World Liberty Financial Bags $3.5M ETH Amid Price Surges

0

0

Highlights:

- World Liberty Financial expands its portfolio with new Ethereum and WBTC investments.

- The Trump-backed crypto investment firm invested $3.5 million in ETH and $1 million in WBTC.

- WLFI’s portfolio valuation soared to about $107.255 million.

Donald Trump’s World Liberty Financial (WLFI) has expanded its crypto portfolio with new investments worth $4.5 million. Lookonchain reported that the investment firm invested $3.5 million in 1,587 Ethereum (ETH) and $1 million in 9.7 Wrapped Bitcoin (WBTC).

A wallet likely linked to #Trump’s World Liberty(@worldlibertyfi) bought 1,587 $ETH($3.5M) and 9.7 $WBTC($1M) ~30 minutes ago.https://t.co/0qWkRUhm0D pic.twitter.com/KaYsTQrQ6G

— Lookonchain (@lookonchain) May 9, 2025

The investments came amid Ethereum’s sudden price upswing. At the time of writing, Ethereum has broken above $2,000 following a 20.4% upswing in the past 24 hours. The token is changing hands at about $2,340 and has a market cap of roughly $283.79 billion.

Over the past seven days, Ethereum has soared by 28.4%, fluctuating between $1,763.97 and $2,411.73. The token has also spiked 31.9% and 58.3% in its 14-day-to-date and month-to-date variables, respectively. However, ETH’s year-to-date price change data reflected a 21.5% decline, which invariably implies that the token has not reclaimed previous highs.

World Liberty Financial’s Portfolio Spikes, Exceeds $100 Million

Earlier this year, WLFI moved over $300 million worth of cryptocurrencies to Coinbase, sparking market participants’ reactions, as many people speculated that the investment firm sold its holdings, which could negatively impact cryptocurrency prices.

WLFI allayed the crypto community’s fear, citing reasons for the transfer in a tweet on February 3. The investment firm stated, “World Liberty Financial moved $307.41 million in 8 assets to CoinbasePrime 6 hours ago—as part of treasury management and business operations.”

Despite the explanations, market participants remained unsatisfied and have sought more transparency from WLFI. After moving most of its coin holdings to Coinbase, the investment company’s portfolio dropped to about $33 million. Since then, WLFI has been acquiring different crypto assets to expand its portfolio. However, its wallet valuation remained below $100 million for over three months.

World Liberty Financial’s portfolio holds $107.255 million in crypto assets. The wallet holds 7.933K ETH worth $18.84 million. Other valuable cryptocurrencies in the portfolio include over $30 million worth of stablecoins, 162.69 WBTC, valued at roughly $16.86 million, 4.998K Staked Ethereum (STETH) worth $11.65 million, 40.718 million Tron (TRX) valued at about $10.54 million, 342.002K ONDO worth $347.13K, etc.

Abraxas Capital Continues to Accumulate Ethereum

On May 8, Crypto2Community reported that Abraxas Capital has been accumulating Ethereum. Per the publication, the investment firm bought 49,644 ETH for about $92 million within 24 hours. In a recent tweet, Lookonchain reported that Abraxas Capital increased its ETH holdings to approximately 61,401 ETH worth roughly $116.3 million.

These consistent purchases signify faith in Ethereum’s potential as a sustainable store of value. In addition, it could elicit Fear of Missing Out (FOMO) among retail investors, leading to more ETH acquisitions. Overall, the impact of heightened ETH procurements will be crucial in driving ETH’s long-term price spike.

ETH has surged past $2,300, up more than 20% in the past 24 hours.

Meanwhile, Abraxas Capital continues to accumulate, withdrawing 61,401 $ETH($116.3M) from exchanges over the last 2 days.https://t.co/ObH6pw7cwd pic.twitter.com/cKk7K8ZXe0

— Lookonchain (@lookonchain) May 9, 2025

Profitable ETH Holders Exceed 50%

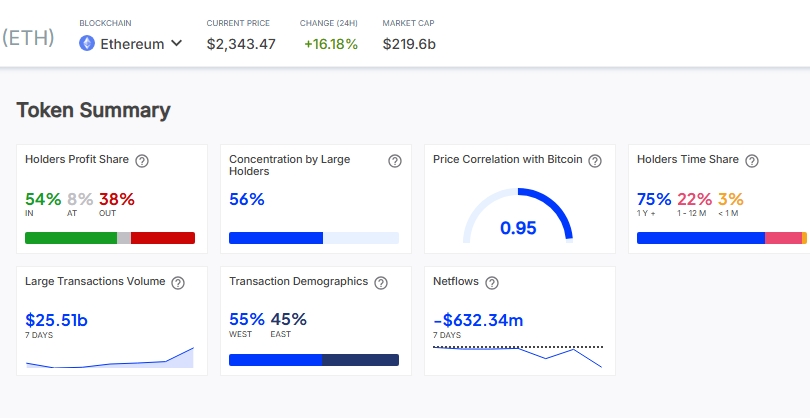

On IntoTheBlock, profitable Ethereum investors reflected 54%. 8% of the token holders are neither gaining nor losing, while 38% are incurring losses. In the past seven days, ETH’s large transaction volume soared to about $25.51 billion, suggesting a busy network. Concentration by large holders was 56%, highlighting whales’ influences in dictating ETH price movements with their actions.

In holders’ statistics by time held, 75% have held the token for over a year. 22% were intermediate holders, while 3% were short-term Ethereum owners. Netflows showed a negative $632.34 million value, implying that more tokens left exchanges than those returned.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.