2nd Largest US Bank Pivots to Crypto, After Texas Buys $5M Bitcoin via BlackRock ETF 🚀

0

0

👋 Welcome to the CoinStats Scoop, your weekly newsletter bringing you the most groundbreaking Web3 innovations and market-moving headlines in the crypto space.

Stay in the loop with all the key market moves, emerging trends, and exciting developments from the past week 📈.

This week saw a flurry of bullish crypto-adoption milestones, signaling a growing institutional appetite for cryptocurrency investments despite the recent market correction.

First, Bank of America, the second-largest US bank, issued a 4% crypto allocation recommendation, while opening access to Bitcoin ETFs for its wealthiest clients starting January 2026.

The Texas state-backed Bitcoin reserve also made history by becoming the first state to actively invest in Bitcoin with its $5 million BlackRock Bitcoin ETF purchase.

Meanwhile, Vanguard is opening crypto ETF access to 50 million clients, while South Korean lawmakers are pushing ahead with stablecoin legislation planned for early next year.

For crypto investors, this signals a wave of regulatory and fundamental developments poised to ignite the market’s momentum heading into 2026 🔥.

In this week’s CoinStats Scoop, you’ll find:

📊 Crypto market analysis and the most important news in Web3.

💼 Bank of America pivots to Bitcoin ETFs, sets 4% crypto allocation recommendation.

⭐ Texas state reserve buys $5 million Bitcoin via BlackRock ETF.

🏦 $10 trillion asset manager Vanguard embraces crypto ETFs.

🌏 South Korea to publish draft stablecoin regulation in December.

🔮 Analysis and key events that will shape the crypto market next week.

Bank Of America Pivots To Bitcoin ETFs, Sets 4% Crypto Allocation Recommendation

Bank of America is opening the door to crypto products for millions of new high-net-worth investors worldwide.

Earlier this week, the second-largest US bank issued its first pro-crypto guidance, recommending a 1% to 4% portfolio allocation for its highest-net-worth brokerage clients across all platforms📊.

🗣️ “For investors with a strong interest in thematic innovation and comfort with elevated volatility, a modest allocation of 1% to 4% in digital assets could be appropriate,” said Chris Hyzy, chief investment officer at Bank of America Private Bank, in the statement.

Bank of America will also open access to Bitcoin exchange-traded funds (ETFs) to its wealth management clients starting January 5, bringing a new source of inflows from previously untapped markets.

This marks the first time the US bank’s clients can gain seamless access to Bitcoin ETFs, which could be seen as a discount opportunity considering Bitcoin’s 30% correction since early October.

Bank of America is the latest among a growing chorus of financial institutions issuing crypto and Bitcoin allocation recommendations in recent years, including BlackRock, Fidelity, and JPMorgan Chase 🏦.

Texas State Reserve Buys $5 Million Bitcoin via BlackRock ETF ⭐

Texas is accelerating the global Bitcoin adoption trend as the first state-backed Bitcoin treasury initiative to actively acquire Bitcoin exposure.

Texas became the first US state to add Bitcoin exposure to an official Bitcoin treasury, the Texas Strategic Bitcoin Reserve, created under Senate Bill 21 (SB 21).

Texas bought $5 million worth of BlackRock’s IBIT Bitcoin exchange-traded fund (ETF) for its strategic reserve, becoming the first state-level investor for BTC 💰.

Texas lawmakers have set aside a total of $10 million for the state-backed Bitcoin reserve, meaning that another $5 million acquisition may be commencing.

However, this is still a relatively small investment compared to Texas’ main investment portfolio, holding more than $600 million in S&P 500 ETFs.

Despite the modest size of the investment, it marks a strong sign of confidence compared to the federal-level Strategic Bitcoin Reserve, which has yet to make an active investment and consists only of Bitcoin forfeited from criminal seizures.

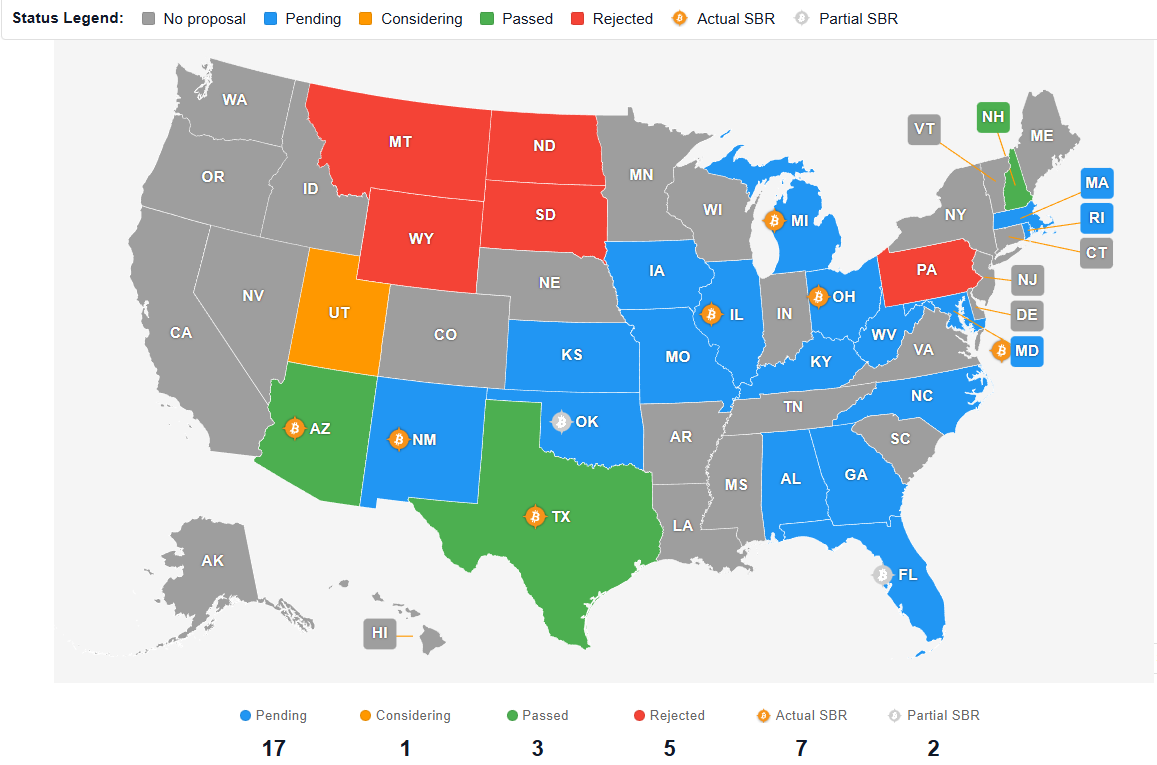

Still, there are only 3 approved state-backed Bitcoin reserves in the US, with another 17 pending approval 🇺🇸.

$10 Trillion Asset Manager Vanguard Embraces Crypto ETFs 🏦

Vanguard, the second-largest asset management firm in the world, is embracing cryptocurrency exchange-traded funds (ETFs), as more wealth managers seek regulated crypto investment products.

Over 50 million of Vanguard’s global clients will be able to trade and own crypto ETFs and mutual funds for the first time 🌍.

The wealth manager will open the door for regulated crypto ETFs based on tokens, including Bitcoin, Ether, XRP, and Solana.

Vanguard has been monitoring the cryptocurrency space, which led to the decision to enable crypto ETFs on the brokerage platform, the wealth manager wrote in a note, adding 📝.

“These products have been tested through periods of market volatility, performing as designed while maintaining liquidity; the administrative processes to service these types of funds have matured; and investor preferences continue to evolve”.

Considering the asset manager’s vast user base, the development will bring millions in newfound inflows, as the brokerage platform’s 50 million clients gain access to crypto for the first time 🚀.

Vanguard’s entry into cryptocurrency products is “structurally more important than BlackRock,” wrote crypto founder and analyst Quinten:

“Their influence is anchored in retirement systems, pensions, and long-horizon capital. If that capital moves toward Bitcoin, it signals long-term integration into global savings.”

South Korea To Publish Draft Stablecoin Regulation In December 🇰🇷

South Korean lawmakers are rapidly pushing ahead with the country’s emerging stablecoin legislation, signaling more regulatory tailwinds in Asia and beyond.

South Korea’s ruling party sent a “last-minute notice” to the country’s lawmakers, urging them to submit the stablecoin regulatory framework’s draft by the December 10 deadline.

Provided that lawmakers can meet this deadline, the draft stablecoin bill may be discussed as soon as January 2026 during the National Assembly 🏛️.

🗣️ “If the government bill does not come over within this deadline, we will take a drive through legislation by the secretary of the political affairs committee,” Democratic Party lawmaker Kang Joon-hyun told news outlet Maeil Business.

However, South Korea has yet to make an official decision on issuing a KRW-backed stablecoin, according to a statement by the Financial Services Commission (FSC) 🔒.

The FSC confirmed that both political parties are collaborating on prioritizing the draft bill until the December 10 deadline.

Market Overview: Bitcoin Rallies to $93.4K on “Vanguard” Effect 🚀

Cryptocurrency markets staged a much-needed recovery, offering some relief to short-term holder cohorts that are most prone to panic selling their unrealized losses, CoinStats data shows 📊.

Bitcoin’s price rallied 6.5% to a new weekly high of $93,484 on Dec. 3, following new liquidity injections from the United States Federal Reserve, paired with the adoption milestones from large US corporations.

Bloomberg’s Bitcoin ETF analyst, Eric Balchunas, attributed Bitcoin’s recovery rally to the “Vanguard effect,” as he explained:

“THE VANGUARD EFFECT: Bitcoin jumps 6% right around US open on the first day after the bitcoin ETF ban was lifted. Coincidence? I think not. Also $1b in IBIT volume in the first 30min of trading. I knew those Vanguardians had a little degen in them, even some of the most conservative investors like to add a little hot sauce to their portfolio.”🚀

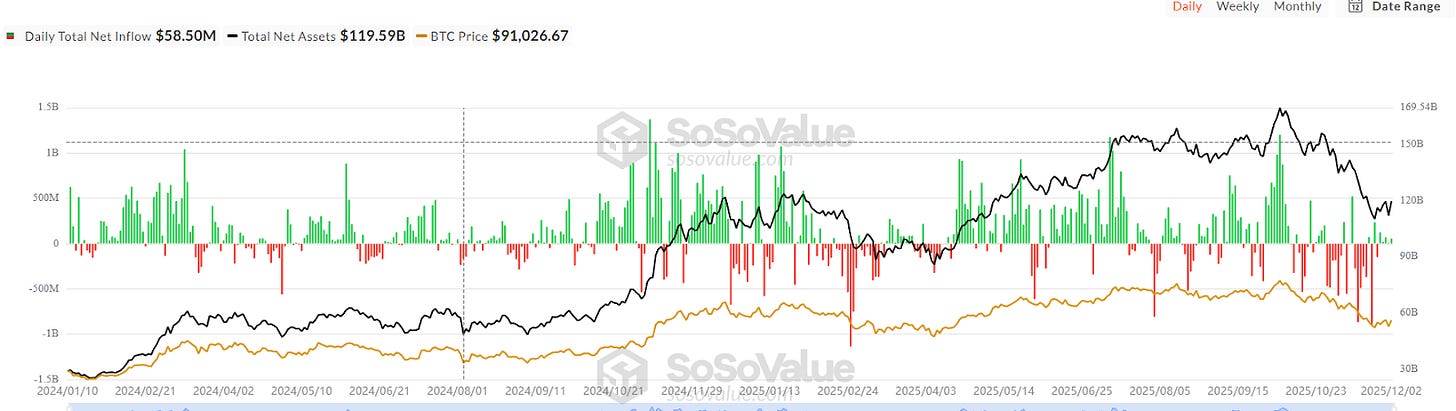

US spot Bitcoin exchange-traded funds (ETFs) also made a modest comeback, with 5 consecutive days of positive net investments, but they have yet to make up for the $3.5 billion sold during November 📈.

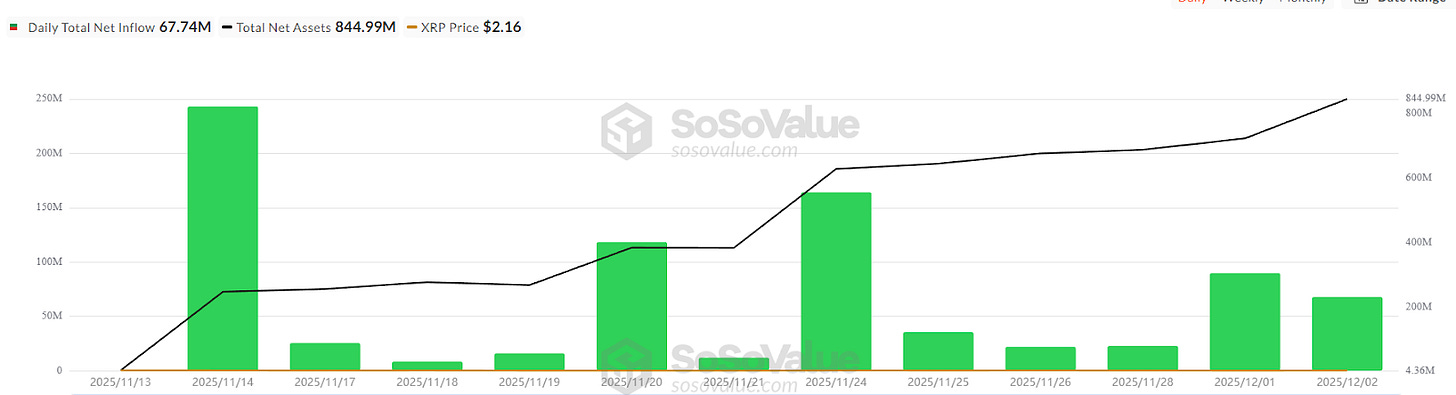

In the wider altcoin sector, the XRP token continued to be the institutional pick of choice, following the launch of the US spot XRP ETF earlier on November 13 💎.

Since launch, the new spot XRP ETFs attracted over $823 million worth of cumulative net inflows, logging a 12-day winning streak of net positive investments, Sosovalue data shows.

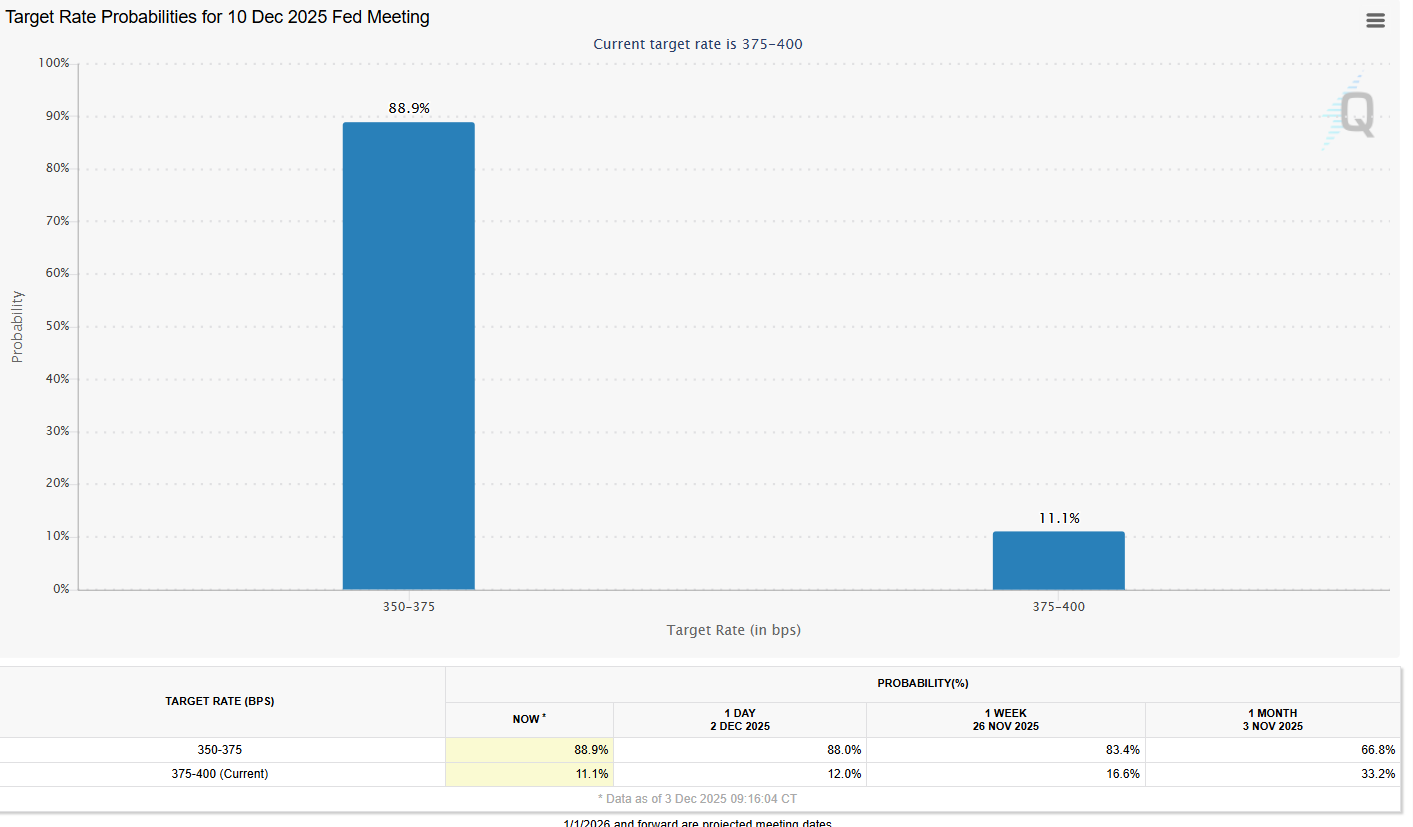

Stock and cryptocurrency investors now look forward to the all-important Federal Reserve meeting on interest rate decisions on December 10, which may dictate the trend of global markets in the upcoming months.

Markets are currently pricing in an 88.9% chance that the FED will deliver a 25 basis point interest rate cut during the upcoming meeting 📉.

Tweets & Memes

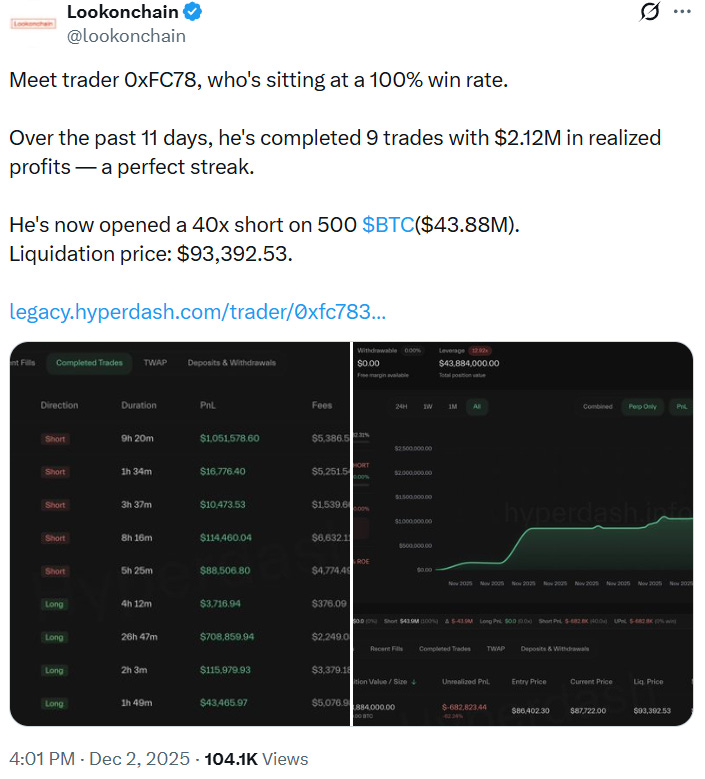

A trader with a 100% win rate is now going short. Does he know something markets don’t yet? 🤔.

A previous Coinbase advisor could be the next SEC chair. It’s all falling into place… 🏛️.

Solana ETFs continue their winning streak, but some investors are still not bullish 📈.

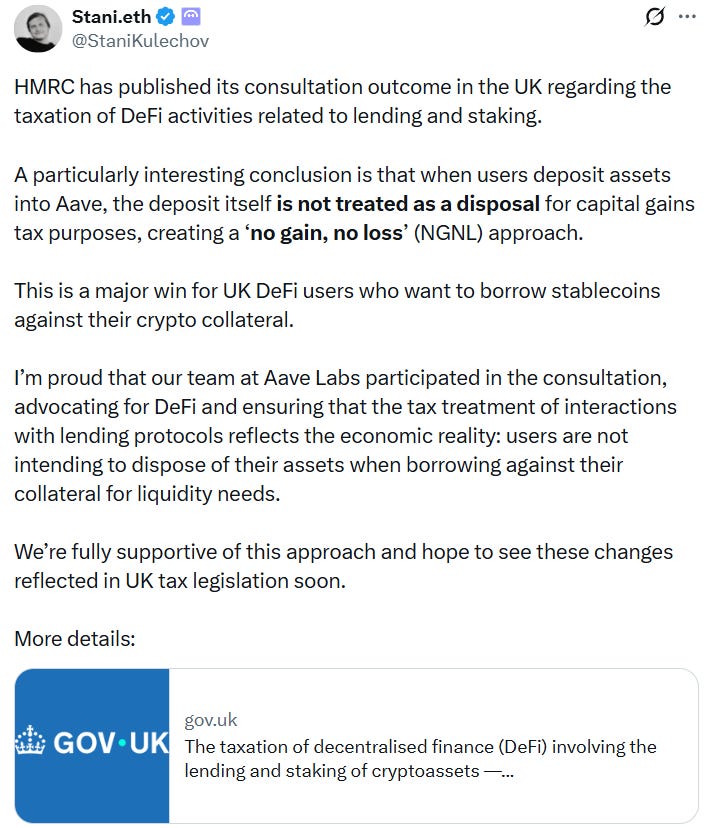

The UK is moving to tax DeFi, and it might be a net positive for the crypto industry 🇬🇧.

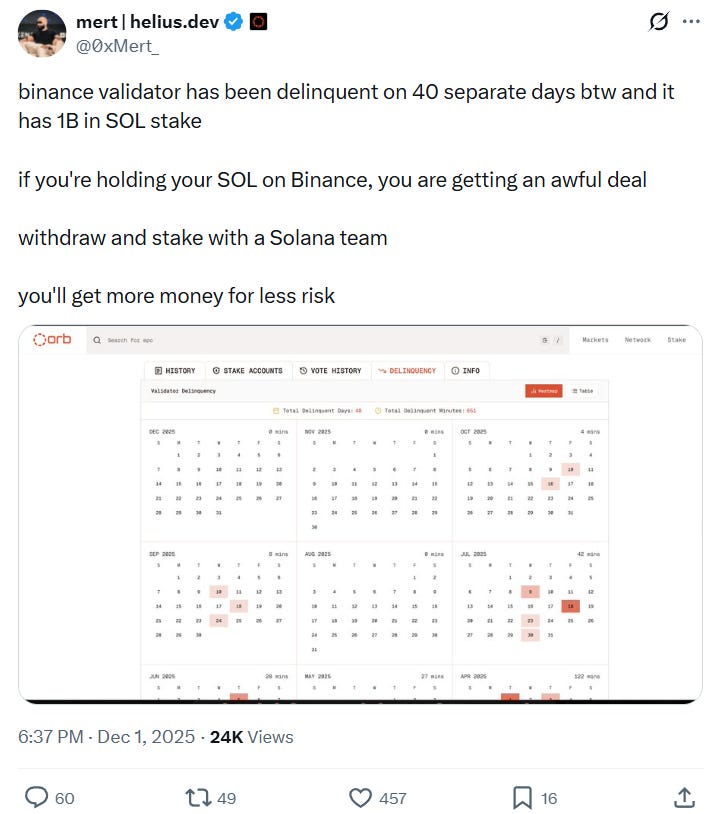

Binance validators are struggling with uptime, signaling that the largest brands aren’t always the most tech-savvy ⚡.

Thank you for reading the weekly CoinStats Scoop Newsletter.

CoinStats will continue to guide you through the world of crypto and DeFi. We’ll see you next week for another edition of CoinStats Scoop! 😎

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.