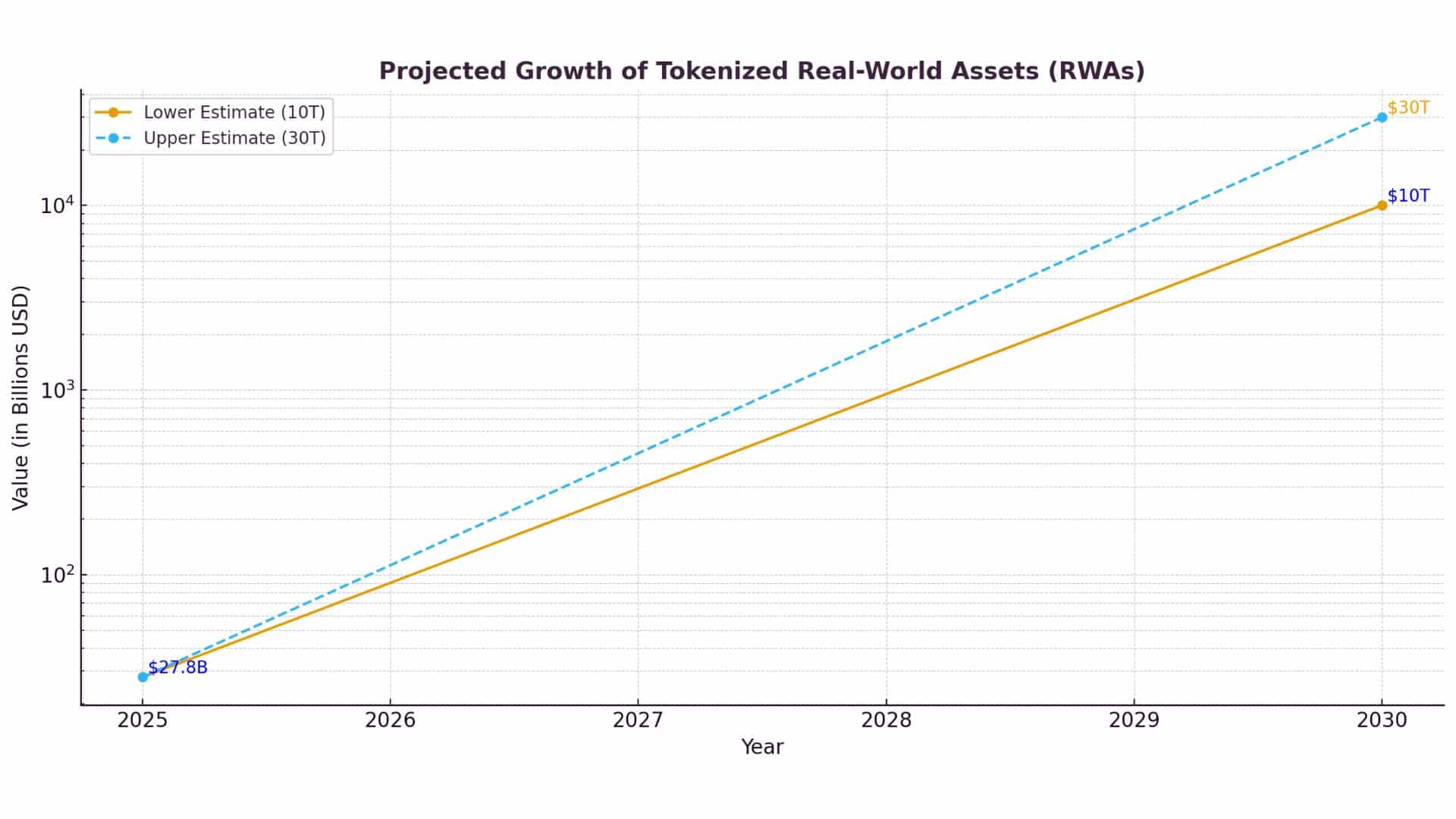

On-chain tokenized real-world assets have already reached $27.8 billion, a 223% increase since early 2025. Analysts believe tokenization could grow 50-fold to between $10 and $30 trillion by 2030.

Why It Matters for Crypto

For crypto readers, the Fed tokenization conference is more than regulatory talk. It signals a growing recognition that blockchain technology can bring transparency and efficiency to real-world finance. Stablecoins and tokenized assets could soon gain stronger institutional backing, bridging the gap between Wall Street and Web3.

Fed Tokenization Conference: Key Insights

| Highlight | Explanation |

|---|---|

| Tokenization focus | Will explore bonds, real estate, and securities on-chain. |

| AI in payments | Likely to cover fraud detection and faster settlements. |

| TradFi–DeFi overlap | How banks and decentralized finance tools might connect. |

Conclusion

Based on the latest research, the Fed tokenization conference could be a defining moment in bringing tokenized finance into the mainstream. If policymakers and institutions align, tokenized assets and stablecoins may soon form part of daily transactions, giving crypto investors and traditional finance participants a common ground.

For now, the spotlight is on October and the outcomes could shape finance for years to come.

Also read: Could RWA Tokenization Hit $16T by 2030? Skynet Reveals Bold Data

Summary

The Fed tokenization conference has sparked wide interest by putting real-world assets and payments innovation under the spotlight. Experts believe tokenization could reshape how money and assets move, opening doors for faster settlements, transparent markets, and broader adoption of blockchain in finance.

Knowing that criterion, the realm of tokenization is believed to change the very way money and assets move with faster settlement times, transparent markets, and the fintech blockchain coming to greater acceptance.

In the view of crypto readers, this means now a joining up of traditional regulators with digital assets to allow long-term growth and integration.

Glossary of Key Terms

Fed tokenization conference: The Federal Reserve’s event on tokenization, stablecoins, and AI in payments, held in October.

Tokenization: The process of tokenizing a real-world asset into a digital token on a blockchain for more efficient trading.

Stablecoins: Digital assets that are pegged to U.S. dollars or other currencies.

TradFi–DeFi overlap: Where traditional banks and decentralized systems interact.

RWAs (Real-World Assets): Tangible assets like bonds and real estate issued as blockchain tokens.

FAQs for Fed Tokenization Conference

1. What is the Fed tokenization conference about?

It’s a Federal Reserve event to discuss tokenization, stablecoins, and AI integration in payments.

2. When will this conference take place?

The conference is scheduled for October 21, 2025.

3. Why is it important for crypto?

It shows regulators and institutions are preparing for blockchain-based finance, boosting legitimacy for digital assets.

4. Could this see tokenized assets break out into the mainstream?

Yes. With clear frameworks, tokenization could expand rapidly into banking, investments, and global payments.

Read More: Why the Fed’s Tokenization Conference in October Could Define the Future of Finance">Why the Fed’s Tokenization Conference in October Could Define the Future of Finance

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.