Arthur Hayes Doubles Down on Ethena (ENA) – Is a Major Price Surge Coming?

0

0

- Hayes doubles ENA holdings, fueling speculation of a price surge.

- Bollinger Bands and RSI signal potential breakout for ENA price.

- USDe listing could trigger massive ENA buybacks and price rally.

Arthur Hayes, co-founder of BitMEX, has once again shown his strong support for Ethena (ENA) by making a massive purchase. Onchain Lens data on-chain shows that Hayes purchased 578,956 ENA tokens on Binance, at an approximate cost of $467,700. This purchase increases his total ENA holdings to 5.02 million tokens, which have a current value of $3.91 million. Although ENA has been struggling in the market in recent times, the fact that Hayes has continued to invest in the company has raised speculations that a price surge is imminent.

Also Read: How to Add Shikoku Inu Coin to Your Crypto Wallet

Hayes’ Bold Move Signals Confidence in ENA’s Future

Hayes’ decision to buy during a period of market weakness is seen as a vote of confidence in the long-term potential of ENA. He is a large holder and, as such, he usually dictates the overall market mood, and his moves might inspire other investors to do the same. As the ENA decreases nearly by half of the all-time high, Hayes sees the present market low as a chance to build and not withdraw.

Currently, ENA is trading at $0.7797, marking a 9% increase in the last week but still well off its peak of $1.52. Although the weekly trading volume declined by 56%, the presence of high-profile supporters such as Hayes might prove essential in the possible recovery of the token.

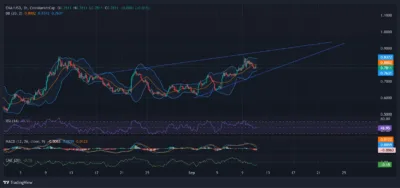

Bollinger Bands, RSI, and MACD – Technical Indicators to Watch

The technical indicators present mixed signals for ENA’s near-term direction. On the 3-hour chart, ENA is trading in a rising wedge formation that can be interpreted as a bearish formation. If the token fails to hold support around the $0.76 to $0.77 region, it could experience further downside, potentially reaching $0.72 or even $0.68.

Considering the Bollinger Bands, resistance is still strict at the ranges of $0.83 to $0.84, which correlates with the upper band. Beyond this level, the momentum would be instrumental and would lead to an increase in ENA to the price range of $0.90 to $1. The RSI is currently at 48.9, which is a neutral level indicating no overbought or oversold level. In the meantime, we have seen the MACD give a bearish crossover, which means the short-term weakening momentum.

Source: Tradingview

Moreover, the Chaikin Money Flow (CMF) is still negative (-0.15), implying that capital outflows could contribute to ENA’s price woes.

A Game-Changing Catalyst on the Horizon?

A significant development could further boost ENA’s prospects: the recent listing of Ethena’s synthetic dollar, USDe, on Binance. USDe started trading on September 9 against pairs of USDC and USDT, which is one of the most essential features of the Ethena protocol.

The fee switch, where protocol revenues are recycled into ENA buybacks, will likely add meaningful upward pressure on the token. Hayes has opined that this upgrade could release up to $500 million in buybacks, potentially propelling a price explosion in ENA.

With Hayes continuing to accumulate and major updates on the horizon, all eyes are on ENA to see if it can defy the odds and trigger a significant price surge.

Also Read: 1.2 Billion XRP Surge in One Day – What’s Happening?

The post Arthur Hayes Doubles Down on Ethena (ENA) – Is a Major Price Surge Coming? appeared first on 36Crypto.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.