Aave Labs’ Horizon Proposes Licensed RWA Platform to Expand DeFi Access

0

0

Horizon, an initiative by Aave Labs, proposed a new financial product to bring real-world assets (RWAs) into decentralized finance (DeFi) under a regulatory framework.

The initiative is expected to generate new revenue streams for the Aave DAO, accelerate GHO adoption, and strengthen Aave’s role as a key player in the growing tokenized asset space. Amid accelerating institutional adoption, projections suggest that RWAs on blockchain networks could reach $16 trillion over the next decade.

Horizon Proposes RWA Product as Licensed Instance of Aave Protocol

In a press release shared with BeInCrypto, Aave Labs’ Horizon proposed launching an RWA product as a licensed instance of the Aave Protocol. This initiative aims to enable institutions to use tokenized money market funds (MMFs) as collateral to borrow stablecoins like USDC and Aave’s GHO.

The move is expected to unlock liquidity for stablecoins and expand institutional access to DeFi. Specifically, it would make DeFi more accessible to regulated financial entities while benefiting the Aave ecosystem.

The interest comes amid growing demand for tokenized real-world assets. Blockchain technology enhances liquidity, reduces costs, and enables programmable transactions.

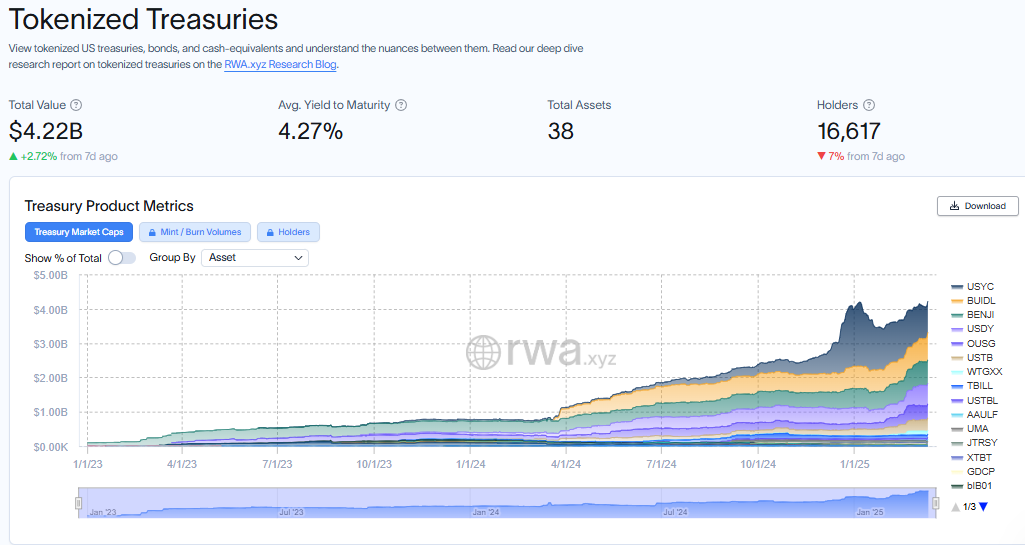

Furthermore, tokenization on blockchain has made traditional assets more accessible on-chain, with tokenized US Treasuries growing by 408% year-over-year to reach $4 billion.

Tokenized US Treasuries. Source: rwa.xyz

Tokenized US Treasuries. Source: rwa.xyz

Subject to approval by the Aave DAO, Horizon’s RWA product will initially launch as a licensed instance of Aave V3. Later, it would transition to a custom deployment of Aave V4 when it becomes available. Horizon has proposed a structured profit-sharing mechanism to ensure long-term alignment with the Aave DAO.

“…a 50% revenue share to Aave DAO in Year 1, alongside strategic incentives to drive ecosystem growth,” Horizon told BeInCrypto.

Additionally, if Horizon launches its token, 15% of its supply will be allocated to the Aave DAO treasury and ecosystem incentives. A portion will also be set aside for staked AAVE holders.

Meanwhile, the rise of RWAs is transforming the financial playing field, and institutions are taking note. Tokenized assets are emerging as a bridge between traditional finance (TradFi) and DeFi, providing investors new opportunities to access yield-bearing assets. Key players include BlackRock (BUILD), Franklin Templeton, and Grayscale.

Institutions To Access Regulated But Permissionless Stablecoin Liquidity

However, DeFi’s open and permissionless nature poses regulatory challenges. It lacks the compliance frameworks required for large-scale institutional participation.

Institutional adoption remains limited without tailored solutions, and integrating RWAs into DeFi at scale remains a significant challenge.

Horizon seeks to bridge this gap by allowing institutions to access permissionless stablecoin liquidity. It will also meet the compliance and risk management requirements of asset issuers.

Tokenized asset issuers can enforce transfer restrictions and maintain asset-level controls. According to the announcement, this would ensure only qualified users can borrow USDC and GHO.

“…separate GHO Facilitator will enable GHO minting with RWA collateral, offering predictable borrowing rates optimized for institutions. This enhances security, scalability, and institutional adoption of RWAs in DeFi,” Horizon added.

The proposed product builds on the institutional framework established by Aave Arc. To ensure a smooth integration, Horizon will implement a permissioned token supply. It will also feature withdrawal mechanisms, stablecoin borrowing for qualified users, and permissioned liquidation workflows.

The initiative is expected to enhance the security, scalability, and institutional adoption of RWAs within DeFi.

However, despite Aave’s permissionless design being one of its greatest strengths, integrating RWAs presents challenges beyond smart contract development.

A licensed instance of Aave’s protocol will require an off-chain legal structure, regulatory coordination, and active supervision. It is imperative to note that the Aave DAO is not designed to handle these functions independently.

Operationally, the Aave DAO and its service providers will oversee the functionality of Horizon’s RWA product. However, Horizon will retain independence in configuring the instance and steering its strategic direction.

The proposal now calls on the Aave DAO to approve Horizon’s RWA product as the protocol’s licensed instance.

The next steps involve refining the proposal with the Aave community and service providers. If there is a consensus on moving forward, the proposal will proceed to a Snapshot vote.

If the vote is in favor, the proposal will advance to the final governance stage for approval.

AAVE Price Performance. Source: BeInCrypto

AAVE Price Performance. Source: BeInCrypto

BeInCrypto data shows that the AAVE price was trading at $173.44 as of this writing, down by 0.24% since Thursday’s session opened.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.