Bitcoin Slips to $86K Due to Long-Term Holders, SEC Drops Aave Investigation After 4 Years 📉

0

0

👋 Welcome to the CoinStats Scoop, your weekly newsletter bringing you the most groundbreaking Web3 innovations and market-moving headlines in the crypto space.

Stay in the loop with all the key market moves, emerging trends, and exciting developments from the past week 📈.

This week, cryptocurrency prices continued to decline, despite another milestone regulatory win for decentralized finance (DeFi).

Earlier this week, the U.S. Securities and Exchange Commission (SEC) announced the official conclusion of its four-year investigation into Aave, the leading decentralized lending and borrowing protocol.

Bitwise Asset Management also issued a bullish outlook for 2026, as over 100 crypto exchange-traded products (ETPs) are set to launch, potentially bringing new capital into Web3 from traditional investors and family offices 🏦.

Despite the positive developments, Bitcoin’s price sank to a weekly low of $85,564, as U.S. spot Bitcoin ETFs continued selling hundreds of millions ahead of the end-of-year illiquidity period.

The caveat for crypto investors? Over 100 crypto ETPs are expected to bring new institutional and boomer capital in early 2026, making the SEC’s approval timeline a key factor for market prospects next year.

In this week’s CoinStats Scoop, you’ll find:

📊 Crypto market analysis and the most important news in Web3.

🍰 100+ new crypto ETPs to bring a “Cheesecake Factory” era for crypto in 2026, according to Bitwise

⚖️ SEC ends Aave probe, as Kulechov shares a 2026 master plan following the regulatory win

🔥 Hyperliquid votes to remove $1 billion in HYPE tokens from circulation

🎭 Presidential memecoins were the main trigger behind the memecoin sector’s rise and fall in 2025

🔮 Analysis and key events that will shape the crypto market next week.

100+ New Crypto ETPs to Bring “Cheesecake Factory” Era for Crypto in 2026: Bitwise

The impending avalanche of cryptocurrency-based exchange-traded products (ETPs) signals another key juncture for mainstream crypto adoption in 2026.

At least 100 cryptocurrency ETPs are set to launch next year, which are expected to “accelerate forward” the crypto industry at a “ridiculous speed,” said Ryan Rasmussen, a researcher at Bitwise, in an interview with Bankless.

Unlike spot cryptocurrencies, crypto ETPs are accessible to a wider array of investors, including family offices, company balance sheets, pension funds, and traditional investors who are not on-chain 🏦.

For traditional and institutional investors, this will usher in a “cheesecake factory” moment for crypto, opening a larger menu for each risk appetite. Rasmussen explained:

“You can imagine investors going through the restaurant and having like two things on the menu, they are not going to be very excited about it, and it’s not going to be a very great experience, but now they’re going to go and have a menu that’s like the Cheesecake Factory of ETPs.”

For Bitcoin, the U.S. spot Bitcoin ETFs were the main source of liquidity during 2025, next to acquisitions from Michael Saylor’s Strategy. Crypto investors expect a similar mechanism once altcoins gain more regulated investment products like ETPs 📈.

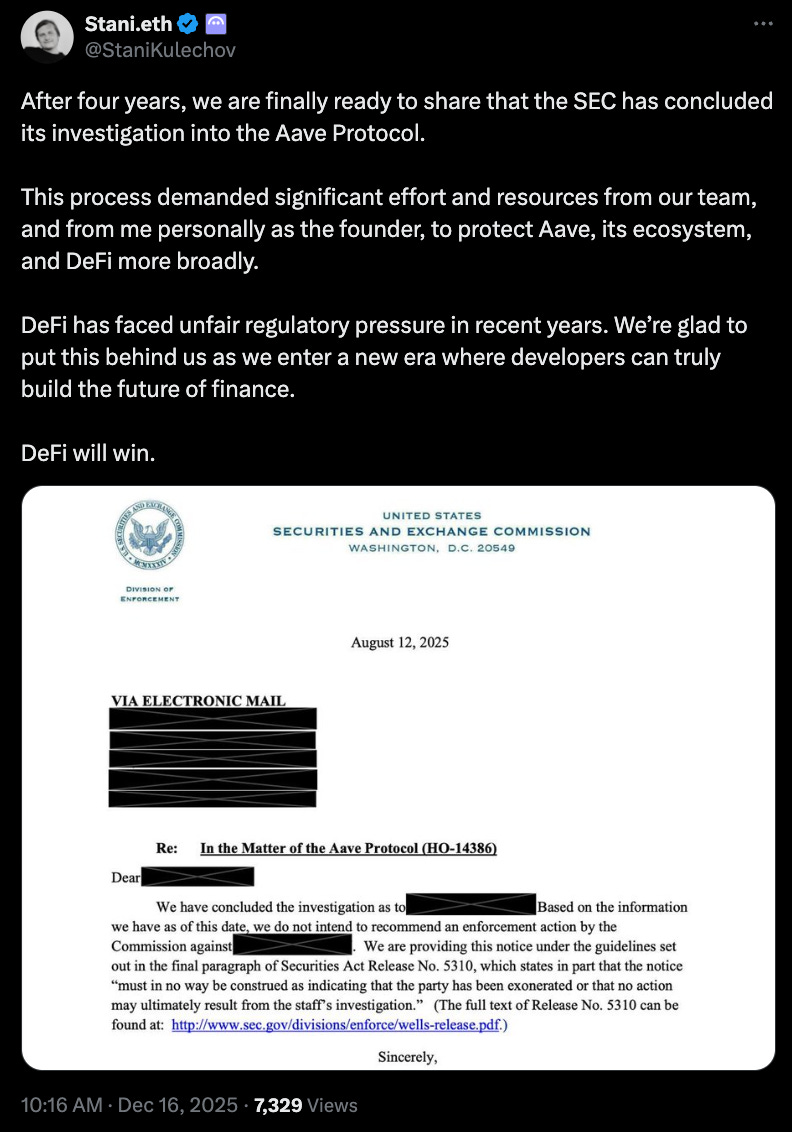

SEC Ends Aave Probe, as Kulechov Shares 2026 Master Plan After Big Regulatory Win ✅

The United States Securities and Exchange Commission (SEC) has ended its four-year investigation into decentralized finance lending protocol Aave, marking another major regulatory win for the emerging crypto industry ✅.

After the investigation, the SEC stated it did “not intend to recommend an enforcement action” against the protocol, according to a letter shared by Aave founder and CEO, Stani Kulechov.

The SEC’s letter is a big win for Aave, as the process demanded significant effort and resources from the team, wrote Kulechov in a Dec. 16 X post.

“DeFi has faced unfair regulatory pressure in recent years. We’re glad to put this behind us as we enter a new era where developers can truly build the future of finance. DeFi will win” 🚀.

The no-action announcement signals a softening approach toward crypto regulation under the Trump administration, following the prior enforcement-heavy stance during the Biden administration.

Since President Trump announced plans to make America a “global crypto hub,” the SEC has dropped numerous high-profile cases against crypto firms, including Ripple, Gemini, and Uniswap Labs.

With more market structure clarity expected in 2026, global startups may increasingly choose to headquarter operations in the U.S., thanks to growing regulatory clarity and institutional appetite for regulated digital asset products 🏦.

The end of the SEC investigation allows Kulechov to focus on Aave’s “master plan,” which includes scaling the platform to reach the first $1 billion in real-world asset deposits, launching Aave V4, Horizon, and the Aave app.

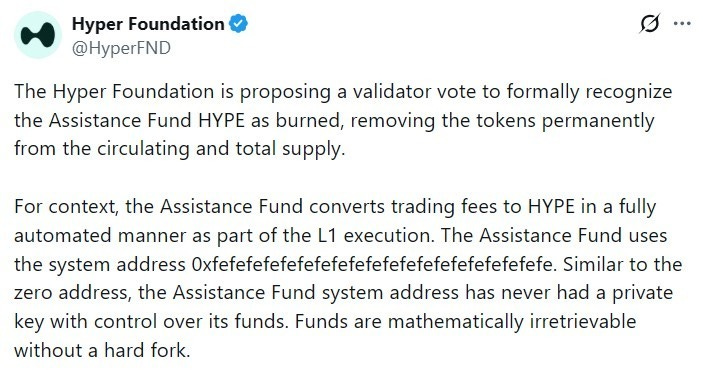

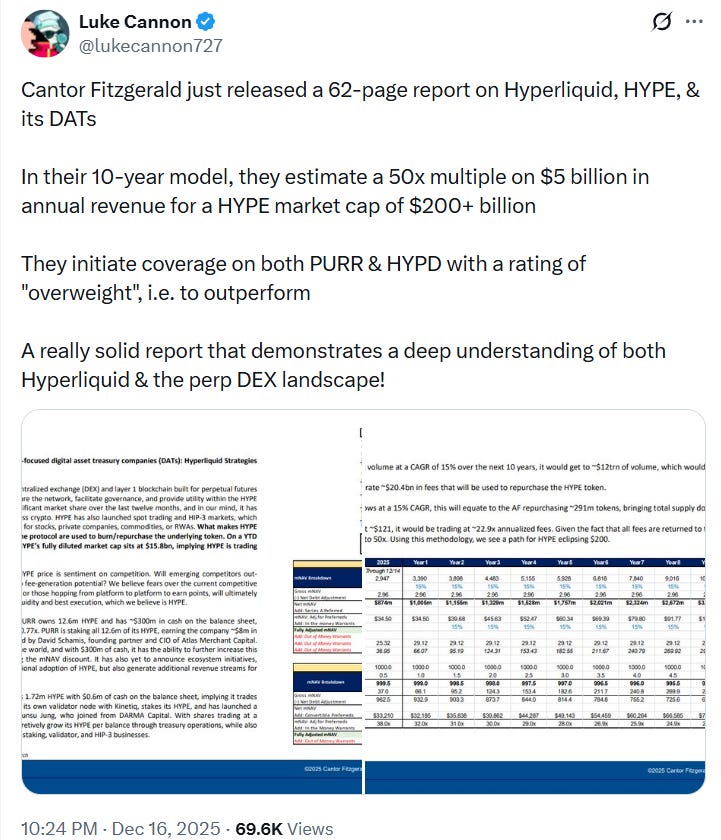

Hyperliquid Votes to Remove $1 Billion in HYPE Tokens from Circulation 🔥

The Hyper Foundation is exploring strategies to shrink the Hyperliquid (HYPE) token’s circulating supply, aiming to create more scarcity for one of the leading decentralized exchange coins 🔥.

The Foundation initiated a validator vote to recognize the HYPE tokens in the protocol’s Assistance Fund as “permanently inaccessible,” excluding them from the total and circulating supply.

The Assistance Fund is an in-built pool that automatically converts trading fees into HYPE tokens and sends them to designated system addresses, currently holding over $1 billion worth of tokens 💰.

If approved, the validator vote would treat these tokens as “burned,” permanently removing them from circulation, since the Assistance Fund was coded without withdrawal mechanisms for the team.

The billion-dollar reduction is potential sell pressure that may come as welcome news for cryptocurrency investors seeking more altcoin exposure.

However, it’s important to note that the fees sent to the Assistance Fund were never meant to be recoverable or sellable, meaning that the validator vote is not an immediate supply reduction, but a move to create more transparency around the HYPE token supply on the open market🔍.

The HYPE token has been one of the standout successes of the 2025 crypto market cycle, rising over 520% since its launch, according to CoinStats data.

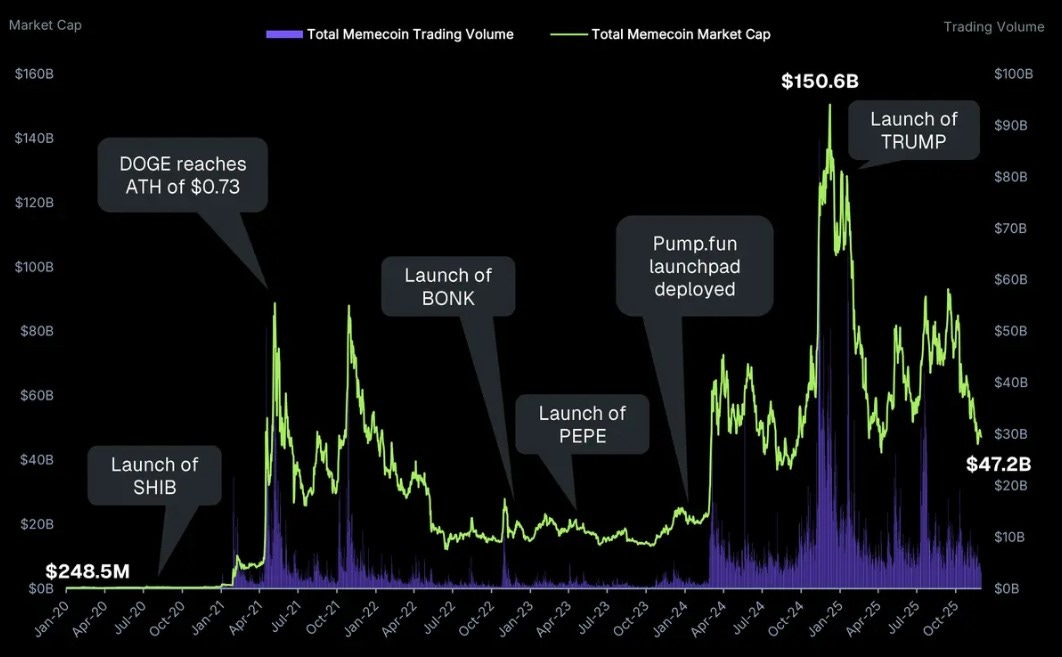

Presidential Memecoins Were Main Trigger for the Memecoin Sector’s Rise and Fall in 2025 🎭

Memecoins soared to new record highs in 2025, but the subsequent decline in speculative investor appetite highlights deeper political ties behind these market dynamics.

The launch of the official Donald Trump (TRUMP) and Official Melania Trump (MELANIA) tokens reshaped the memecoin sector in early 2025, coinciding with President Trump taking office 🇺🇸.

The release of these presidential tokens marked the peak of the memecoin cycle, reflecting investor excitement for Trump’s reelection and the first token associated with a sitting U.S. president.

After the Trump family’s tokens pushed the total memecoin market cap to a $150 billion high, their sharp decline drained much of the speculative appetite, leading to a major drop in memecoin trading volumes and valuations, with the TRUMP token falling 71% since launch, according to CoinStats data 📉.

By November, the total value of memecoins had dropped 73%, from a peak of $150 billion to just $40 billion, showing how quickly social sentiment-driven memecoins can lose value ⚠️.

A CoinGecko report also linked the decline in memecoin demand to the rise and fall of the Trump family’s memecoins and their negative impact on mainstream investor confidence.

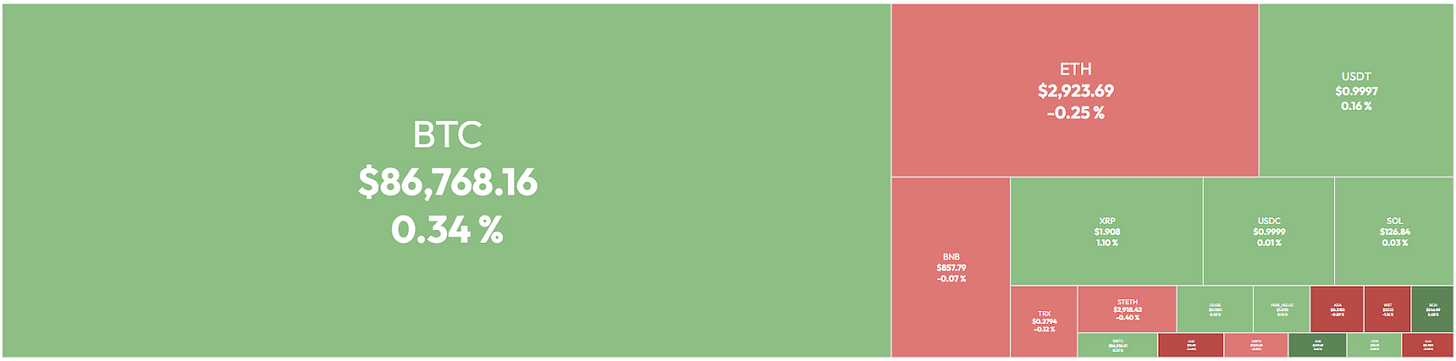

Market Overview: Bitcoin Slips Below $86K, as Altcoin Recovery Proves Short-Lived 📉

Despite several positive regulatory developments this week, leading cryptocurrencies continued to decline.

Bitcoin’s price fell 6% during the previous week, hitting a weekly low of $85,564 before recovering above $86,700, data from CoinStats shows💰.

As the main capital driver for BTC, spot Bitcoin ETFs continued to see weak demand, recording over $500 million in net outflows in the two days leading up to Dec. 16, according to Farside Investors data.

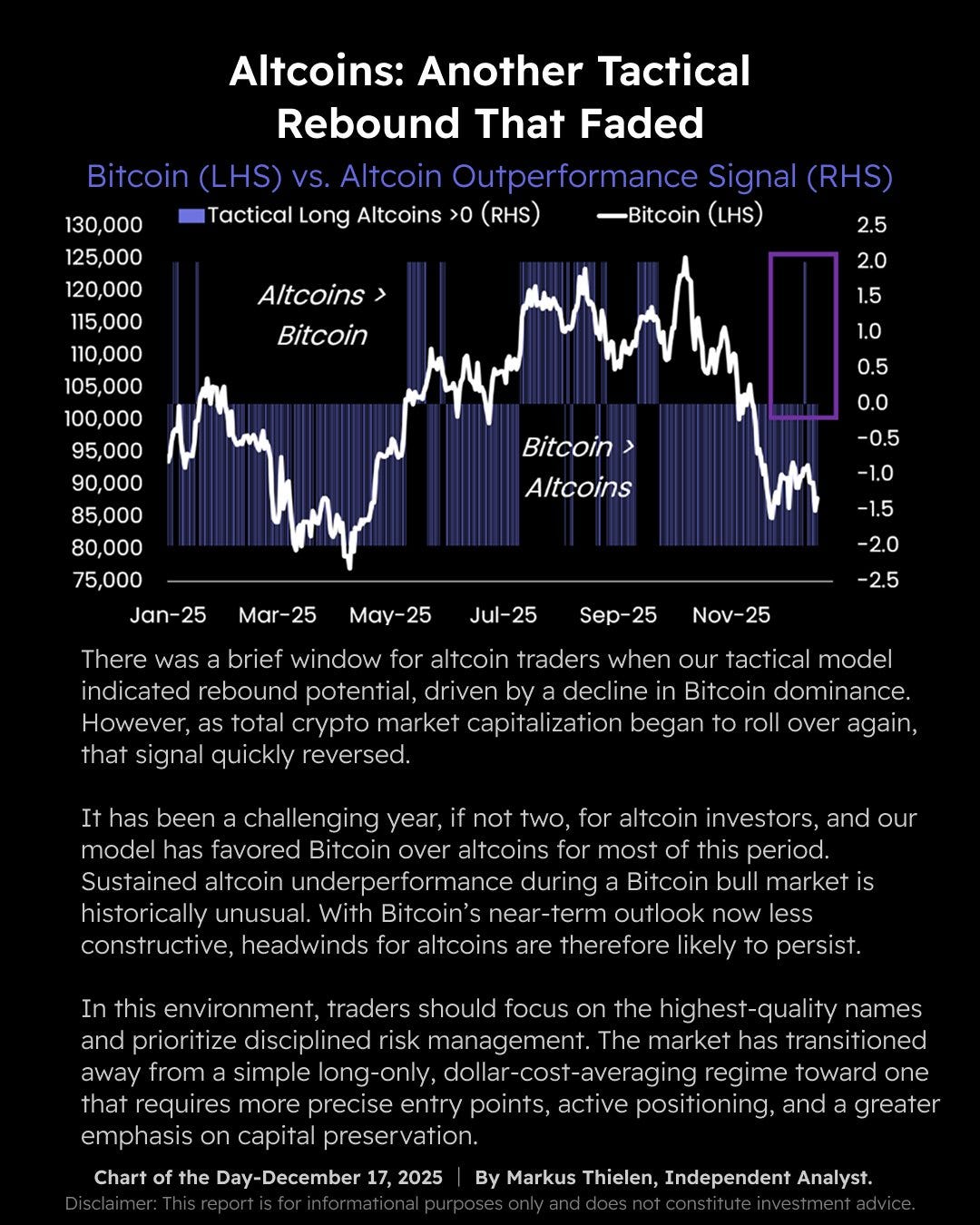

The altcoin market also remained muted over the past week, failing to gain momentum since the $20 billion crypto market correction in early October.

Altcoins initially saw a “tactical rebound” amid declining Bitcoin dominance, but the broader drop in total crypto market capitalization showed that altcoins have limited short-term price potential for year-end, according to a Matrixport research report 📉.

“It has been a challenging year, if not two, for altcoin investors, and our model has favored Bitcoin over altcoins for most of this period. Sustained altcoin underperformance during a Bitcoin bull market is historically unusual. With Bitcoin’s near-term outlook now less constructive, headwinds for altcoins are therefore likely to persist”.

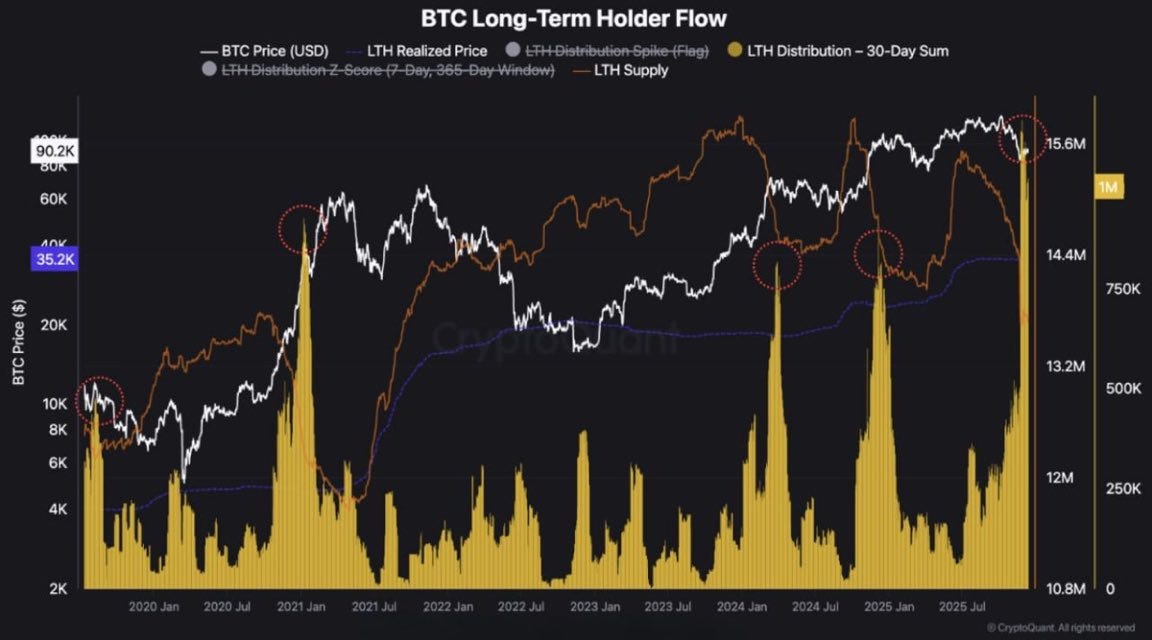

Meanwhile, long-term Bitcoin holders sold their investment at the highest rate seen in over 5 years, signaling another potential distribution phase from the cohort with the most conviction in BTC.

To avoid more downside from the long-term cohort selling, Bitcoin’s price needs to remain above the key $95,000 psychological support level, which currently holds over $1 billion worth of cumulative leveraged long liquidations, threatening more downside if broken.

Tweets & Memes

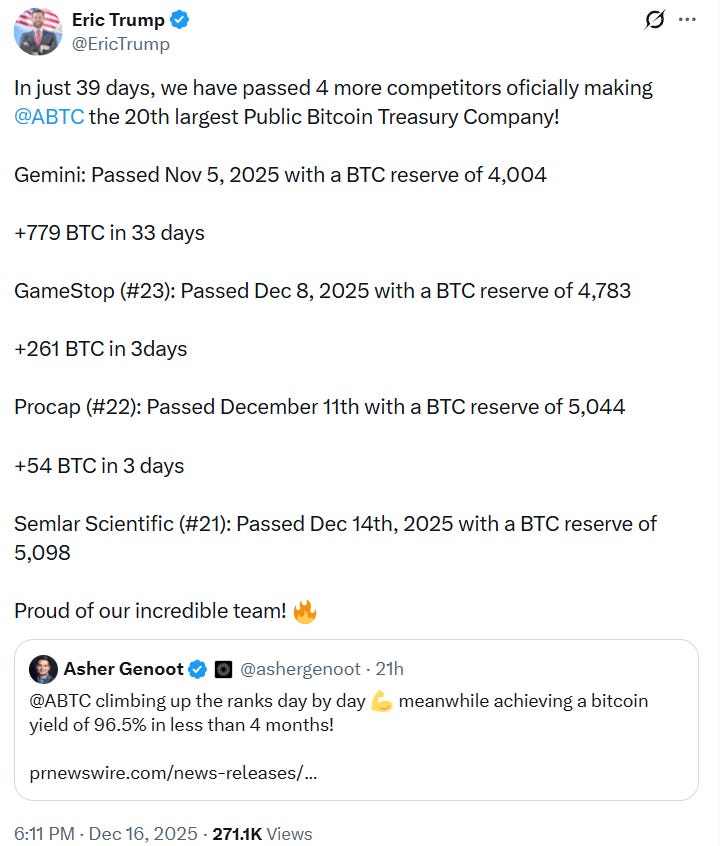

The Trump family is all-in on Bitcoin mining, and you’re still bearish!? ⚡

Quantum computers will harden Bitcoin, not break it, according to Strategy founder Michael Saylor 🛡️.

Canto Fitzgerald is predicting a $200 billion HYPE market cap amid a revenue boom 💥.

Long-term holders are selling into strength, but institutional buyers and ETFs have yet to step in to absorb this supply 📉.

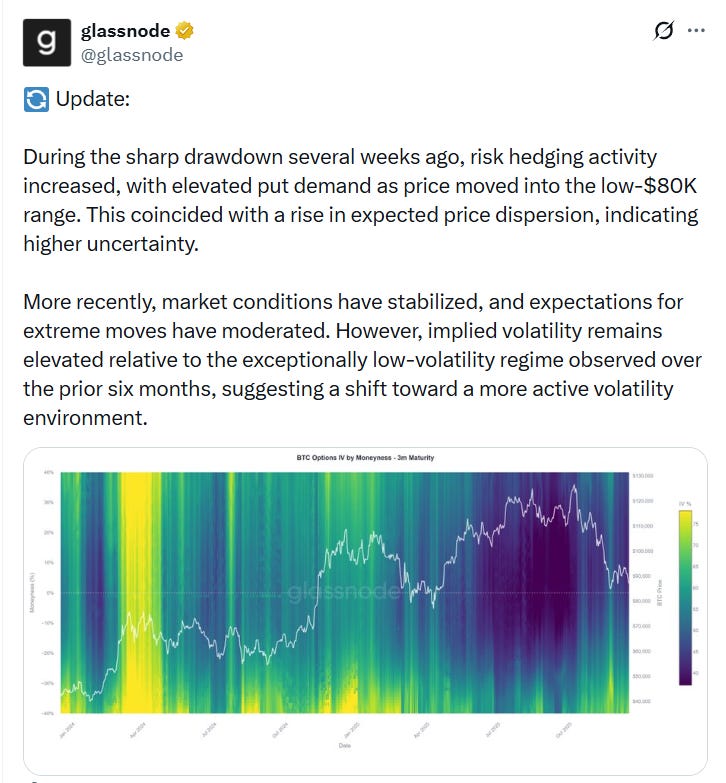

Investors are hedging for smaller downside moves, but implied volatility remains high, so tread carefully if trading with leverage ⚠️.

Machi Big Brother continues depositing millions into his Hyperliquid account 💰. What’s the secret?

Thank you for reading the weekly CoinStats Scoop Newsletter.

CoinStats will continue to guide you through the world of crypto and DeFi. We’ll see you next week for another edition of CoinStats Scoop! 😎

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.