Between Hopes And Red Flags: Bitcoin On The Line This Week

0

0

Bitcoin begins the week against a backdrop of economic and technical uncertainties. While the symbolic threshold of 82,000 dollars struggles to hold, investors are closely watching market signals. Amid geopolitical tensions, worrying technical indicators, and hopes for a bullish reversal, here are 5 elements to closely monitor this week.

Bitcoin: 5 things to know at the beginning of April

In addition to Bitcoin’s dominance, which falls to 58.8%, the first cryptocurrency shows signs of technical fragility this week… Investors are holding their breath. In a context filled with uncertainties, several key signals could influence its trajectory. Here’s what to understand.

Bitcoin faces a bearish signal: the “bearish engulfing” is imposing

The weekly Bitcoin chart recently displayed a “bearish engulfing” candle, a feared technical signal indicating a potential downward reversal. This figure formed as BTC finished the week around 81,200 dollars, its lowest level in two weeks. Traders remain cautious, citing compression between the 50-day and 50-week exponential moving averages, which typically precede explosive movements.

Some see this decline of Bitcoin as a mere breath in a larger bullish market, while others read it as a loss of momentum. The market is on edge, and the evolution of this technical figure could set the tone for April.

April 2, a new turning point in the U.S. trade war?

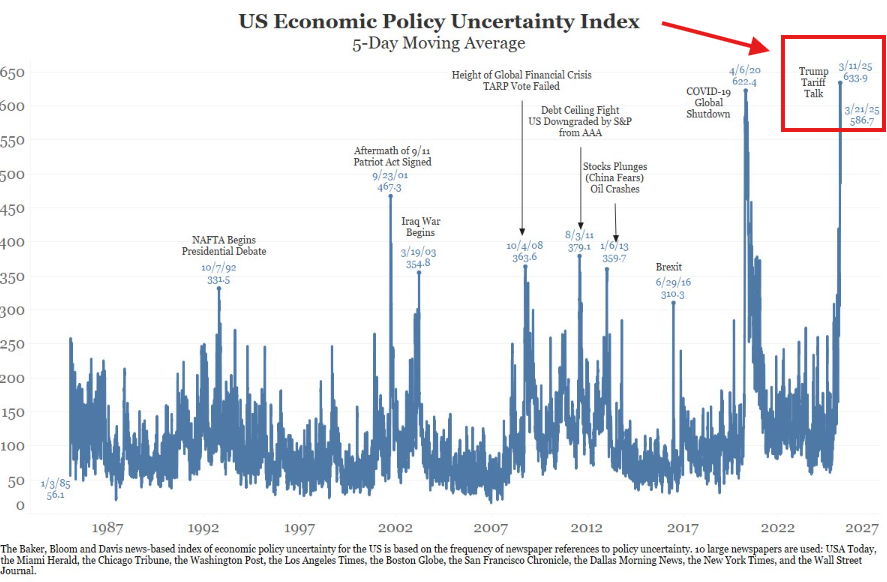

On Tuesday, April 2, the United States could strike hard with a new wave of tariffs, dubbed by Donald Trump as “Liberation Day”. Up to 1.5 trillion dollars in imports could be affected, according to The Kobeissi Letter. This trade hardening could create a shockwave on risk assets, including Bitcoin.

Additionally, a busy week on the macroeconomic front awaits: employment data, speeches from Jerome Powell, and key publications from the FED could significantly influence market perceptions. The index of economic uncertainty is reaching new heights, making reactions unpredictable. Traders remain on alert: this week could change everything.

A disappointing first quarter for Bitcoin

With a decline of 12.7% for the quarter, Bitcoin records its worst first quarter since 2018. The drop since the January peak exceeds 30%, while gold continues to set records. However, according to Glassnode data, this correction remains modest compared to previous cycles, some having experienced drawdowns over 60%.

Despite this relative underperformance, some analysts, like Daan Crypto Trades, believe the quarter “has not been that terrible.” The lack of volatility could actually favor a gradual restart, as soon as the macro context improves. But for now, caution prevails.

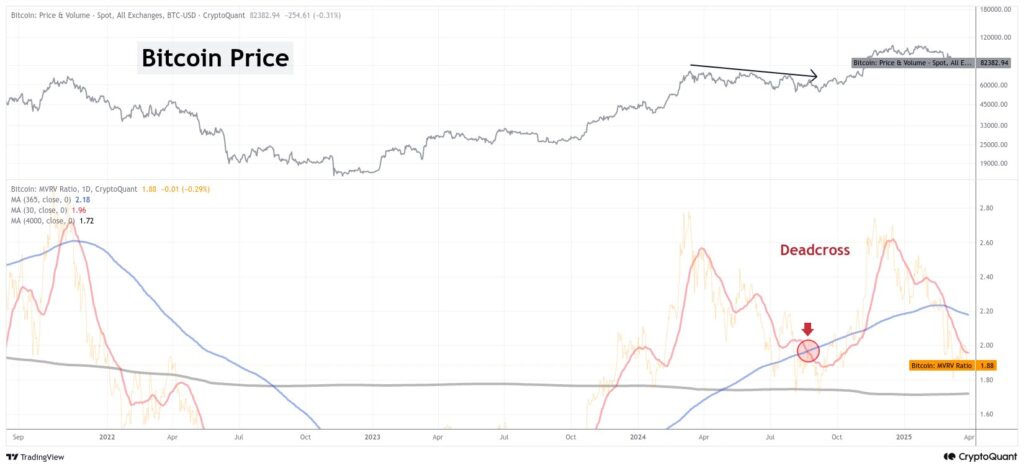

The MVRV ratio calls for caution

The MVRV ratio (Market Value to Realized Value), used to assess whether Bitcoin is overvalued or undervalued, is currently trending towards its historical average. This decline reflects the exit from an overheating zone, which began after a “death cross” observed in early March. If this signal has often preceded price drops, it does not yet indicate a definitive bottom.

According to analyst Yonsei Dent, the market is mimicking past behaviors but remains exposed to a new correction. In the absence of a clear signal of recovery, Bitcoin investors must remain cautious. However, a sustainable recovery could begin if the ratio rebounds after hitting its historical support.

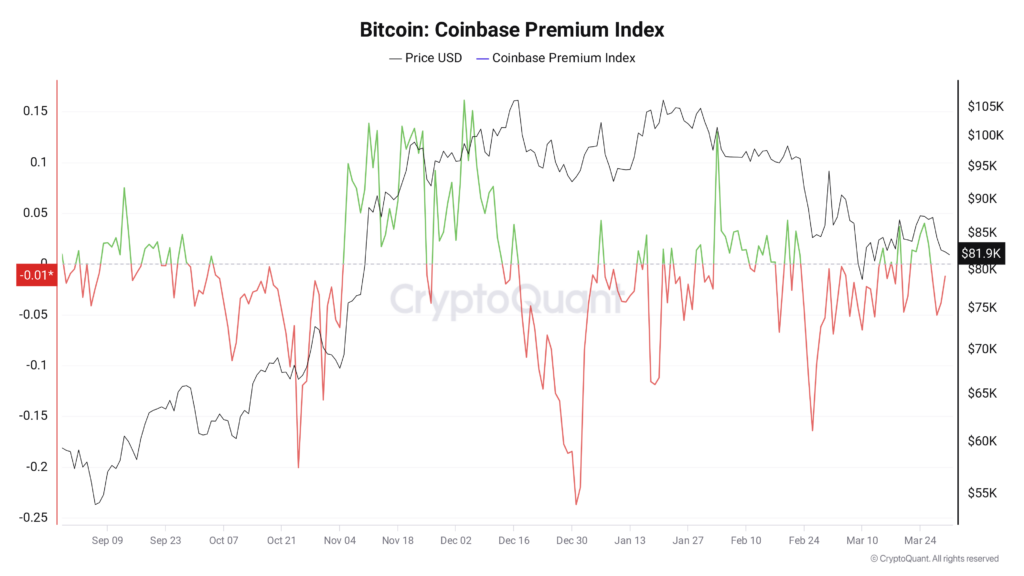

American investors remain hopeful: the return of the Coinbase Premium

The “Coinbase Premium,” an indicator of the confidence of American investors, is once again approaching neutral territory. After a period marked by panic selling, this stabilization indicates renewed interest in Bitcoin in the United States. CryptoQuant emphasizes that this resilience against downward pressure could signal a trend reversal.

A positive premium has historically accompanied sustainable bull market phases. If this dynamic is confirmed, it could mean that institutional buyers are back, ready to accumulate BTC at price levels they find attractive.

A pullback to 72,000 dollars? What direction for Bitcoin this week

This week, Bitcoin’s trajectory could oscillate between tension and opportunity. If the threshold of 80,000 dollars were to give way sustainably, a pullback to supports at 76,000 dollars or even 72,000 dollars could not be ruled out, particularly due to macroeconomic uncertainties and volatility induced by the new U.S. tariff measures.

However, a stabilization of BTC above key moving averages could rekindle bullish momentum. Savvy investors should adopt a cautious approach these days: monitor volumes, avoid impulsive buying, and consider gradual entries into well-identified pullback zones. Patience will be key.

This week is therefore poised to be decisive for Bitcoin, and the 80,000 dollar threshold remains the psychological level to watch. Amid trade tensions, ambiguous technical signals, and macroeconomic expectations, investors are navigating a fog of uncertainties. And to make matters worse in this already turbulent April, Bitcoin miners will face a major challenge, that could seriously affect their profitability.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.