Bitcoin ETFs Inflows Hit $607 Million as BTC Reaches New ATH

1

0

Highlights:

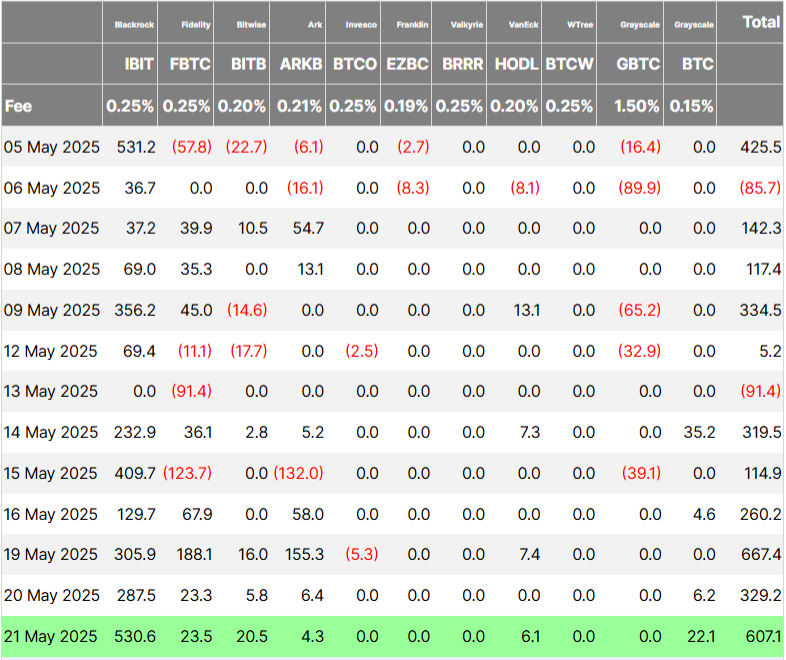

- Bitcoin ETFs got $607 million in inflows, making six days in a row.

- BTC passed $109,000 and reached $111,544 due to strong buying from big investors.

- BlackRock’s IBIT had the biggest inflows with $530.6 million, buying much more than mined Bitcoin.

U.S. spot Bitcoin (BTC) exchange-traded funds (ETFs) saw net inflows totaling $607.1 million on May 21. This marked six consecutive days of positive fund flows. The substantial inflows occurred as BTC surpassed its previous all-time high of approximately $109,000 yesterday. Data from CoinGecko shows that BTC reached a new record of $111,544 within the last 24 hours, mainly due to strong institutional buying and growing demand from ETFs.

BlackRock’s Bitcoin ETF Leads with Massive Inflows and Record Volume

On Wednesday, BlackRock’s iShares Bitcoin Trust (IBIT) led net inflows with $530.6 million. This was IBIT’s largest single-day inflow since May 5, when it received $531.2 million, according to Farside Investors. The ETF has not experienced any outflows since April 9. In a single day, IBIT acquired more than ten times the amount of Bitcoin mined during the same period. It purchased 4,931 BTC, while only 450 BTC were mined that day.

Additionally, IBIT recorded its highest trading volume since January, as reported by the ETF tracking account Trader T. ETF Store president Nate Geraci indicated that the inflow numbers are likely to grow due to the high trading volume observed today.

Over $500mil into iShares Bitcoin ETF…

Nearly $2bil just over past week or so.

Inflows 26 of past 27 days.

*$7+bil* in new $$$ overall.

Given trading volume today, expect these inflow numbers to increase.

— Nate Geraci (@NateGeraci) May 22, 2025

Meanwhile, Fidelity Wise Origin Bitcoin Fund (FBTC) recorded the second-largest inflows of the day, totaling $23.5 million. Bitwise Bitcoin ETF (BITB), and Grayscale Mini BTC Trust each posted positive inflows surpassing $20 million.

Bloomberg ETF analyst Eric Balchunas said the ETF inflows look like a “feeding frenzy.” This happened because Bitcoin’s price rose quickly to almost $112,000 in early May 22 trading. He also noted that the last time ETF trading was this high was in January, near BTC’s previous all-time high. Balchunas added, “All the Bitcoin ETFs are elevated, most are gonna see 2x their average flows incoming.”

$IBIT is going to post its 2nd biggest volume day ever today (outside chance it ends with most). Classic feeding frenzy in effect, new ATHs will do that, eg last time traded this much was 1/23 (last ATH). All the btc ETFs are elevated, most gonna see 2x their average. Flows… pic.twitter.com/LNBysA2C1A

— Eric Balchunas (@EricBalchunas) May 21, 2025

Growing Analyst Optimism and Weaker US Dollar Support Bitcoin’s Rally

The current economic conditions support Bitcoin’s rally and analysts optimism is growing stronger. Their forecasts often shape market sentiment and fuel FOMO. Trader Titan of Crypto predicts Bitcoin may hit $135,000 by 2025. Another crypto analyst, Peter Brandt, agrees with this price target. He says Bitcoin’s price shows the bull run is underway. Brandt believes BTC’s price could reach between $125K and $150K. Some analysts have even higher predictions. Chart analyst Gert Van Lagen believes Bitcoin could reach $300,000 to $320,000 within a year.

One factor that could drive Bitcoin higher is the weakening US dollar. This is reflected in the low demand for the US Treasury’s 20-year bond. On May 21, the U.S. Treasury auctioned $16 billion in 20-year bonds. The auction attracted weaker-than-expected demand, with the yield rising to 5.104%, the highest since 2020. It shows investors are losing confidence in the US fiscal outlook amid growing debt.

IF YOU ARE WONDERING WHY STOCKS JUST ALL WENT DOWN AT ONCE

WE JUST HAD A HORRIBLE BOND AUCTION IN THE UNITED STATES FOR OUR 20-YEAR TREASURIES

Because of the lack of bidders…it caused the 20-year bond yield to surge to 5.1%.

Credit market is screaming for help right now. pic.twitter.com/ne14v5PaVm

— amit (@amitisinvesting) May 21, 2025

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.

1

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.